See Avalara for Shopify in action with an instant, self-guided demo — no sales pitch, no commitments.

BENEFITS

Avalara gives you end-to-end tax automation inside Shopify without juggling multiple vendors.

Automate end-to-end tax compliance

Offload sales tax tasks, from real-time calculation at checkout to returns filing, with one integrated solution for all of your Shopify stores.

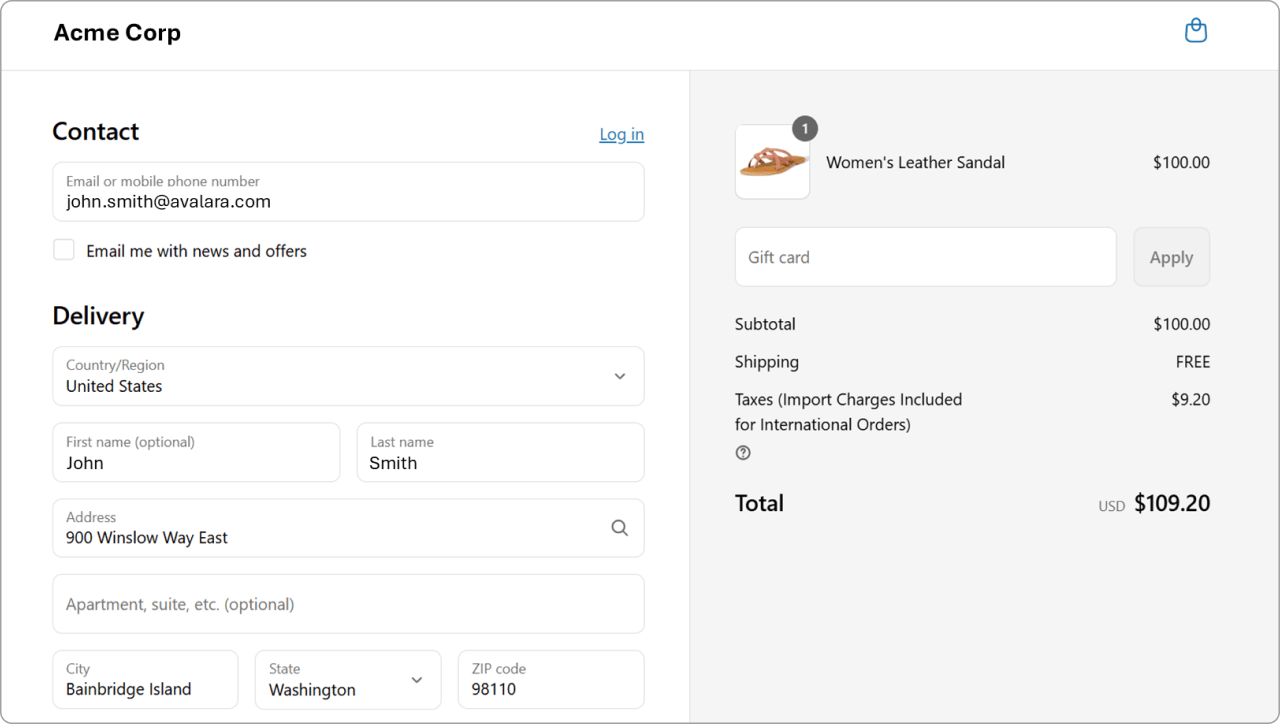

Get tax rates right at checkout

Avalara is one of Shopify’s select tax partners built directly into Shopify checkout, ensuring your customers see more accurate rates with fewer surprises, fewer errors.

