|

|

Avalara Tax Code Classification |

Avalara Managed Tariff Code Classification |

Avalara Managed Tax Category Classification |

|---|---|---|---|

|

Product description |

For current AvaTax users with stable product catalogs |

For ecommerce sellers and companies doing business across borders |

For companies with complex products and frequently changing catalogs |

|

Lookup based on universal identifiers (e.g. UPC, GTIN, EAN, etc.) |

- |

||

|

Avalara tax code classification |

- |

||

|

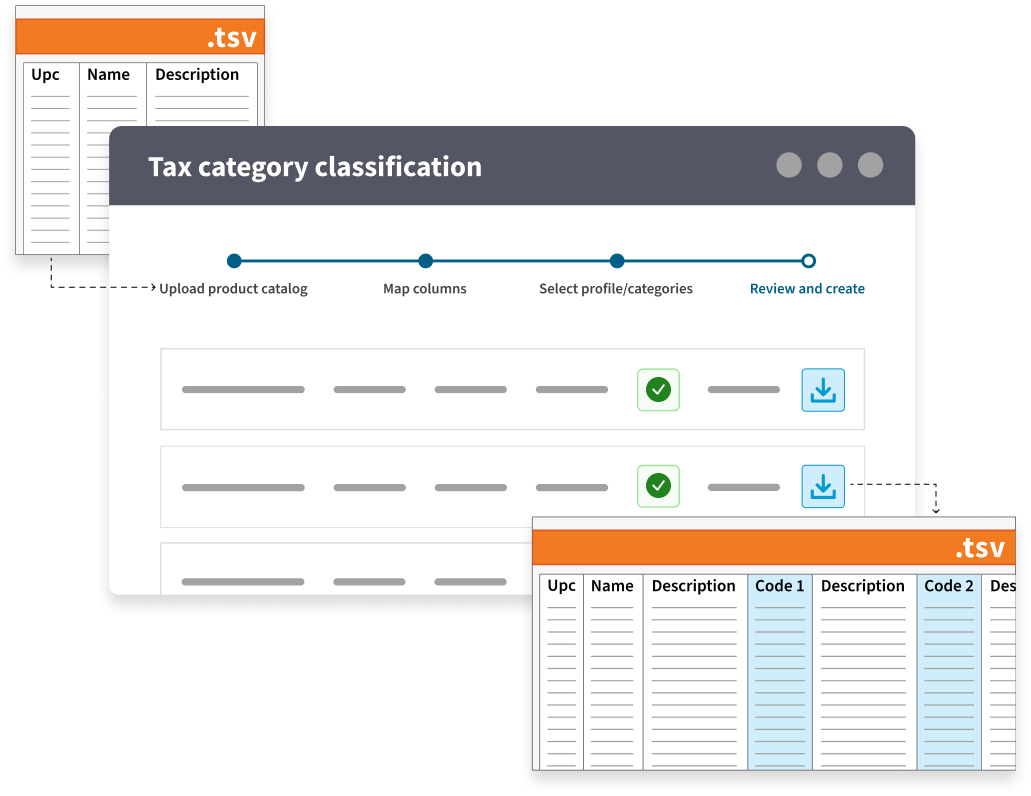

Tax category classification |

- |

||

|

API upload |

- |

||

|

Multiple input formats (API, FTP, direct uploads to UI, etc.) |

- |

||

|

