Everything you need to know about Dynamic QR code under B2C eInvoicing

- Dynamic QR codes are being implemented to encourage digital payments and not for IRN generation.

- A dynamic QR code under B2C eInvoicing must contain all information relevant to that invoice

Generation & printing of Dynamic QR code under the Goods and Services Tax for business to consumer transactions may have been deferred to the end of June 2021 but taxpayers must consider it an opportunity to understand what is it all about.

Here’s what you need to know about dynamic QR code generation :

Since eInvoicing might take some time to be implemented, the Central Board for Indirect Taxes and Customs had directed that businesses with an annual turnover exceeding ₹500 crore generate and incorporate a dynamic quick response or QR code for enabling digital payments on B2C invoices.

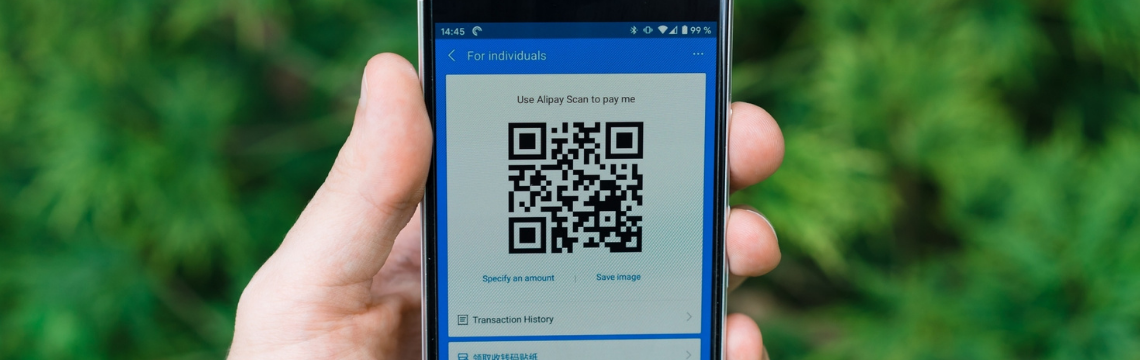

This dynamic quick response code is required to contain information relevant to the eInvoice. This QR code can be scanned and accessed from any mobile device. Since B2C eInvoicing doesn’t require an invoice reference number unlike B2B eInvoicing, the presence of a dynamic QR code is done to encourage digital payments in the country.

Similar to B2B eInvoicing, dynamic QR codes are likely to contain all details that will be relevant for inspection by tax authorities at various tax revenue checkpoints. These are likely to include the following -

- GSTIN of the supplier

- Supplier UPI ID

- Invoice number, given by the supplier

- Date of the generation of invoice

- Bank account details of the payee

- IFSC code

- Break up of CGST, SGST, IGST, Cess

However, a dynamic QR code for B2C transactions is also expected to include two other elements.

- GSTIN of the recipient

- Payment reference link to facilitate easy digital payment

Like B2B eInvoicing, generation of a dynamic QR code will not be required for B2C transactions or some exempt business categories like insurance, transport, banking and non banking.

Prepare your business for e-invoicing under GST

Discover how to meet all compliance requirements while integrating e-invoicing into your tax function.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.