State-by-state guide to click-through nexus laws

Guide sections

If you sell into states where you don’t collect sales tax, you need to be aware of click-through nexus laws.

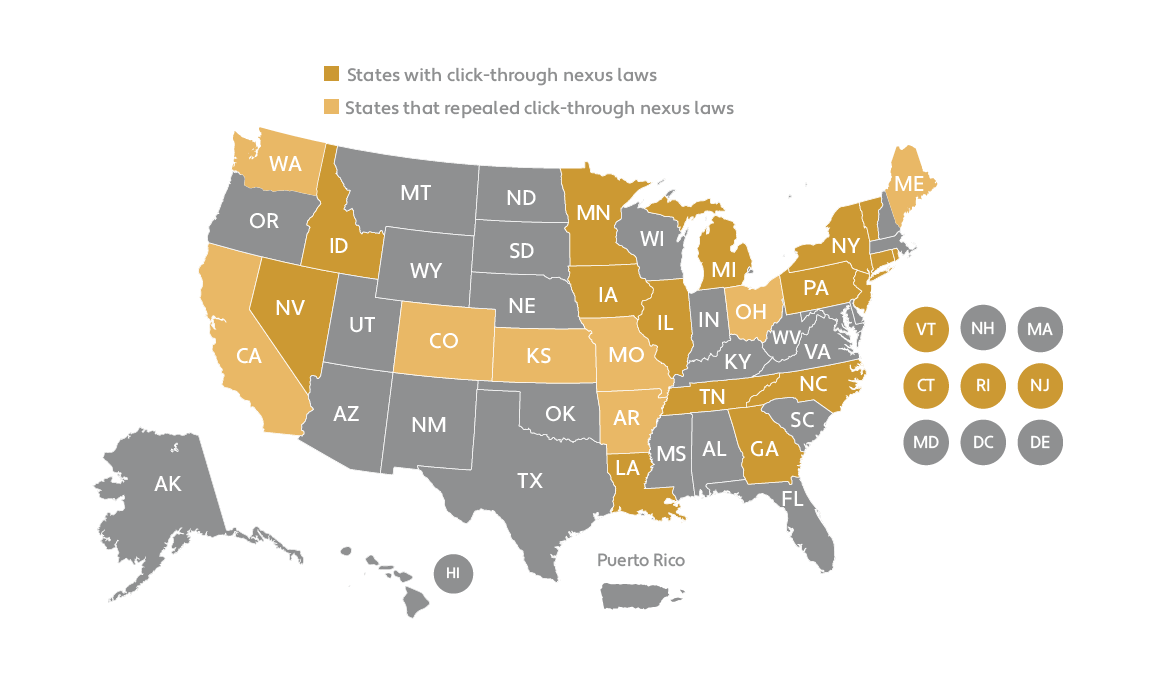

Map of click-through nexus sales tax laws by state

What is click-through nexus for sales tax?

Sales tax nexus is a connection between a state and a business that enables the state to impose a sales tax collection obligation on the business.

Under click-through nexus for sales tax, an out-of-state business with no physical presence in a state establishes a sales tax obligation through online referrals originating from within the state. For nexus to be established, the out-of-state business must pay a commission or other reward for the online referrals.

Many states have a de minimis threshold for click-through nexus, meaning the referrals must generate a certain amount of sales during a specified time period.

Approximately 15 states have click-through nexus laws, and each state’s definition of click-through nexus for sales tax is unique.

Alaska, Delaware, Montana, New Hampshire, and Oregon don’t have a general sales tax or click-through nexus for sales tax.

An out-of-state business can also create sales tax obligations through economic activity in a state (economic nexus), physical presence in a state (physical presence nexus), and ties to affiliates in the state (affiliate nexus). Learn more about sales tax nexus.

Who does click-through nexus affect?

Click-through nexus sales tax laws affect out-of-state retailers with no physical presence in the state (remote sellers) that sell online. If you have business relationships in a state with a click-through nexus law, you could establish sales tax nexus and an obligation to collect sales tax in the state.

What happens if you don’t comply with click-through nexus sales tax laws?

The consequences of not complying with click-through nexus laws can be serious. You could be found liable for back taxes and end up paying sales tax out of pocket, plus penalties and interest. Read What happens if you forget sales tax nexus? for more details.

Click-through nexus sales tax laws by state

Below you’ll find a state-by-state breakdown of click-through nexus sales tax laws.

