- Step 1

- Step 2

- Step 3

- Step 4

Unlike traditional bank loans, Avalara Capital is built directly into the Avalara platform you already use and trust. No long applications. No invasive underwriting. No slow approval processes. Instead, Avalara Capital leverages your business and compliance data to provide a flexible, revolving line of credit through its lending partners that you can access in minutes — without disrupting your cash flow or taking on unnecessary paperwork.

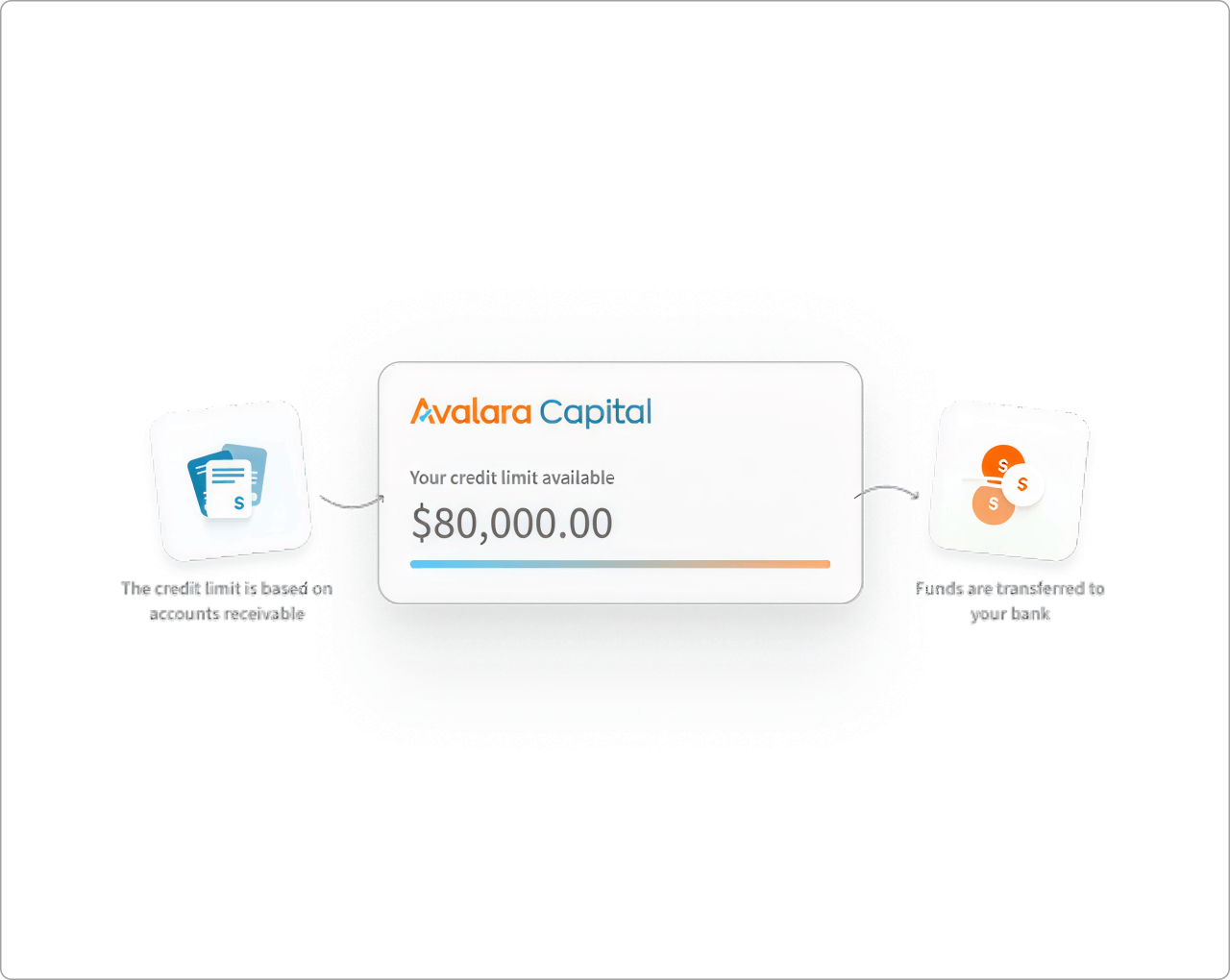

Once approved by our lending partners, you can unlock funds within minutes — not days or weeks. With just a few clicks, the money is deposited directly into your external bank account, so you can resolve tax obligations or cover working capital needs right away.

No. Businesses can apply for financing from Avalara Capital’s lending partners without a hard credit check. That means you can access funds without worrying about negative impacts on your credit profile.

Repayment is automated and flexible. Once funds are drawn, repayments are withdrawn from your external bank account on a set schedule — weekly, biweekly, or monthly. This system helps you avoid overborrowing and helps ensure responsible repayment. On-time repayment can even increase your available credit limit over time. Repayment is made to Avalara Capital’s lending partners in accordance with schedules set by those partners.

Yes. While Avalara Capital is uniquely positioned to help you cover tax liabilities instantly, your credit line can also be used for broader working capital needs — like managing seasonal expenses, covering operational gaps, or seizing growth opportunities.

Avalara Capital is designed for AvaTax customers who meet eligibility criteria based on their business and financial data (e.g., substantial outstanding AR via ERP integrations like NetSuite or QuickBooks).

No. Avalara Capital is transparent and flexible; there are no idle fees, hidden terms, or mandatory drawdowns. You only pay for what you use. The line of credit can sit in the background until you need it, at no additional cost.

*Credit lines are not guaranteed and will be determined upon application approval. All loans are issued and serviced by OatFinancial. Learn more here.