The hard line on beverage alcohol ecommerce trends

The pandemic helped drive online wine sales from roughly $1 billion in 2018 to more than $3 billion in 2021, according to Rabobank Research Analyst Bourcard Nesin. Yet, as Nesin explains during Avalara’s recent webinar, Mastering Alcohol Ecommerce in 2022, the numbers tell a more nuanced story:

- Wine dominates ecommerce

- Direct-to-consumer (DTC) sales represent a fraction of off-premises wine sales

- Ecommerce is as important to marketing as it is to sales

Wine dominates ecommerce

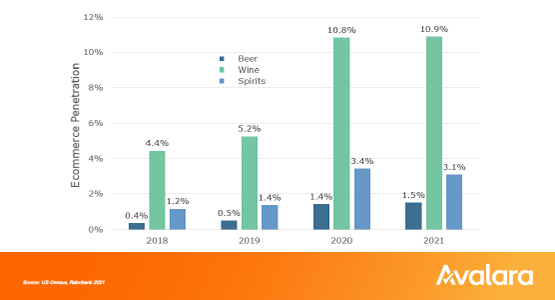

When it comes to ecommerce, wine has long had an advantage over other beverage alcohol categories. Wine represents less than 25% of overall off-premises alcohol sales but captures 62% of online sales, according to Rabobank. Nesin found ecommerce to represent more than 10% of total off-premises wine sales: 10.8% in 2020 and 10.9% in 2021. For beer and spirits, ecommerce comprises a much smaller slice of the off-premises pie: 1.4% (2020) and 1.5% (2021) for beer; 3.4% (2020) and 3.1% (2021) for spirits.

One reason for the dominance of wine sales is that almost all states allow wine producers to ship directly to consumers. Far fewer states allow beer and spirits producers to ship directly to consumers, while less than 15 states permit alcohol retailers (i.e., nonproducers) to ship directly to consumers. Yet DTC sales account for only about a third of beverage alcohol ecommerce, so there are other factors at play.

Wine is also uniquely well suited to ecommerce. In states that permit DTC wine shipping, shopping online is often the most convenient way for consumers to acquire certain hard-to-find vintages or browse wine from a particular region or winery. With more than 11,280 wineries in the U.S. alone (as compared to approximately 2,290 craft distilleries), there’s a lot for budding connoisseurs to explore.

On top of that, the price point of wines tends to be just right. The low price point of beer makes it hard for producers to justify the high shipping costs. And though the price of spirits is better suited to shipping, the market is smaller and fewer states allow direct shipments.

DTC ecommerce represents a fraction of off-premises wine sales

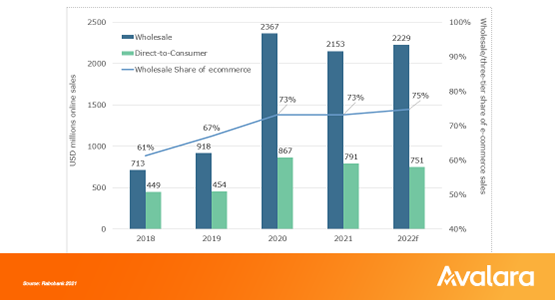

Although wine producers can make direct-to-consumer (DTC) shipments in nearly every state, Nesin says about 75% of online wine sales still go through the three-tier system. Licensed manufacturers and importers sell to licensed wholesalers (Tier 1); licensed wholesalers sell to licensed on-premises and off-premises retailers (Tier 2); licensed retailers sell to consumers (Tier 3).

The primary ecommerce categories within the wholesale channel all experienced impressive growth between 2019 and 2021. Here are Rabobank’s numbers:

- Specialty retail (e.g., Total Wine & More, Wine.com): +85%

- Online grocery (e.g., Costco, Target, Walmart): +235%

- Marketplaces (e.g., Drizly, Instacart): +280%

Wine sales at online grocery stores and marketplaces fared particularly well, essentially quadrupling during the pandemic. Over the same period, online grocery sales overall grew by 100%.

Why did wine and other alcohol outperform other foods and beverages in these channels? Nesin believes it’s because the demand existed prior to the pandemic — COVID-19 was simply the catalyst retailers and platforms needed to build the infrastructure to meet it.

Indeed, brick-and-mortar retailers that entered the pandemic with a big footprint and an existing delivery infrastructure were able to grow their online alcohol sales quickly. For example, only 200 of the 1,100 Walmart stores with grocery delivery services in 2019 offered alcohol delivery. Today, 1,500 of the 3,200 Walmart stores offering grocery delivery will deliver alcohol.

