Customs duty and import tax solutions to take your business global

Help lower costs and grow revenue while maintaining control of your customers’ cross-border experience

Customs duty and import tax solutions to take your business global

Help lower costs and grow revenue while maintaining control of your customers’ cross-border experience

Support international growth with a leading compliance vendor

End-to-end platform that helps you overcome global compliance challenges

Industry-leading tools that plug and play with almost any existing business system

One vendor for both domestic and international compliance needs

Trusted by the biggest names in ecommerce to deliver a superior customer experience

Avalara now powers the duty and import tax features of the Shopify global commerce hub, Shopify Markets. Explore this and 1,400+ other signed partner integrations that work with what you already use.

Discover our range of global compliance solutions

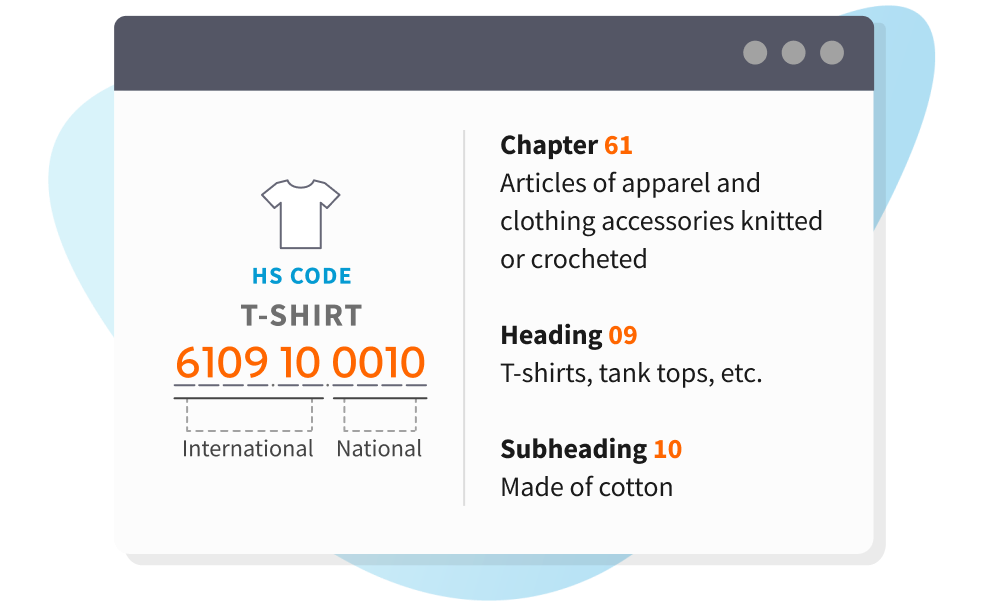

Avalara Item Classification

Classify Harmonized System codes with confidence

From self-serve capabilities to managed classification services, we automate the assignment of HS codes with a solution that can be implemented on its own or seamlessly integrated with Avalara AvaTax Cross-Border.

Avalara Trade Restrictions Management

Navigate government restrictions on cross-border selling

We flag items with restrictions in place, as well as those that are prohibited from entering a country, to help you understand and comply with cross-border government regulations.

Avalara AvaTax Cross-Border

Don’t let compliance, duties, and cross-border tariffs impact your customer experience

Simplify your compliance process with a flexible, unified platform to help calculate or estimate customs and duties upfront with greater accuracy.

Avalara Import One-stop Shop Solution and Avalara VAT Registration

Access and registration in an estimated $800-billion ecommerce market

Take advantage of changes to EU VAT laws with our Import One-Stop Shop (IOSS) solution. In addition, we provide step-by-step guidance to get you VAT registered in countries where you’re obligated to collect and remit sales tax.

Avalara Fiscal Representation

Secure a fiscal representative in any country

Sometimes, global compliance authorities in certain European countries require businesses to appoint a fiscal representative. Avalara has in-house fiscal representative services in Europe and around the world. Our dedicated VAT experts can help secure a fiscal representative for EU trading and assist you with any international VAT questions.

Avalara VAT Reporting and customs compliance

Simplify VAT returns with automation

Decrease the high cost and hassle of returns preparation, filing, and remittance. Our single automated solution calculates VAT and helps keep you compliant with U.K. and EU rules.

Avalara e-Invoicing

Avalara e-Invoicing helps your business adapt and grow

To keep selling in existing countries and new markets with evolving e-invoicing requirements, it’s essential to stay compliant. Our integration methods help you avoid having to overhaul custom and legacy systems by easily adding to what you already use, in addition to helping you future-proofing your business to stay on top of changing rules.

Payments and shipping

Offer local payment methods and clear customs smoothly

Avalara uses the Digital River global online payments platform to maximize conversions and help grow revenue. We also partner with UPS, Passport Shipping, and Easyship to provide international shipping solutions from some of the best providers in the industry.