Demystifying E-Invoicing: The Game-Changing Mechanism under GST

It hasn’t been very long since e-way bills changed the way business was conducted in India and already another game changer is making its way through the tax reform pipeline. Come January 2020 and e-invoicing will be introduced to taxpayers. This will impact all business entities in the long run and change the way business reporting is done today. This whitepaper outlines the game-changing mechanism of e-invoicing under GST.

Let us find out what is an e-invoice

- E-invoice is the reporting of transactions on an immediate basis and having such information available in a common or standardized format. Its objectives are to avoid tax fraud, maintain a standard readable format across offices and various software and finally easy flow of data to returns & e-way bills.

- As against the common belief, e-invoice does not mean the generation of an invoice from a central portal of the tax department. The current practice of invoice generation may be the accounting front, or the documentary invoice so generated by the seller shall remain the same. The seller can continue to print the physical invoice with their company logo and other information.

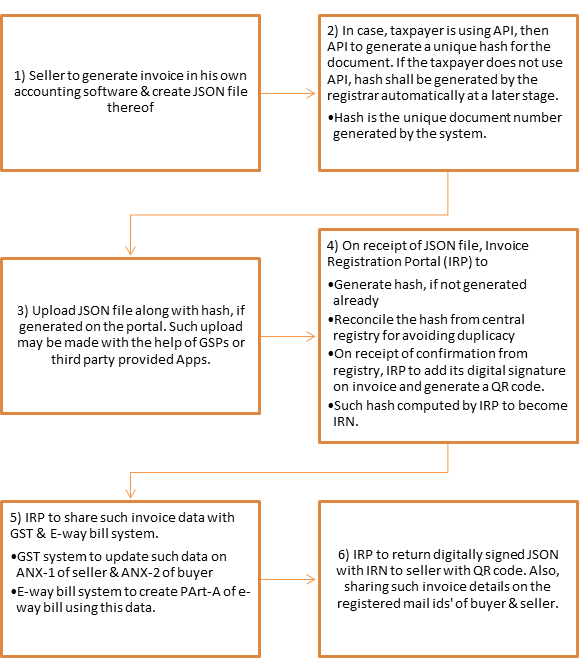

- Under the e-invoice regime, a seller shall have to upload details of a transaction and get it electronically validated from the Invoice Registrar Portal (IRP) of government. Upon validation, a unique Invoice Registration Number (IRN) along with a QR code and digitally signed copy of the invoice shall be available to both the seller and the buyer. Further, such data shall be auto-generated in the returns and e-way bills.

Let us check out how e-invoicing is going to work under GST

Essential characteristics of an e-invoicing system:

- Multiple modes are available of creation of an e-invoice under GST, such as -

- Web-based – JSON file to be submitted using a web browser. The list of 10 such websites has already been notified.

- API – Using API mode, the big taxpayers and accounting software providers can interface their systems and pull the IRN after passing the relevant invoice information in JSON format. This system shall work like the e-way bill methodology.

- Text message (SMS)

- Mobile application

- Offline tool – This tool shall be made available free of charge to small and medium taxpayers having turnover below INR 1.5 crores per annum.

- GSP

- Concept of Invoice Registration Number (IRN):

- IRN (Invoice Reference Number) will be the hash generated by the IRP. Unique IRN issued for each document.

- The unique IRN will be based on the computation of hash which is generated using GSTIN of the generator of the document (invoice or credit note etc.), Year and Document number like a unique invoice number.

- Since the hash generated will be reconciled with the Central Registry before approval, the chances of duplication are significantly eliminated. In case, a duplicate hash is found upon reconciliation with the registry, the registrar shall reject the registration & inform the sender. Thus, only unique invoices will, therefore, be accepted & registered by the registrar.

- Hence, IRN shall result in a distinctive identification number for each document so submitted.

- IRN so generated can be used instead of invoice by the goods carrier along with the e-way bill within a timeline of 30 days from the date of generation.

- Requirement of Digital Signature by e-invoice Registration Portal:

- Once the hash is verified, the registrar will digitally sign the document with the private key of IRP. This will certify the correct reporting of the transaction.

- Such e-invoice with the digital signature will be useful for the e-way bill.

- Verification through QR Code:

- The IRP will also generate a QR code containing the unique IRN (hash) along with some important parameters of invoice and digital signature so that it can be verified on the central portal as well as by an Offline App.

