State-by-state guide to marketplace facilitator laws

Guide sections

Your guide to state laws and regulations for marketplace facilitators and marketplace sellers

If you sell via an online marketplace such as Amazon, Etsy, or Walmart, you need to understand a set of sales tax regulations that focus on marketplace sales — marketplace facilitator laws.

Marketplace facilitator laws impose an obligation on the platform that facilitates the sale (the marketplace facilitator) to collect and remit sales tax on behalf of the marketplace seller. These laws are significant because they shift the obligation to collect and remit sales tax from the seller to the marketplace platform.

Sellers are still responsible for collecting and remitting sales made outside of a marketplace platform, including on an ecommerce site, at a trade show, or from a physical location.

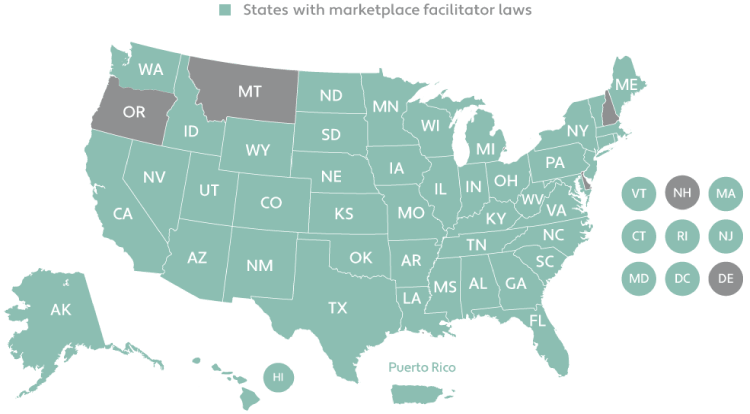

Marketplace facilitator laws by state

Last updated January 31, 2025

Marketplace facilitator laws began to appear shortly after states realized that while Amazon had started taxing sales of its own products, it wasn’t charging sales tax on third-party, or marketplace, sales. Given that more than half of all Amazon transactions occur through its marketplace, a significant portion of sales were going untaxed.

Many marketplace facilitators argue they aren’t the actual seller — they merely provide the platform that facilitates sales — and therefore aren’t responsible for collecting and remitting the sales tax; that obligation has historically fallen on the seller.

States, however, don’t want to miss out on tax revenue from marketplace sales. To capture it more effectively, nearly all states have adopted marketplace facilitator laws that shift the burden of tax collection to the marketplace facilitator. Like many facets of sales tax, marketplace facilitator laws vary by state in their application and definition.

These laws are also closely related to non-collecting seller use tax reporting laws. In some states, sellers — including marketplace facilitators — are exempt from the marketplace facilitator law provided they comply with non-collecting seller use tax reporting requirements.

Below you’ll find a state-by-state breakdown of marketplace facilitator laws. We also clarify if a state has a non-collecting seller use tax reporting requirement. More information for marketplace sellers is available in our state-by-state registration requirements for marketplace sellers guide.

Although we hope you’ll find the information helpful, this guide does not offer a substitute for professional legal or tax advice. If you have questions about your tax liability or concerns about compliance, please consult your qualified legal, tax, or accounting professional. Because states constantly update and amend their sales and use tax laws, see each state’s tax authority website for the most up-to-date and comprehensive information.

Sales tax help for marketplace facilitators and sellers

Avalara can help both marketplace platforms and marketplace sellers automate tax compliance processes.

Alabama

Enforcement date:

January 1, 2019

Summary:

Marketplace facilitators with Alabama marketplace sales in excess of $250,000 are required to collect tax on sales made by or on behalf of their third-party sellers.

Learn more about Alabama’s economic nexus law and Alabama registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, Alabama reports non-collecting seller use tax

Additional information:

Alaska

Enforcement date:

Varies depending on the jurisdiction

Summary:

Although there’s no statewide sales tax in Alaska, more than 100 local governments levy local sales taxes. Some of these now require marketplace facilitators to collect and remit their local sales taxes on behalf of third-party sellers. The collection obligation applies to marketplace facilitators with $100,000 or more in statewide gross sales of property, products, or services delivered into the state of Alaska in the current or previous calendar year.

The collection requirement for marketplace facilitators is not in effect statewide.

Learn more about Alaska’s economic nexus law and Alaska registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Arizona

Enforcement date:

September 20, 2016; updated effective October 1, 2019

Summary:

A business that has nexus with Arizona, operates an online marketplace, and makes online sales on behalf of third-party merchants is required to collect and remit Arizona transaction privilege tax on all sales made through the marketplace if its gross retail proceeds or income exceed $100,000 annually.

