The Avalara Solution

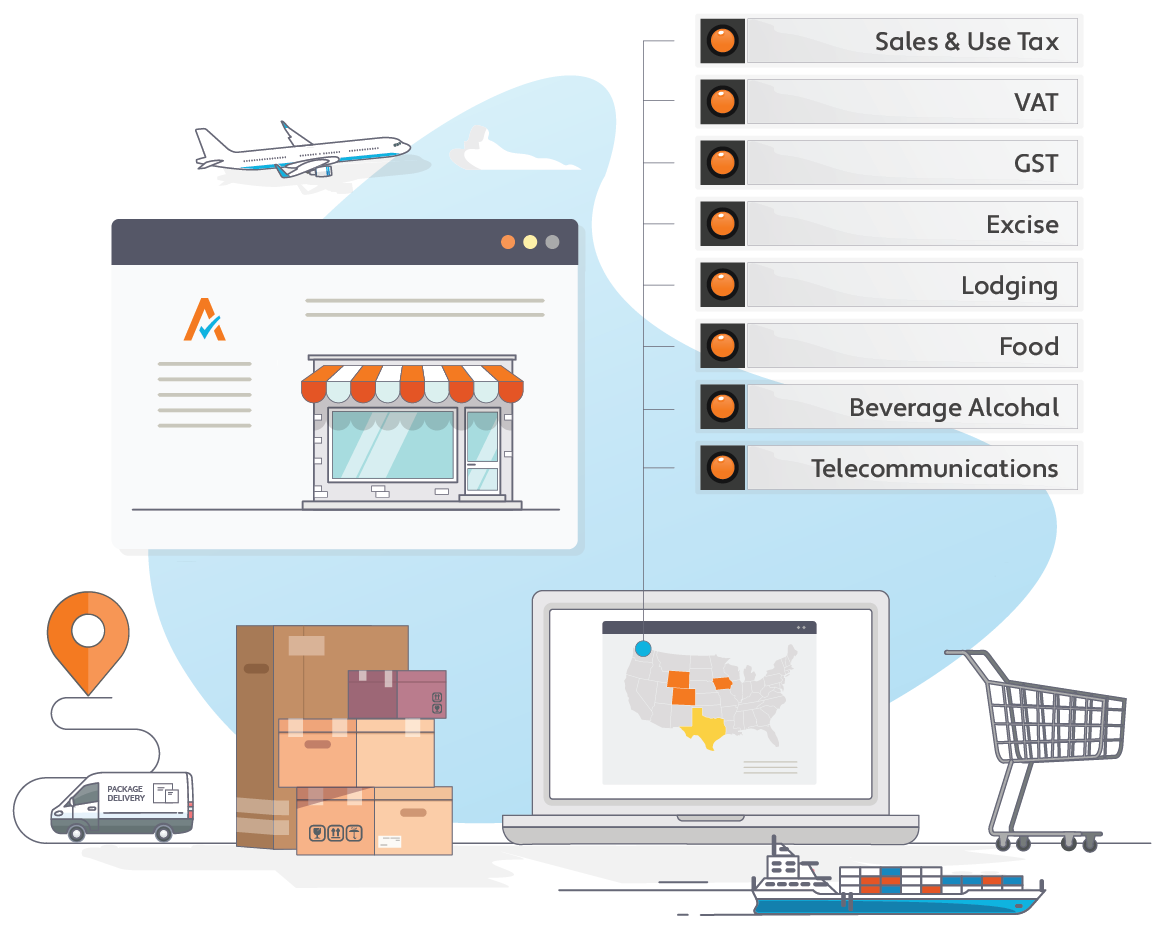

A solution for every tax challenge

Avalara can provide worry-free compliance to any kind of business.

Find the Avalara solution for you

We serve sole proprietorships to Fortune 500 companies operating around the globe — we can help you manage your tax compliance, too.

Enterprise solution

Find the Avalara solution for you

We serve sole proprietorships to Fortune 500 companies operating around the globe — we can help you manage your tax compliance, too.

Enterprise solution

How Avalara automation can make compliance easier

How Avalara automation can make compliance easier

Discover your tax obligations and where your business must file and remit.

Register your business in multiple locations with a single form.

Calculate EU VAT rates and all 12,000+ U.S. jurisdictions, and apply the right tax codes to products sold internationally.

Manage exempt sales by collecting and verifying documents at the point of sale, and provide auditors with secure access to records.

File and remit easily with automatically filled, signature-ready returns.

Avalara helps solve common compliance challenges

Challenge: AUDIT RISK

Using incorrect tax rates, missing registrations, and filing late returns are just some of the errors that can put your business at risk of audits and fines.

Solution: GREATER ACCURACY

Automation makes rate calculations more accurate, helps ensure returns are filed on time and exemption certificates are up to date, and makes registration much easier.

Challenge: DRAINING RESOURCES

Researching the many rules and regulations, filing returns, and other complicated compliance tasks can pull your team away from revenue-generating tasks.

Solution: OFFLOAD TIME-CONSUMING TASKS

Avalara can handle your returns prep and filing, and tedious tasks that are prone to error can be automated.

Challenge: DATA YOU CAN RELY ON

Pulling accurate and consistent tax data into your systems from the ever-changing tax landscape can be difficult.

Solution: A SINGLE SOURCE OF TRUTH

Avalara provides a single source of data with a higher degree of accuracy for all of your channels and point of sale.

Challenge: GROWING LIABILITIES

Expanding into new markets and adding new products adds to your compliance obligations.

Solution: GROW WITH CONFIDENCE

Automation makes it easier to scale, and staying on top of your tax obligations means you can enter new territories and markets with confident compliance.

Challenge: KEEPING CUSTOMERS HAPPY

Charging the wrong tax rate or being unclear at the checkout can drive your customers to your competitors.

Solution: IMPROVED BUYING EXPERIENCE

Avalara delivers real-time rates directly to your shopping cart or invoicing system at the moment of purchase.

Connect with Avalara

You’re just a few steps away from stress-free global compliance. Simply tell us a bit about you and your business to get started.