- Such a QR code can be scanned to get the following information:

- GSTIN of supplier

- GSTIN of Recipient

- Invoice number as given by Supplier

- Date of generation of invoice

- Invoice value (taxable value and gross tax)

- Number of line items

- HSN Code of the main item (the line item having the highest taxable value)

- Unique Invoice Reference Number (hash)

- QR code will enable quick view, validation and access of the invoices from the GST system from hand-held devices

- Availability of offline app to authenticate the QR code of the invoice and its basic details. An online connection will only be required to view all the details

- Multiple registrars shall be available for smooth and thorough operations. However, till now NIC is proposed to be the first registrar. To avoid duplication of e-invoices, the GST system and IRP will perform a de-duplication check with the central registry to ensure that the IRN that is generated is unique for each invoice. Hence, there shall be only one registered IRN for each invoice. In the case of multiple registrars (more than one IRPs) only one IRP will return a valid IRN to the seller. Except for one, all other IRPs will reject the request of registration.

- A standard format for E-invoice was established after ICAI & industrial consultation. Hence, the same e-invoice format shall be issued for all kinds of businesses. However, excluding the mandatory field, it is upon the taxpayer to fill the non-mandatory fields.

- E-invoice data shall be available only for 24 hours on IRP. Thereafter, it shall be stored in the Central registry created by the government for this purpose. This is to ensure timeliness, efficiency, and effectiveness of the IRP.

- Cancellation of an E-invoice is possible. This will have to be reported to IRN within 24 hours. Any cancellation after 24hrs could not be possible on IRN, however one can manually cancel the same on the GST portal before filing the returns.

- The flow of data for other compliance purposes thereby reducing the reconciliation problems.

So, how are businesses going to benefit from e-invoicing?

- One-time reporting of invoice data as against reporting in multiple formats i.e. in returns & e-way bill

- Auto-generation of sales & purchase register for the new returns

- Use of data in Part A of an e-way bill to ensure smooth and efficient generation of e-way bill

- Reduction in tax fraud by reduction in fake invoices, etc.

- Easier tracking and reliability of B2B transactions

- System-level matching of Input & output tax to reduce verification issues while filing GST returns

- Easier access and readability of invoices across government offices and other stakeholders

When will e-invoicing impact you as a business?

Initially from January 01, 2020, such E-invoice shall be applicable to all Business-to-Business (B2B) transactions voluntarily.

From April 01, 2020, a registered person, whose aggregate turnover in a financial year exceeds INR 100 crore, shall be required to generate an e-invoice for all B2B sales. This is a mandatory requirement.

Further, a registered person, whose aggregate turnover in a financial year exceeds INR 500 crore to an unregistered person (i.e. B2C transactions), shall be required to issue an invoice with a Quick Response (QR) code from April 01, 2020.

Gradually, all the transactions (irrespective of turnover requirements) shall be covered in a phased manner.

Latest update: The government introduced a new GST e-invoice scheme under which businesses with a turnover of Rs 500 crore and above will generate all invoices on a centralised government portal starting October 1, 2020. Earlier, the turnover threshold for businesses was set at Rs 100 crore.

As a business, what actions are required at your end?

- As a seller, you require a utility that will output the invoice data in JSON format, either from the accounting or billing software or ERP or excel/word document or even a mobile app. Check for such compatibility with your software vendor.

- However, GSTN shall provide an offline tool wherein data can be entered and converted into a JSON file. The small and medium-sized taxpayers (having annual turnover below Rs 1.5 Crores) can also avail accounting and billing systems being offered by GSTN free of cost. GSTN shall also empanel 8 accounting & billing software to provide basic accounting & billing system free of cost to small taxpayers.

- Make your stakeholders aware of such change so that your input and output transactions are clearly reflected in the e-invoicing regime.

- Stay updated with the legal and technological requirements for e-invoicing

Additional key takeaways

- Generation of an e-way bill is the responsibility of the taxpayer who will be required to report the same to the IRP of GST. Thus, in case of reverse charge, the buyer shall be responsible to make the necessary compliance.

- Documents to be reported to IRP:

- Invoice

- Credit Note by Supplier

- Debit Note by Recipient

- Any other document as may be required to be reported

- Parameters to generate hash are:

- GSTIN of the supplier

- Invoice number of the supplier

- Financial Year (YYYY-YY)

- IRN or hash generation algorithm will be prescribed by GSTN in the e-invoice standard.

- The e-invoice standardized schema has mandatory and optional items. The e-invoice shall not be accepted in the GST System unless all the mandatory items are present. The optional items are to be used by the seller and buyer as per their business need to enforce their business obligations or relationships.

- As of now, bulk uploading facility is not supported. However, ERP or accounting system may be designed in such a way that it makes request one by one. For the user, it will not make any difference.

Avalara is an experienced application service provider (ASP) and partner of authorized GST Suvidha Providers (GSPs). To understand how our cloud-based application Avalara India GST can help you with GST compliance including e-invoicing, contact us through www.avalara.com