Although we hope you’ll find the information helpful, this guide does not offer a substitute for professional legal or tax advice. Because states constantly update and amend their sales and use tax laws, see each state’s tax authority website for the most up-to-date and comprehensive information.

Reduce tax risk

Increase the accuracy of your tax compliance with our cloud-based tax engine and tax research services.

Alabama click-through nexus

Alabama doesn’t have a click-through nexus law.

Arizona click-through nexus

Arizona doesn’t have a click-through nexus law.

Arkansas click-through nexus

Effective date: October 27, 2011

Repealed effective: July 1, 2019

California click-through nexus

Effective date: September 23, 2011

Repealed effective: April 1, 2019

Colorado click-through nexus

Effective date: July 1, 2014

Repealed effective: June 1, 2019

Connecticut click-through nexus

Effective date: May 4, 2011

Amended effective: December 1, 2018, and July 1, 2019

Click-through nexus may be established when an out-of-state seller rewards a Connecticut resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

Gross receipts from sales from such referrals exceed $100,000 during the preceding four quarterly periods

Previous threshold rules:

- The de minimis threshold changed from $2,000 to $250,000 as of December 1, 2018

- The de minimis threshold changed from $250,000 to $100,000 as of July 1, 2019

See SB 417 (2018), HB 7424 (2019), and Conn. Gen. Stat. § 12-407(a).

Florida click-through nexus

Florida doesn’t have a click-through nexus law.

Georgia click-through nexus

Effective date: October 1, 2012

Click-through nexus may be established when an out-of-state seller rewards a Georgia resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

Cumulative gross receipts from such referrals exceed $50,000 during the preceding 12 months

See HB 386 (2011).

Hawaii click-through nexus

Hawaii doesn’t have a click-through nexus law.

Idaho click-through nexus

Effective date: July 1, 2018

Click-through nexus may be established when an out-of-state seller rewards an Idaho resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

Cumulative gross receipts from such referrals exceed $10,000 during the preceding 12 months

See HB 578 (2018) and Title 63, Chapter 36.

Illinois click-through nexus

Effective date: January 1, 2015

Repealed effective: June 28, 2019

Reenacted effective: January 1, 2020

Click-through nexus may be established when an out-of-state seller rewards an Illinois resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

- The in-state person provides potential customers with a promotional code or other mechanism that allows the retailer to track referral sales

- The retailer’s cumulative gross receipts from such referrals were at least $10,000 during the preceding four quarterly periods

Indiana click-through nexus

Indiana doesn’t have a click-through nexus law.

Iowa click-through nexus

Effective date: January 1, 2019

Click-through nexus may be established when an out-of-state seller rewards an Iowa resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

The retailer has more than $10,000 in gross revenue from Iowa sales in the immediately preceding or current calendar year

See SF 2417 (2018).

Kansas click-through nexus

Effective date: October 1, 2013

Repealed effective: July 1, 2021

See SB 83 (2013), SB 50 (2021), and Kansas Department of Revenue Notice 21-23.

Kentucky click-through nexus

Kentucky doesn’t have a click-through nexus law.

Louisiana click-through nexus

Effective date: April 1, 2016

Click-through nexus may be established when an out-of-state seller rewards a Louisiana resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

Cumulative gross receipts from such referrals exceed $50,000 during the immediately preceding 12 months

See HB 30 (2016).

Maine click-through nexus

Effective date: October 9, 2013

Repealed effective: January 1, 2022

See HP 251 (2013) and Maine Revenue Services Tax Bulletin No. 111 (2021).

Maryland click-through nexus

Maryland doesn’t have a click-through nexus law.

Massachusetts click-through nexus

Massachusetts doesn’t have a click-through nexus law.

Michigan click-through nexus

Effective date: October 1, 2015

Click-through nexus may be established when an out-of-state seller rewards a Michigan resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

- Cumulative gross receipts from sales of property in Michigan from such referrals exceed $10,000 during the preceding 12 months

- The seller’s total cumulative gross receipts from referral sales to Michigan purchasers exceed $50,000 during the immediately preceding 12 months

See SB 658 (2015) and Michigan Department of Treasury RAB 2021-21 (Sales and Use Tax Nexus Standards for Remote Sellers).

Minnesota click-through nexus

Effective date: July 1, 2013

Click-through nexus may be established when an out-of-state seller rewards a Minnesota resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

Cumulative gross receipts from referral sales of tangible personal property in Minnesota exceed $10,000 during the 12-month period ending on the last day of the most recent calendar quarter before the calendar quarter in which the sale is made

See HF 677 (2013) and Minn. Stat. sec. 297A.66 (Subd. 4a) (2023).