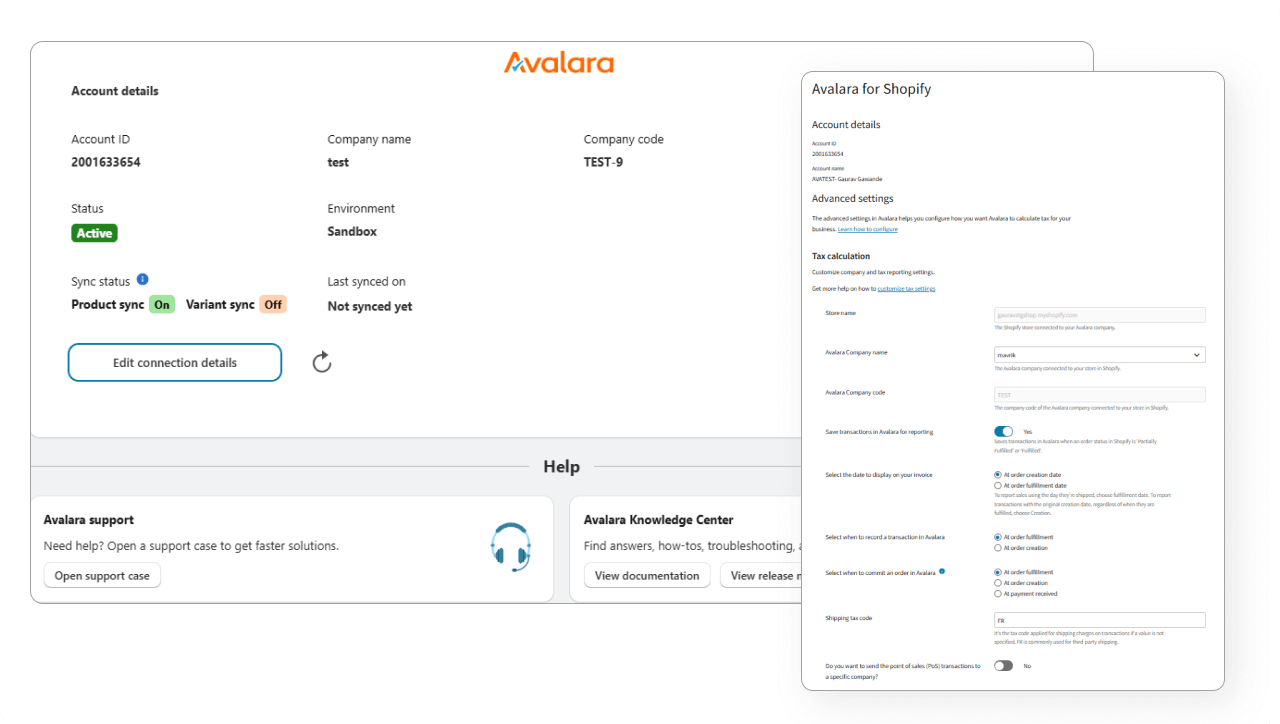

Set up easily on any Shopify plan

Avalara is available on any Shopify plan with no developer work needed. Onboard quickly with AI assistance and access tax experts for compliance needs or setup guidance.

