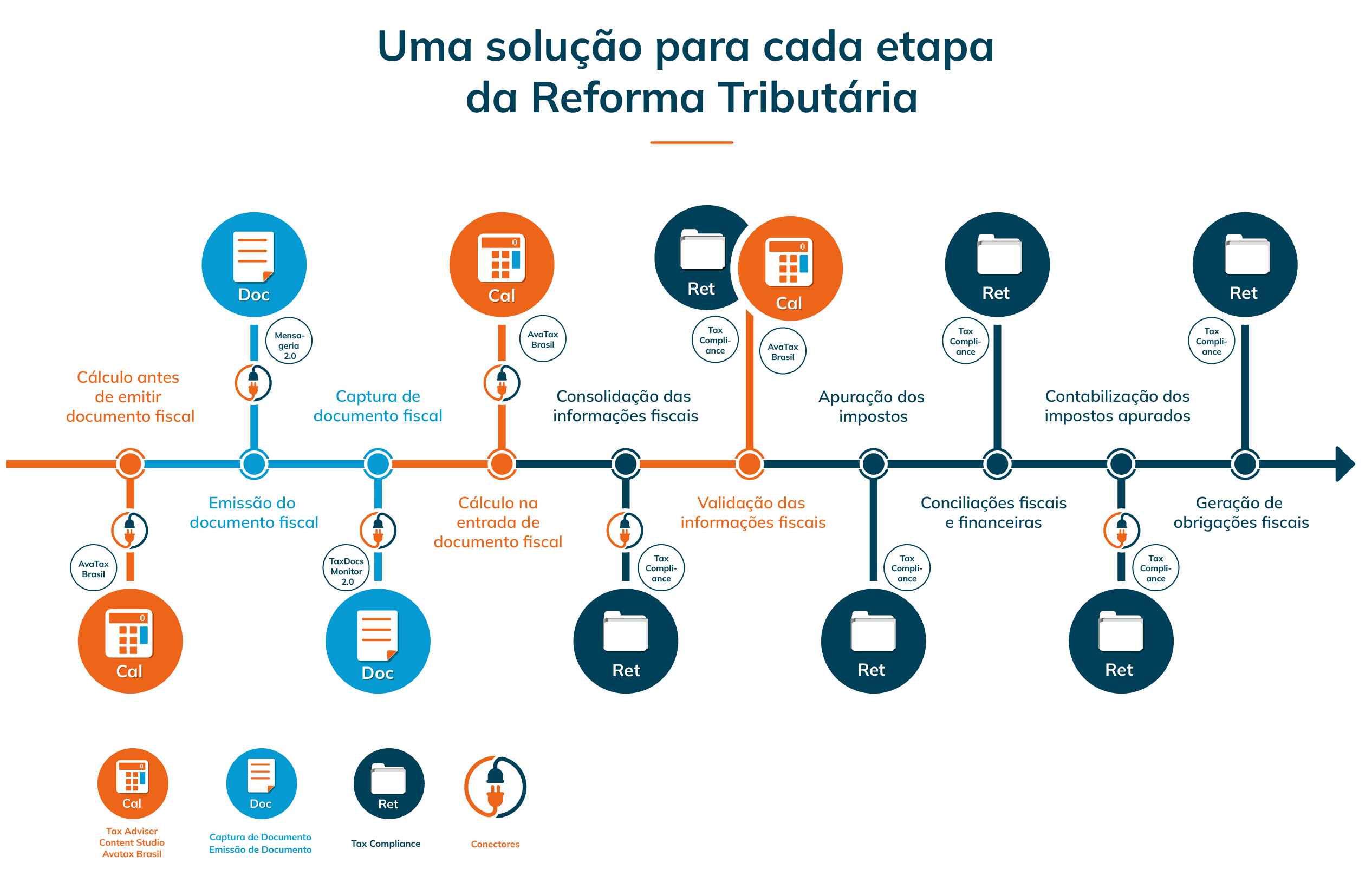

A Reforma Tributária está transformando o sistema fiscal brasileiro e a Avalara está preparada para conduzir sua empresa nessa transição com tecnologia, inteligência fiscal e segurança.

Nosso time de especialistas interpreta as mudanças da legislação para traduzir o novo modelo tributário em regras claras e aplicáveis ao seu cenário fiscal.

Com a Avalara, sua empresa percorre a jornada da Reforma Tributária com confiança, previsibilidade e total suporte fiscal.

Saiba mais sobre como podemos ajudar na adaptação ao novo sistema tributário.

Por que Avalara

Tecnologia Proprietária

- Pacote completo de soluções Avalara

- Capacidade de processar milhões de transações sem limitações

- Transformação externa de dados direto no ERP

- Integração com ERPs legados sem necessidade de migração

Expertise Especializada

- +20 anos de experiência no mercado fiscal brasileiro

- Equipe altamente capacitada em conformidade tributária

- Conhecimento profundo das obrigações acessórias

Eficiência Operacional

- Automação completa da jornada fiscal

- Eliminação de gargalos mensais de fechamento

- Redução de retrabalho e risco de multas

Foco no Core Business

- Cliente foca no negócio principal

- Avalara cuida de toda operação fiscal

- Transição suave sem interrupção de processos