Mississippi click-through nexus

Mississippi doesn’t have a click-through nexus law.

Missouri click-through nexus

Effective date: July 1, 2013

Repealed effective: January 1, 2023

Nebraska click-through nexus

Nebraska doesn’t have a click-through nexus law.

Nevada click-through nexus

Effective date: October 1, 2015

Click-through nexus may be established when an out-of-state seller rewards a Nevada resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

Cumulative gross receipts from the Nevada referrals exceed $10,000 during the preceding four quarterly periods

See AB 380 (2015).

New Jersey click-through nexus

Effective date: July 1, 2014

Click-through nexus may be established when an out-of-state seller rewards a New Jersey resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

Cumulative gross receipts from the New Jersey referrals exceed $10,000 during the preceding four quarterly sales tax periods

See A3486 (2014) and New Jersey Division of Taxation Tax Topic Bulletin S&U-5 (2023).

New Mexico click-through nexus

New Mexico doesn’t have click-through nexus law.

New York click-through nexus

Effective date: June 1, 2008

Click-through nexus may be established when an out-of-state seller rewards a New York resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

Cumulative gross receipts from the New York referrals exceed $10,000 during the preceding four quarterly sales tax periods

See New York State Department of Taxation and Finance TSB-M-08(3)S (2008).

North Carolina click-through nexus

Effective date: August 7, 2009

Click-through nexus may be established when an out-of-state seller rewards a North Carolina resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

- Cumulative gross receipts from the North Carolina referrals exceed $10,000 during the preceding four quarterly sales tax periods

See SB 202 (2009), 2009 Tax Law Changes and § 105‑164.8.

North Dakota click-through nexus

North Dakota doesn’t have a click-through nexus law.

Ohio click-through nexus

Effective date: July 1, 2015

Repealed effective: August 1, 2019

Oklahoma click-through nexus

Oklahoma doesn’t have a click-through nexus law.

Pennsylvania click-through nexus

Effective date: December 1, 2011

Click-through nexus may be established when an out-of-state seller rewards a Pennsylvania resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise.

There is no de minimis threshold for Pennsylvania click-through nexus.

Rhode Island click-through nexus

Effective date: July 1, 2009

Click-through nexus may be established when an out-of-state seller rewards a Rhode Island resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

Cumulative gross receipts from the Rhode Island referrals exceed $5,000 during the preceding four quarterly sales tax periods

See R.I. Gen. Laws § 44-18-15 and this Rhode Island Division of Taxation Important Notice.

South Carolina click-through nexus

South Carolina doesn’t have a click-through nexus law.

South Dakota click-through nexus

South Dakota doesn’t have a click-through nexus law.

Tennessee click-through nexus

Effective date: July 1, 2015

Click-through nexus may be established when an out-of-state seller rewards a Tennessee resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

Cumulative gross receipts from the Tennessee referrals exceed $10,000 during the preceding 12 months

See HB 644 (2015) and Notice #15-12 (2015).

Texas click-through nexus

Texas doesn’t have a click-through nexus law.

Utah click-through nexus

Utah doesn’t have a click-through nexus law.

Vermont click-through nexus

Effective date: December 1, 2015

Click-through nexus may be established when an out-of-state seller rewards a Vermont resident for directly or indirectly referring potential purchasers to the seller by an internet link or otherwise, and:

Cumulative gross receipts from the Vermont referrals exceed $10,000 during the preceding tax year

See 32 V.S.A. § 9701 and the Vermont Department of Taxes.

Virginia click-through nexus

Virginia doesn’t have a click-through nexus law.

Washington click-through nexus

Effective date: September 1, 2015

Repealed effective: March 15, 2019

Washington, D.C., click-through nexus

Washington, D.C., doesn’t have a click-through nexus law.

West Virginia click-through nexus

West Virginia doesn’t have a click-through nexus law.

Wisconsin click-through nexus

Wisconsin doesn’t have a click-through nexus law.

Wyoming click-through nexus

Wyoming doesn’t have a click-through nexus law.

Keep on top of remote seller sales tax laws

Click-through nexus is one of the many ways your business can establish sales tax nexus: an obligation to register, collect, and remit sales tax in a jurisdiction. To learn more about remote seller sales tax nexus laws, view our sales tax nexus laws by state resource.

If you’ve determined you have a new sales tax obligation due to economic nexus laws, the typical next step is to register your business with the jurisdiction. Avalara Licensing can help with that.