EXPLORE

Avalara integrates with Dynamics 365 Finance to automate tax determination, returns filing, and exemption management powered by AI for scale and greater accuracy.

BENEFITS

Stay compliant and scale with Avalara and Microsoft Dynamics 365 Finance

Apply smarter rates, automatically

Use Avalara’s AI-powered rate engine to apply tax rules in real time based on geolocation and product type — helping reduce errors.

Free up your finance team

Automate tax calculation and reporting in Dynamics 365 Finance to simplify compliance and reduce manual work.

Stay ahead of changing tax obligations

Avalara tracks your transaction activity and sends an alert before you exceed nexus thresholds in new states or jurisdictions.

Strengthen compliance recordkeeping

Automate exemption certificate collection and validation to help reduce audit exposure and improve documentation accuracy.

Automate returns from preparation to payment

Avalara handles sales tax filing and payment across states — helping reduce complexity and save time for your team.

Reduce errors, risk, and rework

With Avalara, you can simplify tax tasks, reduce missed filings, and support cleaner compliance across your systems.

How it works

Simplify tax compliance in your Microsoft Dynamics 365 Finance ERP

Integrated products in Microsoft Dynamics 365 Finance

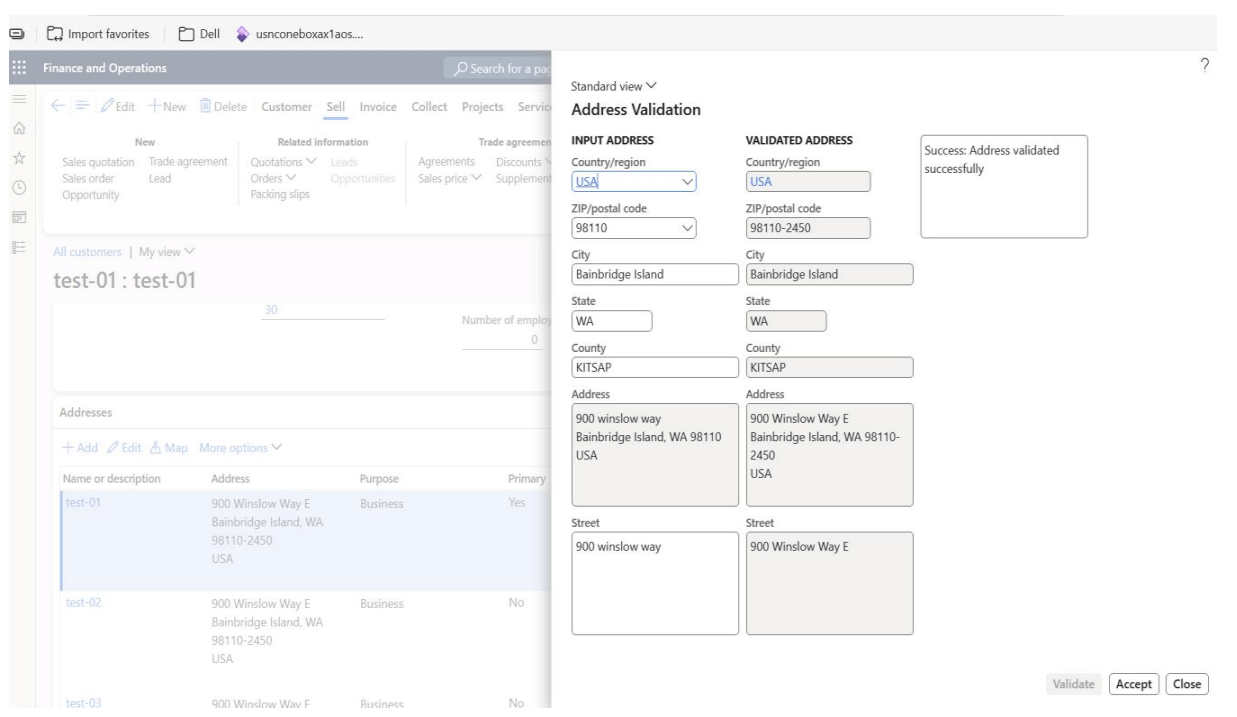

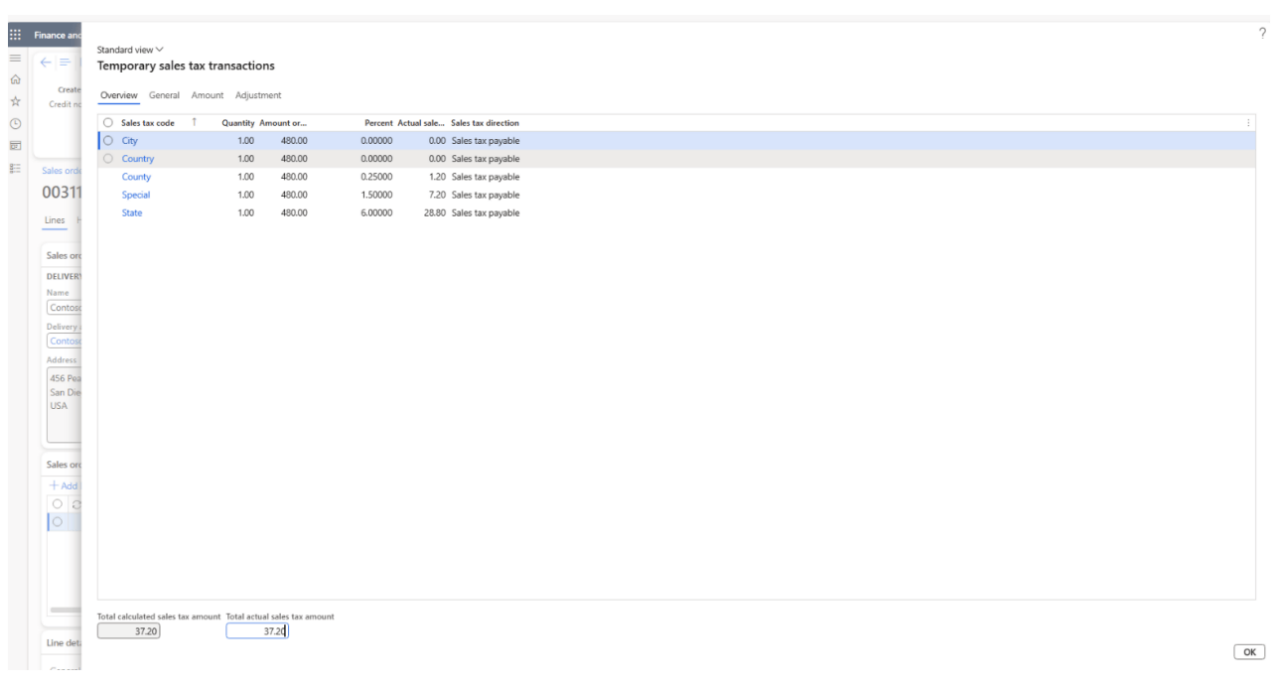

AvaTax is the global tax engine at the heart of our AI-powered compliance platform. It delivers highly accurate, real-time tax calculations for multiple tax types (U.S. sales and use tax, VAT, and industry-specific taxes) across city, county, state, federal, and international jurisdictions.

Offload the hassle of returns preparation, filing, remittance, and notice management (for U.S. sales and use tax or VAT). Our solution saves time, reduces costs, and ensures greater accuracy for businesses of any size in any industry. Avalara Returns processed and filed more than 6 million returns in 2024.

