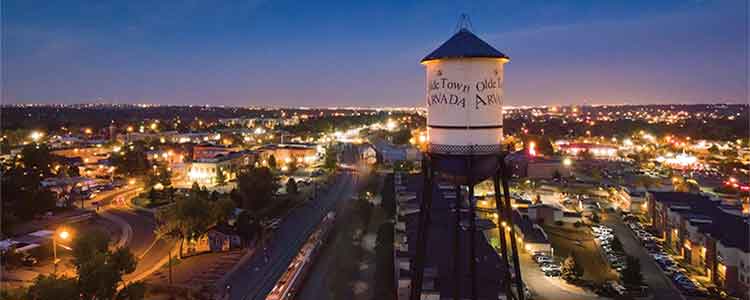

Short-term rentals legalized in Arvada, Colorado

- Sep 1, 2020 | Jennifer Sokolowsky

Arvada, Colorado, has legalized short-term rentals and created rules for their operation that will go into effect at the end of October.

Under the new law, short-term rental hosts must be licensed annually and may operate up to three vacation rentals at a time. Each property may be rented out for short terms for a maximum of 240 nights per year.

The ordinance also requires hosts or their designated contacts to be available 24 hours a day, seven days a week to respond to complaints about the rental within one hour. Operators must also give guests a city-provided pamphlet explaining the rules for short-term renters, including noise and parking regulations. Short-term rental properties must have an additional on-site parking space for guests. Large events, such as weddings, may not be held at vacation rentals.

The city said it may bring in a third party to identify hosts who are offering short-term rentals without a license. The finance department would request that those operators apply for a license, and the code enforcement department could issue a citation or summons to those who don’t respond.

Hosts who violate the rules can be fined $150 for the first violation, $300 for the second, and $1,000 for the third, and the operator’s license will be revoked after three violations.

The new measure also requires short-term rental hosts to add city sales tax and lodging tax to guests’ bills and file monthly returns to remit the taxes to the city. That’s in addition to state sales tax. Before they can collect state taxes, hosts must register with the state for a tax license.

Airbnb and Vrbo automatically collect state-administered short-term rental taxes for their hosts in Colorado, but they don’t collect city taxes in Arvada.

If taxes aren’t collected for you, you’re responsible for taking care of them yourself. Even if your rental platform collects taxes for you, you’re still required to register for tax licenses and file regular lodging tax returns.

MyLodgeTax can automate and simplify short-term rental tax compliance, including registration and filing with state and local tax authorities. For more on short-term rental taxes in Colorado, see our state Vacation Rental Tax Guide. If you have tax questions related to vacation rental properties, drop us a line and we’ll get back to you with answers.