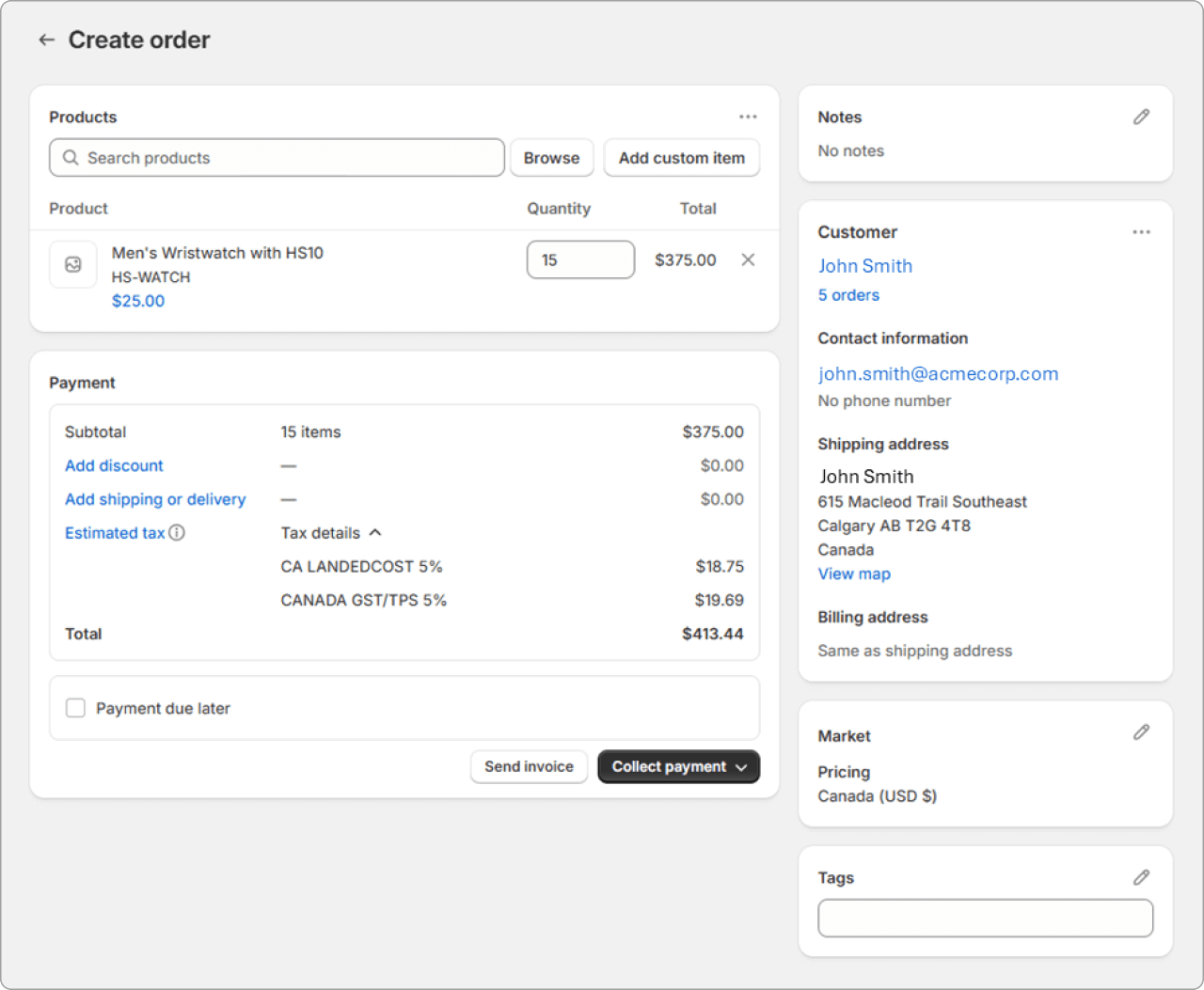

Grow confidently across borders

Expand into new states or sell internationally with Avalara support for VAT and cross-border tax in 190+ countries helping you stay ahead of changing rules and thresholds.

