GST Applicable For Remuneration Paid To Directors - What You Need To Know?

In a recent ruling issued by Rajasthan bench of the Authority for Advance Ruling AAR, in the case of Clay Craft India Pvt Ltd, it was announced that the remuneration paid to directors at an organisation would attract the Goods and Service Tax under the Reverse Charge Mechanism. How does this apply to directors at organisations? Is there a threshold on remuneration that attracts GST? Is this liable to full-time directors only or are executive directors also being brought under scrutiny? Here’s everything you need to know.

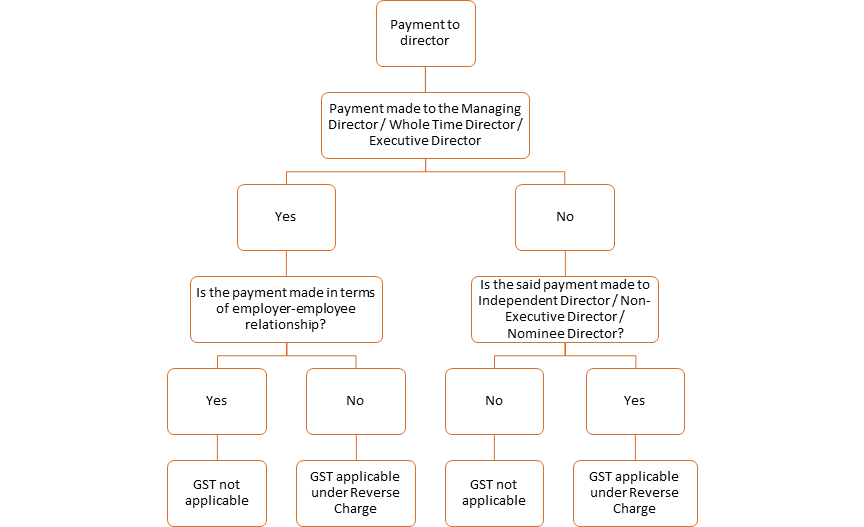

The position of directors in an organisation can be classified in executive and non-executive directors. While executive directors like the managing director, whole-time director etc. are involved in the day to day affairs of an organisation and are on the organisation’s payroll, non-executive directors include nominee directors or independent directors and only visit the organisation for board meetings or shareholder meetings and are paid a sitting fee. GST is not applicable on the remuneration paid to executive directors, but it is applicable on the remuneration paid to non-executive directors.

Instances where GST is applicable on Payments made to Directors

- GST is applicable on sitting fees paid to Directors for attending board meetings.

- GST is applicable on payment made to directors for professional or technical services provided to the company (TDS not deducted under Head Salary)

- GST is applicable on payments made to independent directors, non-executive directors and nominee directors at an organisation.

Still not sure whether GST is applicable on payments made to directors within your organisation? We created a scenario flowchart to help readers understand how GST applies to remuneration given to directors.

Flowchart of Applicability of GST on Payments made to Director

Is there a threshold on remuneration that attracts GST?

Presently, there has not been a formal announcement of a threshold or limit beyond high GST is applicable. This tax is applicable under the reverse charge mechanism.

What is the reverse charge mechanism under the Goods and Services Tax?

Reverse charge is a mechanism where the recipient of the goods and/or services is liable to pay GST instead of the supplier. Traditionally, the supplier of goods or services pays the tax on supply, but under the reverse charge mechanism, the chargeability is reversed. Section 9(3) and 9(4) of the CGST Act contain provisions with reference to the Reverse Charge Mechanism in regard to services that are supplied from time to time.

As services rendered by non-executive directors occur from time to time, the reverse charge mechanism is applicable to their remuneration. In this case, GST is applicable on services provided by the director in the capacity of a director and not as an independent service provider - this is why reverse charge mechanism is applicable, and the director needs to pay GST and not the company.

Prepare your business for e-invoicing under GST

Discover how to meet all compliance requirements while integrating e-invoicing into your tax function.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.