Cloud computing, ecommerce and sales tax compliance

Conquering new sales tax frontiers in the cloud

When it comes to sales tax revenue, states are striking out to conquer new frontiers. Yet, unlike their forefathers before them, many lack the pioneering fortitude to stake a firm claim in fertile Cloud territory.

Tech firms are breaking new ground with online software and services, and, following the 2018 South Dakota v. Wayfair, Inc. decision, states are accelerating their adoption of new sales tax laws. These laws, however, are being defined at the state level. The result is a virtual wasteland of ambiguity. This begs the question, as a technology vendor, when and where have you triggered sales tax nexus and how will you respond to ensure sales tax compliance?

Clearing the path to the cloud

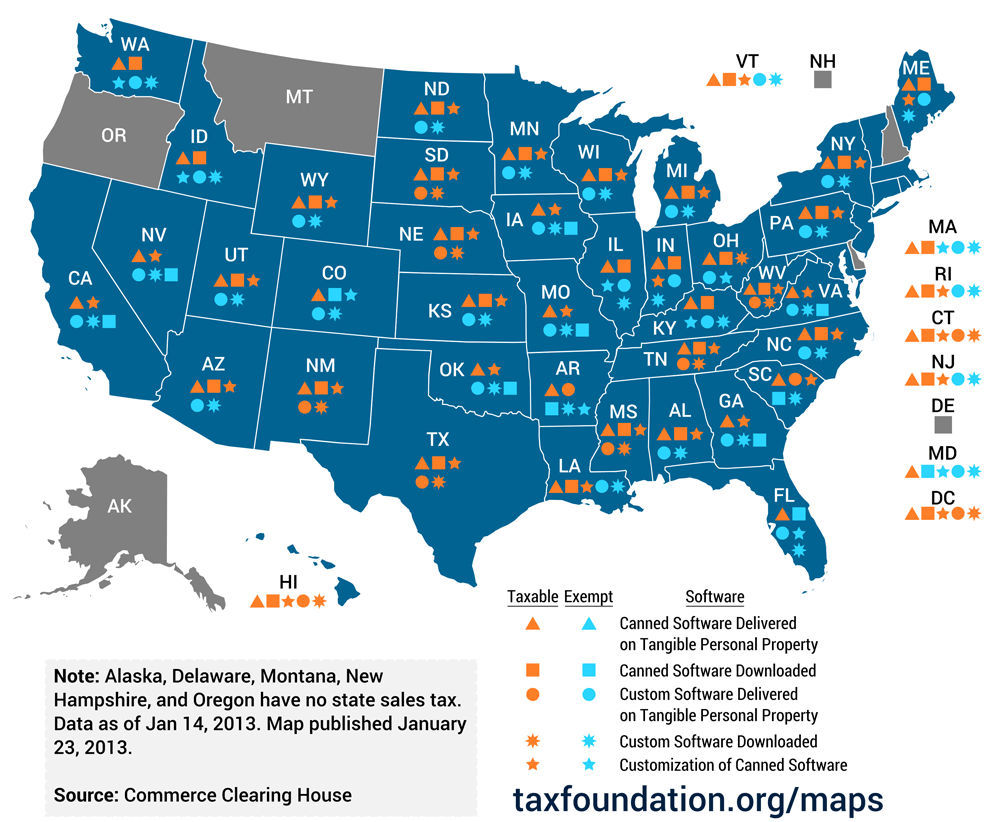

States have made significant headway in defining the taxability of prewritten or “canned” software and digital goods1 (music, movies and books), and many have moved forward with the parameters for “intangibles” such as cloud-delivered products and services. More than a dozen states have specifically addressed Software-as-a-Service (SaaS).

Twenty questions taxonomy

Navigating sales tax law feels a bit like a modern-day Twenty Questions. Today’s “tax-onomy” hardly lends itself to the basic deductive reasoning of animal, vegetable or mineral. Start by breaking it down to the basics: What are you selling? How do your customers buy it? It’s also helpful to define basic parameters such as:

- Packaged or custom

- Tangible or virtual

- Product or service

Packaged or custom: If you sell or distribute software, the laws are fairly defined. Most states consider prewritten software (sometimes called packaged or canned software) to be “tangible personal property” and tax or exempt it accordingly. Most states agree that custom software falls outside this definition and exempt it, although there are some exceptions to this rule.

