Is IOSS right for my business?

Earlier this year, the Import One-Stop Shop (IOSS) was introduced as part of the great EU VAT reform, the largest changes to VAT collection across the European trading bloc in 30 years.

Since the introduction of OSS and IOSS, here at Avalara, we have been working closely with our customers to help answer some of the most pressing questions they have about the reforms, and how they can incorporate the changes into their business.

Whether you’re a business registered within the EU or outside of the bloc, including the UK, these changes are likely to affect you.

We recently hosted a webinar with our VAT specialists Mathew Harrison, James Bright and Lyndsey Robinson to help sellers evaluate whether IOSS is right for their business. Missed the episode? Listen again here to hear from the experts.

Or, if you’re short on time, we’ve recapped the conversation below.

What is IOSS?

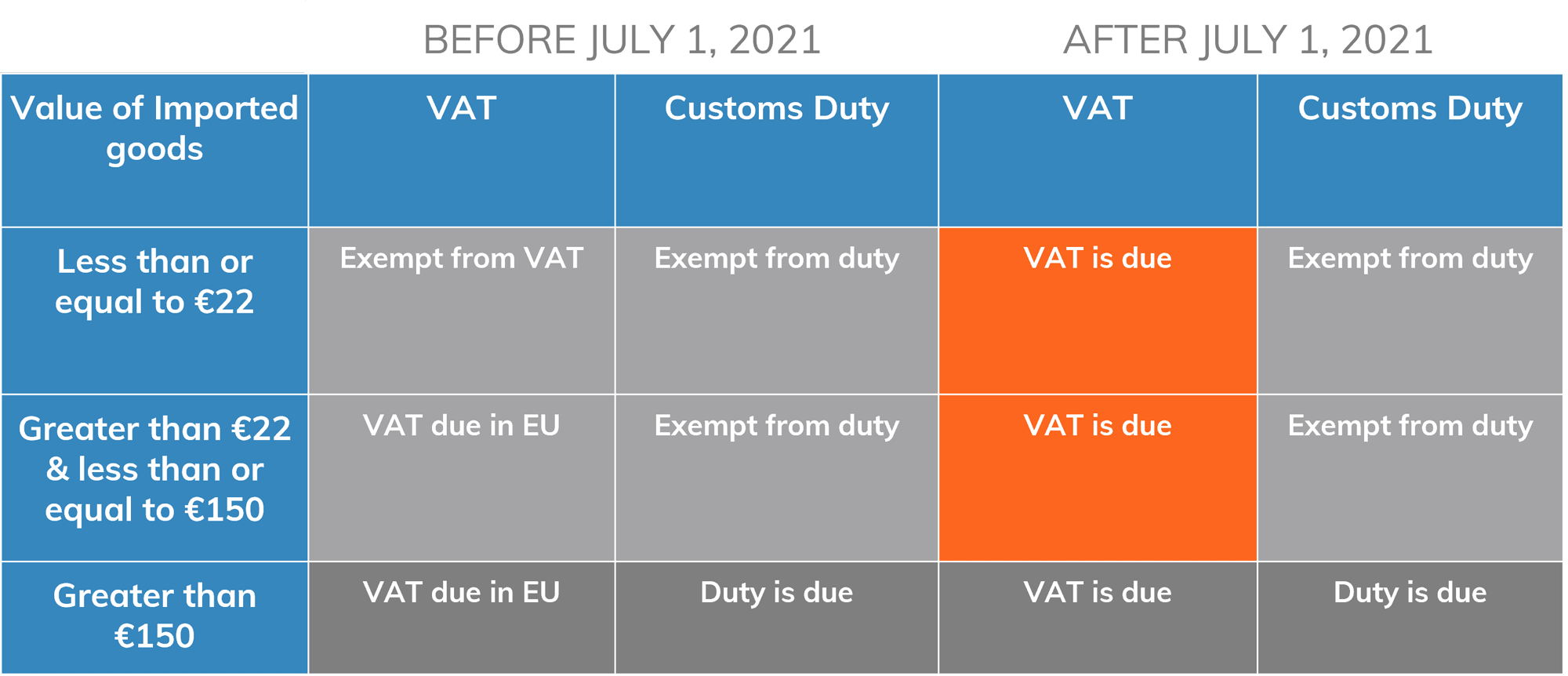

Introduced on July 1 2021, the IOSS scheme applies to goods being sold into the EU with a total consignment value of under €150. Its introduction forms the basis of the EU’s most significant change to its VAT system in a generation.

As part of the reform, the EU also removed the €22 import VAT exemption, which means all businesses not using IOSS will have to pay import VAT on all goods being sold into the EU.

If you qualify for the scheme but haven’t yet registered, it’s not too late to sign-up. Visit our IOSS dedicated portal to access a range of helpful materials.

Image: How the process has changed (click to enlarge)

What are your options?