Learn more about Arizona’s economic nexus law and Arizona registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Arkansas

Enforcement date:

July 1, 2019

Summary:

A marketplace facilitator that sells or facilitates more than $100,000 in sales or at least 200 transactions of tangible personal property, taxable services, a digital code, or specified digital products for delivery into Arkansas in the previous or current calendar year must collect and remit sales or use tax on all sales made through the marketplace for delivery into Arkansas.

Learn more about the Arkansas economic nexus law and Arkansas registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

California

Enforcement date:

October 1, 2019

Summary:

A marketplace facilitator that sells or facilitates sales of tangible personal property into California must collect and remit sales or use tax on all sales made through the marketplace for delivery into California.

The collection requirement applies to in-state marketplaces and out-of-state marketplaces with sales of tangible personal property in California that exceed $500,000 in the current or preceding calendar year.

Learn more about California’s economic nexus law and California registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Colorado

Enforcement date:

October 1, 2019

Summary:

A marketplace facilitator with a physical presence in Colorado or economic nexus with the state must collect and remit sales or use tax on all sales to Colorado consumers made through the marketplace.

Learn more about Colorado’s economic nexus law and Colorado registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, Colorado reports non-collecting seller use tax

Additional information:

Connecticut

Enforcement date:

December 1, 2018

Summary:

Marketplace facilitators that facilitated retail sales of at least $250,000 during the prior 12-month period are required to collect and remit sales tax on behalf of their marketplace sellers. A marketplace facilitator is defined as anyone that provides a forum that lists or advertises taxable tangible personal property for sale by marketplace sellers; directly or indirectly collects receipts from the customer and remits payments to the marketplace seller; and is compensated for such services.

Learn more about Connecticut’s economic nexus law and Connecticut registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, Connecticut reports non-collecting seller use tax

Additional information:

Florida

Enforcement date:

July 1, 2021

Summary:

Marketplace facilitators that have a physical presence in Florida or facilitated retail sales of at least $100,000 during the previous calendar year are required to collect and remit sales tax on behalf of their marketplace sellers.

A marketplace facilitator is defined as a person who facilitates a retail sale by a marketplace seller by listing or advertising for sale taxable tangible personal property and directly or indirectly collects payment from the customer and remits payments to the marketplace seller.

The term doesn’t include a person who solely provides travel agency services. With certain exceptions, it also excludes a person who is a delivery network company.

Learn more about Florida’s economic nexus law and Florida registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Georgia

Enforcement date:

April 1, 2020

Summary

A marketplace facilitator that makes or facilitates taxable retail sales of $100,000 or more in aggregate in the previous or current calendar year is the retailer for each taxable retail sale it facilitates in Georgia on behalf of a marketplace seller. A franchisor is not considered a marketplace facilitator with respect to any dealer that is its franchisee.

Learn more about Georgia’s economic nexus law and Georgia registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Hawaii

Enforcement date:

January 1, 2020

Summary:

A marketplace facilitator that has physical or economic nexus with Hawaii must collect and remit sales tax on all sales into the state, including those by an unlicensed seller. Marketplace sellers may be liable for Hawaii general excise tax (GET) in some situations.

Learn more about Hawaii’s economic nexus law and Hawaii registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, Hawaii reports non-collecting seller use tax

Additional information:

Idaho

Enforcement date:

June 1, 2019

Summary:

Marketplace facilitators with a physical presence in Idaho and remote marketplace facilitators with more than $100,000 in combined sales into the state must collect and remit state tax on all sales into the state, their own and those by third-party sellers. Remote marketplaces are not responsible for collecting local sales tax.

Learn more about Idaho’s economic nexus law and Idaho registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Illinois

Enforcement date:

January 1, 2020

Summary:

Marketplace facilitators are required to collect tax on sales made by or on behalf of their third-party sellers in Illinois if, in the preceding 12-month period, cumulative gross receipts from sales of tangible personal property to purchasers in Illinois by the marketplace facilitator and its marketplace sellers are $100,000 or more; or the marketplace facilitator and sellers cumulatively enter into 200 or more separate transactions for the sale of tangible personal property into Illinois.

Learn more about the Illinois economic nexus law and Illinois registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Indiana

Enforcement date:

July 1, 2019; updated effective January 1, 2024

Summary:

Marketplace facilitators that make or facilitate sales in Indiana and meet the economic nexus thresholds of $100,000 in sales in Indiana must collect and remit sales tax on all taxable sales made through the marketplace. This requirement also applies to lodging marketplaces.