Tangible or virtual: Certain states categorize software sales by delivery method: physical product, load and leave or electronic delivery. Exemptions vary broadly state to state. In some cases, electronic delivery is exempt; other states consider all packaged software subject to sales tax regardless of delivery method. Categorization can go even more granular with taxability broken out separately for sale, lease or licensing. Pay attention to home rule laws to determine whether you owe sales and use taxes to local jurisdictions as well as whether server location and access bring nexus into play.

Product or service: If you are a service-based business, you may have considered the rule of thumb that services are typically exempt and thought, “Whew, I’m off the hook.” Don’t be so sure. Some states tax technology services at either the full sales tax rate or a reduced rate and may or may not exempt cloud services. If your business falls under the purveyance of Application Service Provider (single tenant), information services, data services or consulting, there’s a good chance the states in which you do business have guidelines in place. This is less likely the case for multi-tenant SaaS.

The map below, courtesy of The Tax Foundation, provides a comprehensive and detailed illustration of how states are handling sales and use tax for software-related product and services.2

Uncharted taxation territory

Despite valiant efforts by financial and legal experts to educate businesses and consumers on the benchmarks for taxing software and services, most states’ criteria are nebulous at best. An article in the June 2013 issue of IACPA’s The Tax Advisor by two PriceWaterhouseCoopers CPAs reiterates the complex nature of cloud computing taxation calling out states who have taken a clear position on SaaS, either to tax it (Pennsylvania, Texas, Utah) or exempt it (Colorado, Virginia). The authors also do a great job of breaking down complex rulings in such states as Massachusetts, Nebraska, South Carolina and Wisconsin.

Businesses should prepare for some yo-yo decisions on these rules as lawmakers figure out exactly how far they want to plunder into uncharted territory.

Happy audit trails to you

Sales tax compliance isn’t easy. Or cheap. Most companies who handle sales tax on their own make mistakes — costly mistakes. A recent Aberdeen Group study showed that trying to achieve sales tax compliance costs businesses somewhere in the ballpark of $24,000. If an audit is imminent, that cost is two to four times higher. Wakefield Research puts audit costs closer to $96,000.

Software companies could be in a more tenuous position. One SaaS executive divulged that his company’s spend to clean up sales tax compliance issues for target acquisitions is between $500,000 and $1.5 million per company.3

Should you be audited, there are steps you can take to make the process go more smoothly:

- Justify intent with detailed records of your transactions and reasons for charging or not charging sales tax (cite statutes and rulings).

- Explain to the auditors why you did things the way you did. This can also help in the event a moratorium entitles you to a refund or grace period or if the laws change.

- Show a good faith effort to follow the law, which may entitle you to reduced or waived penalties.

Circling the wagons

Better yet, mitigate risk before it happens. Unless you have a large dedicated team of tax experts, outsourcing makes the most sense. For maximum benefit, go with a Cloud solution for sales tax. We don’t have to tell you that SaaS solutions are the most affordable, scalable and flexible. Plus, they’re IT-friendly, requiring little or no time from your internal teams. Look for a web-based solution that integrates easily with your ecommerce shopping cart or ERP to accelerate implementation and rollout. Cloud solutions also provide up-to-the minute rate calculations and real-time filing for improved accuracy.

Don’t let primitive practices derail your productivity. Automating sales tax management with AvaTax lets you focus on what you do best: blazing new trails in technology innovation.

References

1 Identification & Taxability of Digital Products, Shane Ratigan, JD, Avalara

2 Exemptions for Business-to-Business Transactions on Software, The Tax Foundation

3 Software as a Service (SaaS) and Other Cloud Service Providers Potentially Affected by Recent and Pending Rule Changes, Issues and Insights, Armanino McKenna LLP

Reduce tax risk

Increase the accuracy of your tax compliance with our cloud-based tax engine and tax research services.

Contact us at: 877-780-4848