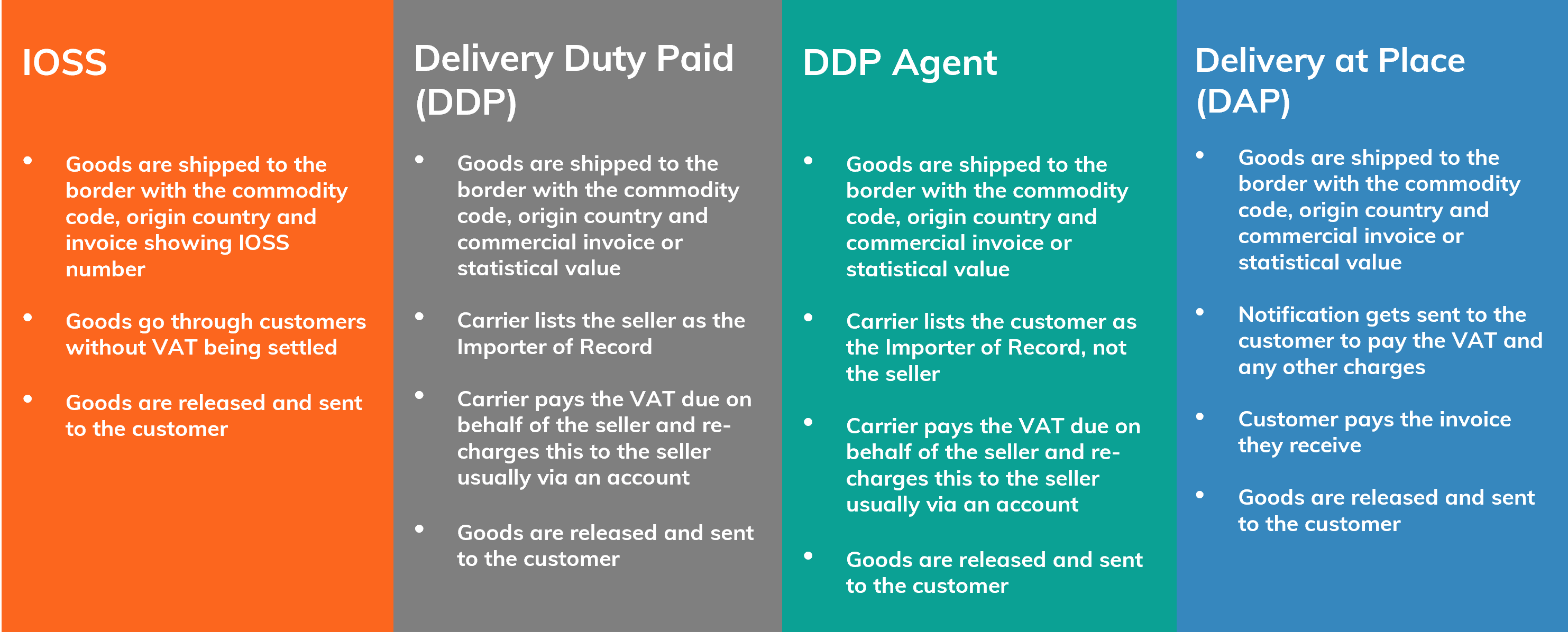

If you are selling goods into the EU, there are now four options available to you: Delivery at Place (DAP), Delivery Duty Paid (DDP), DDP Agent and IOSS.

Image: The four EU shipping options including IOSS (click to enlarge)

Understanding which of these options is best for you and your business will depend on several considerations such as:

- How many sales do you make to the EU?

- What type of customer experience do you want to provide?

- What percentage of your products are returned?

- How quick do you want your shipping process to be?

- What percentage of your consignments are below €150?

- What’s the value to your business of simplifying your VAT compliance?

Your answer to these questions will determine the best option that will meet your needs, and those of your customers.

For businesses eligible for IOSS, there are a range of benefits to be had including improved cashflow, reduced rates of returns and improved customer service. However, it’s not without its challenges.

While the scheme is designed to simplify VAT reporting, there is some initial complexity in ensuring you are set-up ready to obtain approval. The increased number of VAT rates, ensuring accuracy of pricing and making sure you are charging and displaying tax correctly at the point-of-sale is essential to the registration process.

Failing to get the correct customs process in place can result in goods being undervalued and customers disappointed.

Ready to sell into Europe? Maximise your ROI

It is advisable that you take the time to assess the options available to you and understand the benefits, costs and requirements for each.

You’re not on your own. Our VAT experts are on hand to explain the options and help you make the right decision for your business. Don’t forget, there is a wealth of materials available to you via our site such as our guide to understanding DDP or our blog on the EU VAT reforms.

Avalara's end-to-end IOSS solution

Sell to all 27 EU member states with just one VAT return. Get your business ready with our end-to-end IOSS solution.

Ecommerce Tax Trends Report 2022

Get a comprehensive look at the latest developments in the ecommerce industry.

Stay up to date

Sign up today for our free newsletter and receive the latest indirect tax updates impacting businesses selling internationally straight to your inbox.