This may be “catch-up growth,” as Nesin notes, “but it’s important because the infrastructure is permanent. Online alcohol sales are not going to go away” when the pandemic becomes endemic or subsides. In fact, the online market for wine will likely continue to grow because the consumer base has broadened. Once primarily the purview of elite collectors searching for hard-to-find wine, shopping online for wine has become commonplace among the general public.

Ecommerce is as important to marketing as it is to sales

Despite the dominance of the three-tier channel, and the fact that it’s much more complicated to manage than DTC sales, Nesin says, “It’s almost a universal truth that wineries underfund their three-tier ecommerce operations relative to their DTC businesses.” They shouldn’t.

DTC vs. the three-tier system

Nesin urges wineries to continue investing in online channels and devote more resources to their three-tier sales even as on-premises sales rebound. Just as online sales can’t replace the tasting room experience, online sales can’t be replaced by tasting room sales. And remember that three-tier ecommerce represents 75% of all online wine sales in the U.S. (excluding wine clubs). “In other words,” Nesin says, “three-tier ecommerce sales are three times larger than DTC sales for the traditional wine model.”

Wine has a head start in the digital world. It’s less regulated than spirits and better suited to ecommerce than beer, and the internet is the best way for consumers to access and explore the massive number of SKUs the wine industry has to offer. Yet as Nesin notes, wine’s share of online alcohol sales is dropping, from 72% of online alcohol sales in 2018 to 62.2% in 2021.

Nesin recommends wineries “go on the offensive and devote more resources to their ecommerce channel.” With few other options at their disposal, consumers have been willing to navigate clunky websites to get the wine they want delivered to their door. Eventually, their patience will wear thin and they’ll gravitate toward slicker, more responsive ecommerce sites.

Furthermore, ecommerce is more than just a sales channel: It’s become an essential marketing channel because the rise in digitally native consumers is translating to an increase in digitally influenced sales.

The transactional aspects of ecommerce are just the tip of the iceberg.

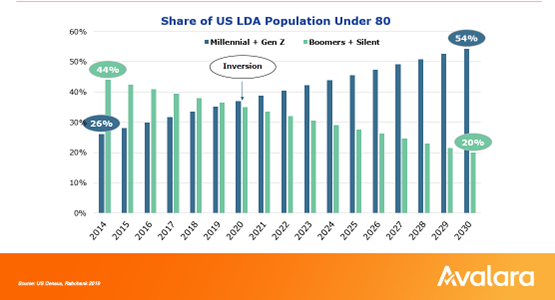

Alcohol companies typically spend a lot of money to build brand awareness through billboards, but younger consumers are more likely to be influenced by what they see on their mobile devices. As digital natives, they also tend to be more swayed by digital content than their older counterparts.

And as of 2020, Millenials and legal-drinking-age Zoomers outnumber older generations.

Consumers engage with a brand every time they see the brand’s name listed on a website — not just when they’re on the brand’s own website — so it’s critical to keep product descriptions and images on third-party websites up to date. Unfortunately, this task is often overlooked. According to Nesin, only 5% of wine suppliers are proactively working to manage their products’ images and descriptions on Wine.com, the largest online wine retailer in the U.S.

That content does more than drive conversions on that one retailer site; it shapes the impressions consumers have of a brand.

“It’s incumbent upon us to step back every once in a while to think about what’s going on and prepare strategies for both today and tomorrow,” says Jeff Carroll, General Manager for Beverage Alcohol at Avalara. He notes that companies able to recognize the importance of ecommerce prior to the pandemic were well positioned to pivot to online sales when COVID-19 limited on-premises sales.

Nesin wants wineries to think about the resources they devote to on-premises vs. off-premises sales. Ecommerce already accounts for more than 10% of off-premises wine sales, and he expects revenue from online channels to match or surpass on-premises sales in a few years. Do you have enough people to manage your brand on your ecommerce channels? According to Nesin, the difference between a good ecommerce team and a bad ecommerce team comes down to people. He explains most wineries just haven’t invested in the people they need to succeed in the digital world.

You’ll find more useful information in the on-demand webinar, Mastering Alcohol Ecommerce in 2022 and Rabobank’s 2022 alcohol ecommerce playbook.

Cover photo by Canva

Avalara Tax Changes 2024: Get your copy now

Stay ahead of 2024’s biggest tax changes with this comprehensive, compelling report covering seven industries.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.