Trusted by companies in every industry

|

Product features

|

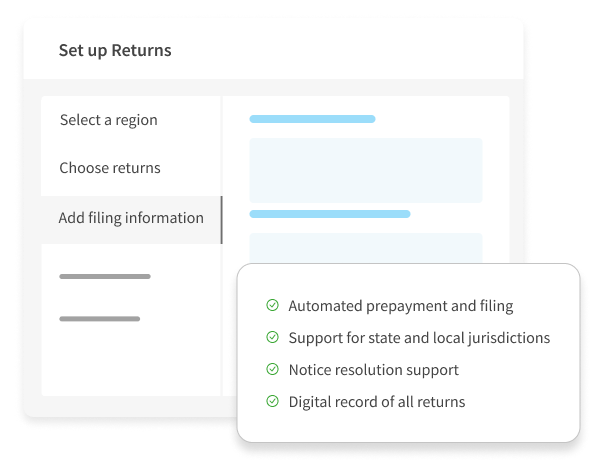

Managed Returns

|

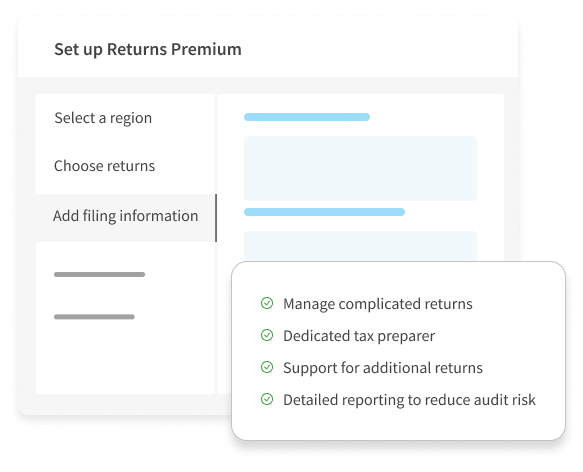

Managed Returns Premium

|

|---|---|---|

|

Automated extract of sales data from marketplaces, ecommerce, and accounting platforms |

X |

X |

|

Sales and sellers use tax forms for every state and local jurisdiction |

X |

X |

|

Consumer use tax filing |

X |

X |

|

Support for free SST returns |

X |

X |

|

Avalara prepares and files customer returns |

X |

X |

|

Automatic approval every filing |

X |

X |

|

Single source of payment (Avalara Treasury) |

X |

X |

|

Notice management |

X |

X |

|

Prepayments calculation and filing |

X |

X |

|

Multilocation-based returns |

X |

X |

|

Advanced return adjustments (e.g., FL Enterprise Zone tax incentive) |

X |

X |

|

Advanced return schedules (e.g., CO Public Improvement Fee, CA Schedule H) |

X |

X |

|

Canadian returns |

X |

X |

|

Credit carry-over support |

X |

X |

|

Multi-user account access |

X |

X |

|

Automated syncing with multiple sales and accounting channels |

X |

X |

|

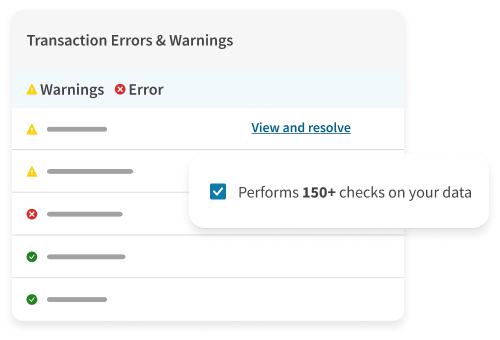

CSV transaction upload and error alerting |

X |

X |

|

Transaction creation and editing within the UI |

X |

X |

|

State liability detail reports |

X |

X |

|

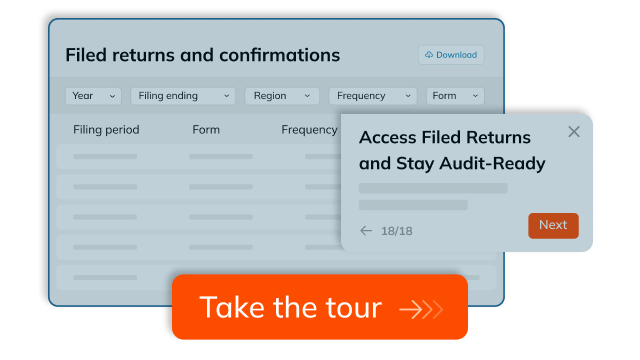

Access to historical returns and confirmations |

X |

X |

|

Management of filing entities and users in a single account |

X |

X |

|

Direct point of contact and tax preparer |

X |

|

|

Special handling of returns |

X |

|

|

White glove service for high-volume, high-revenue, complex returns |

X |