Get ahead of nexus and audit risk

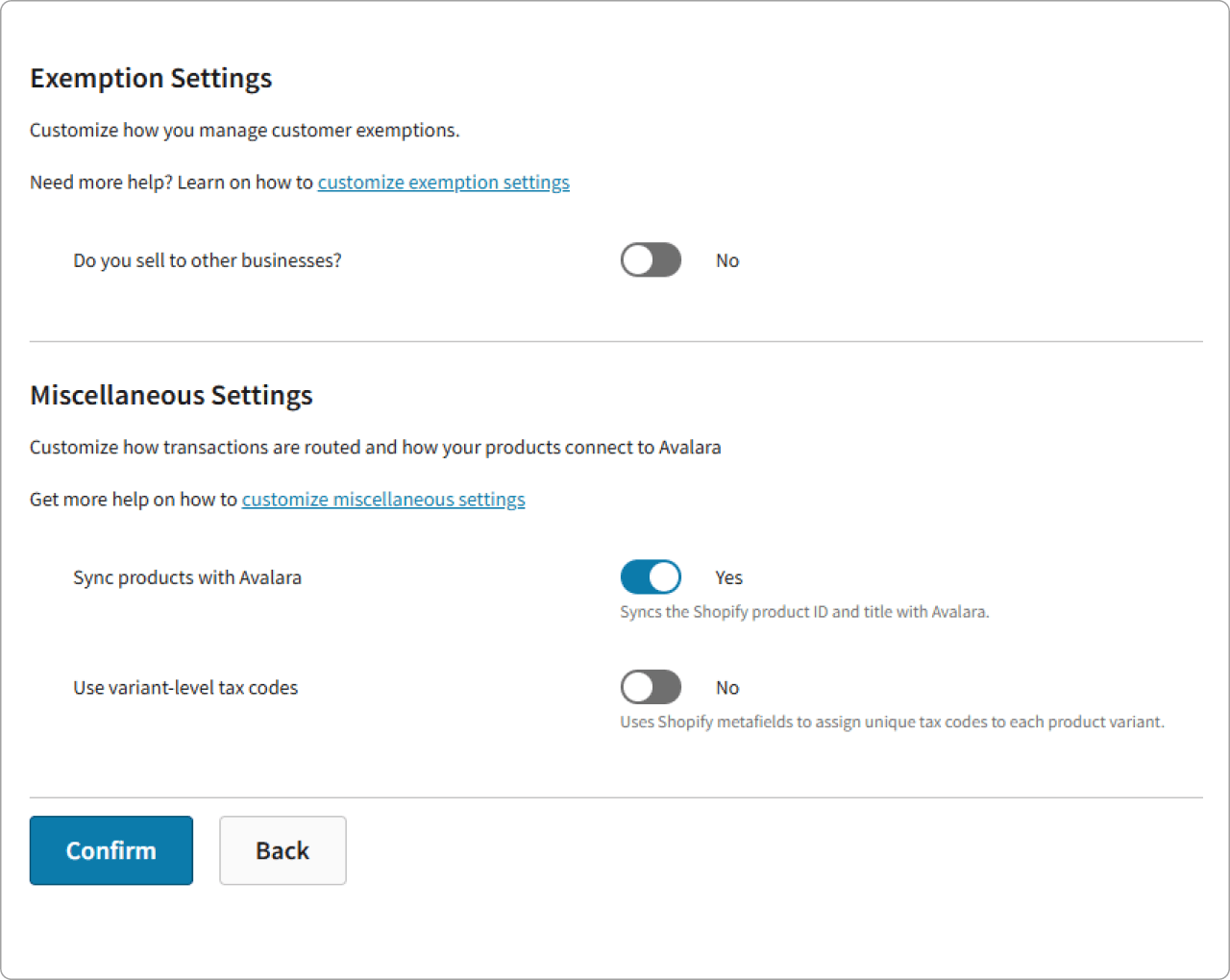

Avalara monitors nexus risk, supports exemption management for B2B and B2C sales, and helps prevent compliance issues even if you’re already out of compliance.

Save time on returns and remittance

Streamline tax filing and remittance by using Avalara for tax calculation and automated tax returns, reducing risk and manual work.

HOW IT WORKS

Plug the power of Avalara into your Shopify store and workflows

Integrate one product or multiple products to power your compliance

Apply more accurate, regularly updated tax rates based on location, taxability, legislation, and more.

Offload the hassle of returns preparation, filing, and remittance.

Collect, process, and access exemption documents.

Drive cross-border sales with a solution that optimizes customer experience.

Satisfy your tax registration requirements with solutions tailored to your business.

Let our tax experts guide you through nexus, business licenses, backfiling, and the implementation of Avalara tools.

CUSTOMER STORIES

See what our customers have to say

“I had worked with Avalara at one of my previous companies and we chose Avalara because we realized that they have the right expertise and could so easily connect with our Shopify platform.”

—Anne Masson,

CFO, ICONIC London

“Avalara has certainly made our tax compliance easier. In fact, I can’t even imagine how we would have done it in a manual way. I think it would’ve been impossible.”

—Anne Masson,

CFO, ICONIC London

“I don’t lose sleep worrying about late or misfiled taxes and penalties, and Avalara keeps us up to date as requirements change.”

—Robin Hecht,

Controller, Boll & Branch

“The automation and support provided by Avalara have transformed our tax processes, allowing us to focus on our core business and future growth.”

—Vivek Dadhania,

Tax Manager, Therabody

Dive deeper

Resources to get you started

EXPLORE

IMPLEMENT

USE

Frequently asked questions

Which tax types does Avalara for Shopify cover?

Avalara for Shopify currently handles transaction taxes such as sales tax and VAT, and customs duty and import tax for your international transactions. Our integration will extend to other tax types in the future.

How does Avalara for Shopify differ from Shopify Tax?

Avalara for Shopify is ideal for larger retailers with greater complexity and international sales. Tax codes in Avalara for Shopify are also more regularly updated, and customers receive direct support from Avalara.

How does Avalara for Shopify stand out from other options on the Shopify Tax Platform?

Avalara helps businesses of all sizes get tax compliance right. Proud to be one of the first partners available on the Shopify Tax Platform, Avalara has been providing tax calculation services for Shopify Plus users since 2015 and we’re pleased to now be able to serve all Shopify customers who choose to automate their tax compliance with us.

Avalara for Shopify is equipped to handle international tax calculation, including VAT, customs duties, and import taxes.

We provide supplementary solutions for tax return preparation, filing, and seamless exemption certificate management, complementing our core tax calculation product, AvaTax.

I have multiple companies, will Avalara for Shopify work for me?

Yes. Avalara for Shopify can manage your sales tax compliance across multiple companies or storefronts, and even manage the process across complex corporate structures (e.g., parent or subsidiary companies). There’s no limit or extra cost for using Avalara for Shopify in multiple companies.

Which Shopify plans does Avalara support?

Avalara for Shopify supports all Shopify plans, including Basic, Advanced, Plus, and Enterprise.