Learn more about Indiana’s economic nexus law and Indiana registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Iowa

Enforcement date:

January 1, 2019

Summary:

A marketplace facilitator that meets the economic nexus threshold and makes or facilitates Iowa sales on behalf of itself or one or more marketplace sellers must collect and remit sales tax on each facilitated taxable Iowa sale.

Learn more about Iowa’s economic nexus law and Iowa registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No. The Iowa Department of Revenue is authorized to establish and impose notice and reporting requirements for remote retailers, including marketplace facilitators who don’t collect and remit sales and use tax. However, it hasn’t done so.

Additional information:

Kansas

Enforcement date:

July 1, 2021

Summary:

Marketplace providers that make or facilitate more than $100,000 in sales of taxable property or services in Kansas during the current or immediately preceding year must register, collect, and remit sales tax on each facilitated taxable sale. This is true regardless of whether the seller would have been required to register and collect sales tax. As of April 1, 2022, marketplace facilitators are also liable for 911 fees on prepaid wireless services.

Learn more about the Kansas economic nexus law and Kansas registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Kentucky

Enforcement date:

July 1, 2019

Summary:

Marketplace providers that make or facilitate retail sales of tangible personal property, digital property, or services delivered or transferred electronically in Kentucky and meet the economic nexus threshold of $100,000 in sales or 200 or more separate transactions must register, collect, and remit sales tax on each facilitated taxable sale. This is true regardless of whether the seller would have been required to register and collect sales tax. Marketplace providers that make their own sales must obtain two sales tax permits: one for their own sales, and one for sales facilitated for marketplace sellers.

Learn more about Kentucky’s economic nexus law and Kentucky registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Louisiana

Enforcement date:

July 1, 2020; updated effective August 1, 2023

Summary:

A marketplace facilitator that has economic nexus with Louisiana must collect and remit sales tax on all marketplace sales for delivery into the state. Marketplace facilitators should include all sales made through the platform when calculating the economic nexus threshold (more than $100,000 in sales of tangible personal property, electronically transferred property, or taxable services in the state).

Learn more about Louisiana’s economic nexus law and Louisiana registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, Louisiana reports non-collecting seller use tax

Additional information:

Maine

Enforcement date:

October 1, 2019; updated effective January 1, 2022

Summary:

A marketplace facilitator that has economic nexus with Maine must collect and remit sales tax on all marketplace sales for delivery into the state. Marketplace facilitators should include all sales made through the platform when calculating the economic nexus threshold (more than $100,000 in sales of tangible personal property, electronically transferred property, or taxable services in the state).

Learn more about Maine’s economic nexus law and Maine registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Maryland

Enforcement date:

October 1, 2019

Summary:

A marketplace facilitator that has an obligation to collect Maryland sales tax, sells or facilitates sales of tangible personal property into Maryland, and processes payments on behalf of sellers must collect and remit sales tax on all sales made through the marketplace for delivery into Maryland. However, a marketplace facilitator and seller may ask for a waiver of this collection requirement if:

- The marketplace seller is a publicly traded communications company;

- The marketplace facilitator and marketplace seller have an agreement that the seller will collect and remit applicable taxes; and

- The marketplace seller provides the facilitator with evidence that the seller is licensed to engage in the business of an out-of-state vendor in Maryland

Learn more about Maryland’s economic nexus law and Maryland registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Massachusetts

Enforcement date:

October 1, 2019

Summary:

A remote marketplace provider that makes or facilitates more than $100,000 in sales in the commonwealth in the current or prior taxable year must collect and remit tax on all taxable sales made through the marketplace in Massachusetts. A marketplace facilitator that is not remote must collect and remit tax on all taxable sales made through the marketplace in Massachusetts if it makes or facilitates more than $100,000 in sales in the commonwealth in the current or prior taxable year.

Learn more about the Massachusetts economic nexus law and Massachusetts registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Michigan

Enforcement date:

January 1, 2020

Summary:

In-state marketplace facilitators and remote facilitators with economic nexus must collect and remit tax on all taxable sales made through the marketplace in Michigan. Economic nexus is established when, in the previous calendar year, a remote marketplace facilitator has more than $100,000 in gross receipts from direct and facilitated sales into Michigan, or at least 200 direct or facilitated transactions in the state.

Learn more about Michigan’s economic nexus law and Michigan registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Minnesota

Enforcement date:

October 1, 2018; amended October 1, 2019

Summary:

In-state marketplace providers and remote providers with economic nexus must collect and remit tax on all taxable sales made through the marketplace in Minnesota. Economic nexus is established when a remote marketplace provider makes or facilitates more than $100,000 in sales or at least 200 transactions in the state during the prior 12-month period.