Configurable output formats (.csv, Oracle, .xml, webhooks, etc.) |

- |

||

|

Reporting and analytics |

- |

||

|

Up to 1 million items per month |

- |

||

|

Job management within the tool |

- |

- |

|

|

Special compliance considerations for SNAP, WIC, etc. |

- |

- |

|

|

Professional services assistance and mapping |

- |

- |

|

|

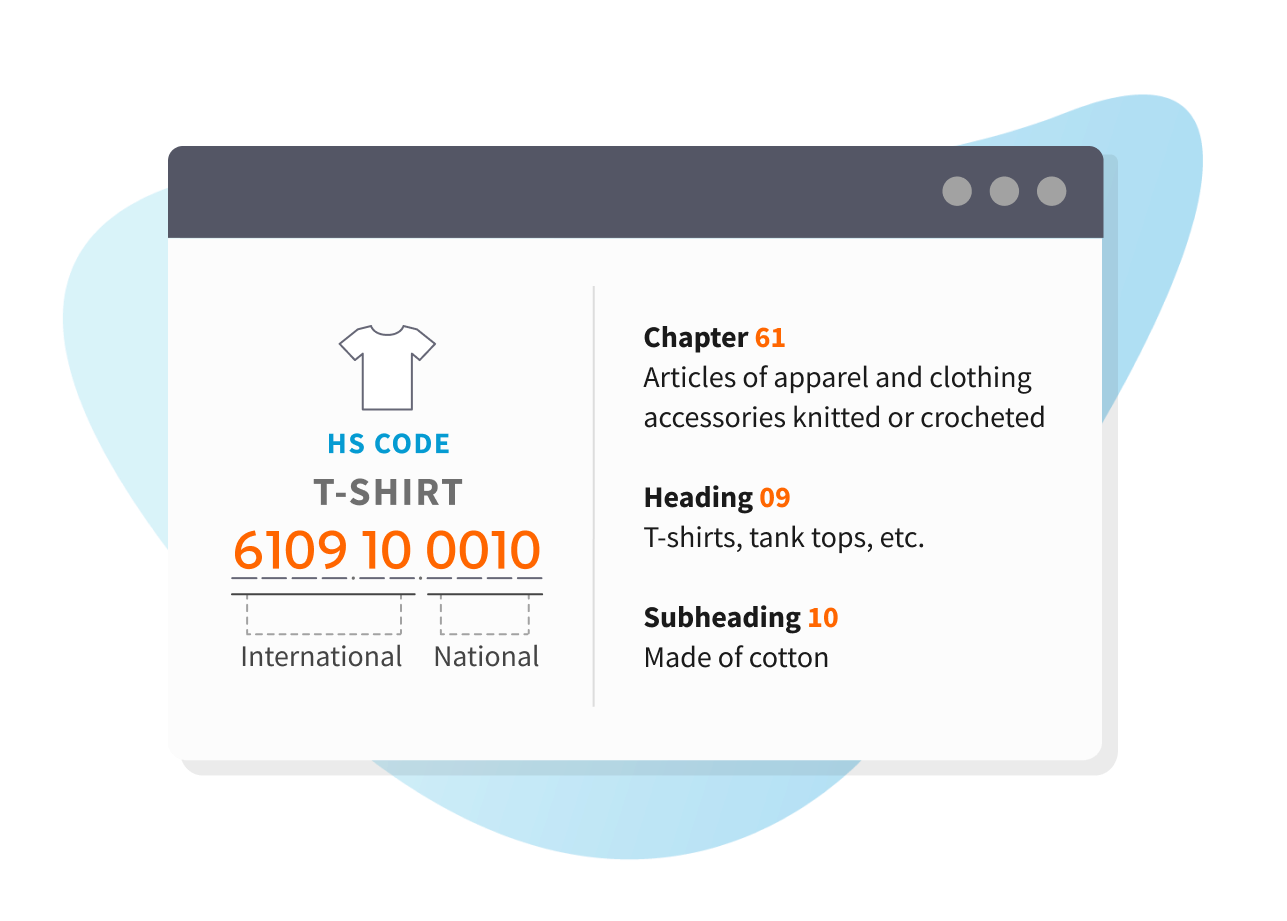

Country-specific HS code classification |

- |

- |

The Harmonized System, or HS, is formally known as the Harmonized Commodity Description and Coding System. It’s the international standard for classifying traded products. It started in 1988 and is maintained by the World Customs Organization (WCO).