Excise tax data replication for improved reporting and analysis

Avalara Returns Excise customers can benefit from new functionality

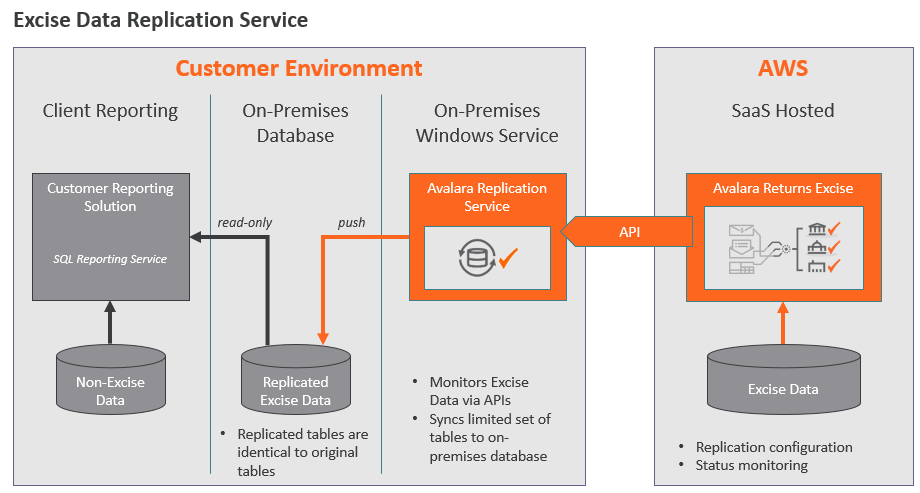

While cloud-based solutions offer many benefits, reporting and analysis that requires a mix of cloud and on-premises data can be challenging. With shared data stored in the cloud via a SaaS solution, data is always up to date and easy to access for standard reporting. But accessing that data for combined analytics with local data can require significant manual effort to download data extracts into spreadsheets and import data to local databases. This work not only takes valuable time, it’s error prone. One way to address these challenges is through automated data replication.

Data replication automates the copying of data from a master database to a replicated server database so that reporting users can continue to work with a snapshot (say, as of the end of the month) while other users continue to update the master. Having full access to a local snapshot copy of your data along with your favorite database query tools can provide powerful analysis functionality that isn’t possible using only cloud-based or only local tools.

Avalara now offers a data replication service for our Returns Excise customers. Replicating Returns Excise data from the cloud enables our excise customers to duplicate both transaction data from their tax schedules and master data (e.g., business entities, locations, and products) and store a copy locally to leverage the tools and systems they frequently use. This can be extremely helpful when a user wants to combine tax data from the cloud with local data for analysis, as well as with General Ledger or inventory reconciliation processes.

Features of Returns Excise data replication services

Automated — Replication services can be set up to automatically download a snapshot of data on demand or on a regular cadence. Systems administrators can create a replication schedule, ensuring updated data is replicated to local data tables from the cloud precisely when needed.

Secure — Communications between Returns Excise in the cloud and the local data copy are always authenticated, authorized, and encrypted so valuable data remains secure.

Simple — Returns Excise replication services employs a delete/reload strategy that avoids complicated data synchronization problems. Each time a new snapshot of data is downloaded locally, the previous version is automatically deleted, so users never risk having a mix of old and new data.

Standard maintenance — As with any on-premises solution, regular updates are necessary to ensure changes to the cloud database schema are reflected in the replicated system. Avalara will perform standard maintenance to ensure ongoing replication operations as our cloud systems change.

If you’re a current Returns Excise customer and you’re interested in learning more about Returns Excise data replication services and how it can help with monthly tax reporting and analysis, please contact your Avalara Account Manager.

Need help managing your Excise exemption certificates or vendor forms? Learn more about Avalara Excise Capture.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.