Streamline exemption certificate management to increase efficiency, save time, and reduce risk. ECM automates the process of collecting, storing, and validating exemption certificates for businesses of any size. ECM managed over 51 million documents and certificates in 2024.

Avalara AvaTax for Accounts Payable automates consumer use tax compliance at scale. It uses real-time data and AI to determine product taxability, detect vendor sales tax errors, self-assess use tax, and allocate tax across jurisdictions — all from one centralized platform that integrates with most purchasing systems.

Gain access to a one-stop shop for end-to-end international trade compliance. Avalara Cross-Border offers a suite of purpose-built products designed to calculate and estimate customs duties and import taxes in real time; automate the assignment and management of HS, HTS, and schedule B codes; and help businesses navigate global trade restrictions. Avalara Item Classification offers HS code support for over 180 countries.

Simplify the process of complying with vastly complex e-invoicing requirements. Avalara E-Invoicing and Live Reporting provides global compliance and coverage through a single application.

Improve the way you manage Forms 1099, W-9, W-2, 1095, and others to simplify IRS e-filing, reduce the risk of IRS penalties, and streamline vendor information collection.

Avalara AvaTax for VAT delivers automated VAT calculation for global sales and purchasing transactions. The solution uses AI to assign country-specific rates in real time, helping businesses apply the correct VAT treatment, reduce errors, and prepare for cross-border expansion. AvaTax for VAT integrates with most business systems, supports 190+ countries, and enables compliance with complex VAT rules at scale.

Avalara VAT Returns automates preparation, filing, and remittance of VAT in 49 countries. The solution validates and files data based on local rules; supports real-time reporting, OSS/IOSS, and SAF-T; and uses AI to improve accuracy and reduce compliance risk across global operations.

CUSTOMER STORIES

See what our customers have to say

Dive deeper

IMPLEMENT

USE