Learn more about Minnesota’s economic nexus law and Minnesota registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Mississippi

Enforcement date:

July 1, 2020

Summary:

A marketplace facilitator that has economic nexus with Mississippi must collect and remit sales tax on marketplace sales for delivery into the state. Marketplace facilitators should include all sales made through the platform when calculating the economic nexus threshold (more than $250,000 in sales of tangible personal property or taxable services in the state). The law exempts third-party food delivery and includes an election for marketplace sellers with more than $1 billion in national revenue (including sales of affiliates and franchised entities) to directly collect sales and use tax.

Learn more about Mississippi’s economic nexus law and Mississippi registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Missouri

Enforcement date:

January 1, 2023

Summary:

A marketplace provider that makes or facilitates more than $100,000 in the state in the current or previous calendar year (determined quarterly) must collect and remit sales tax on behalf of its third-party sellers. This requirement does not apply to certain advertising services, travel agency services, or third-party payment processors. Although marketplace sellers are relieved of the duty to collect or remit sales tax on sales made through a collecting marketplace, they may still be required to register with the state and report all Missouri sales.

Learn more about Missouri’s economic nexus law and Missouri registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Nebraska

Enforcement date:

April 1, 2019

Summary:

A marketplace provider that makes or facilitates more than $100,000 in sales or 200 transactions in the state in the current or previous calendar year must collect and remit sales tax on behalf of its third-party sellers. Although marketplace sellers are relieved of the duty to collect or remit sales tax on sales made through a collecting marketplace, they must still register with the state and report all Nebraska sales.

Learn more about Nebraska’s economic nexus law and Nebraska registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Nevada

Enforcement date:

October 1, 2019

Summary:

A marketplace provider is required to collect tax on behalf of sellers in Nevada if, in the current or immediately preceding calendar year, it had cumulative gross receipts exceeding $100,000 from retail sales made or facilitated to customers in Nevada, or made or facilitated at least 200 separate retail sales transactions in the current or preceding calendar year. A marketplace and a seller can agree, in writing, to have the seller collect the tax due instead.

Learn more about Nevada’s economic nexus law and Nevada registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, Nevada reports non-collecting seller use tax in some cases

Additional information:

New Jersey

Enforcement date:

November 1, 2018

Summary:

A marketplace facilitator is required to collect and remit sales tax on sales made through any physical or electronic marketplace owned, operated, or controlled by a marketplace facilitator, even if the marketplace seller is registered with New Jersey for the collection and remittance of sales tax. However, a marketplace facilitator and marketplace seller may enter into an agreement with each other regarding the collection and remittance of sales tax.

Learn more about New Jersey’s economic nexus law and New Jersey registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

New Mexico

Enforcement date:

July 1, 2019

Summary:

A remote marketplace provider with at least $100,000 in total taxable gross receipts from sales in the state in the previous calendar year must register with the state and remit gross receipts tax on all sales made or facilitated in the state.

Learn more about New Mexico’s economic nexus law and New Mexico registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

New York

Enforcement date:

June 1, 2019

Summary:

A remote marketplace provider that made or facilitated more than $500,000 in gross sales and 100 transactions in the state in the preceding four quarterly periods is required to obtain a certificate of authority, collect sales tax, file returns, and remit tax on all sales into the state. All in-state marketplaces are required to collect tax on all sales in the state.

Learn more about New York’s economic nexus law and New York registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

North Carolina

Enforcement date:

February 1, 2020; updated July 1, 2024

Summary:

A remote marketplace facilitator that made or facilitated more than $100,000 in gross sales in the state in the previous or current calendar year is required to obtain a certificate of registration, collect sales tax, file returns, and remit tax on all sales into the state. A marketplace and a seller can agree, in writing, to have the seller collect the tax due instead.

Learn more about North Carolina’s economic nexus law and North Carolina registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

North Dakota

Enforcement date:

October 1, 2019; updated effective January 1, 2019

Summary:

A remote marketplace facilitator must collect and remit sales or use tax on all sales into the state if it makes or facilitates more than $100,000 in gross sales of tangible personal property or other taxable items in the state in the current or previous calendar year.

Learn more about North Dakota’s economic nexus law and North Dakota registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Ohio

Enforcement date:

September 1, 2019

Summary:

A remote marketplace facilitator must collect and remit sales or use tax on all sales into the state if it makes or facilitates more than $100,000 in gross sales or at least 200 transactions of taxable or exempt tangible personal property or services in the state in the current or previous calendar year.

Learn more about Ohio’s economic nexus law and Ohio registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Oklahoma

Enforcement date:

July 1, 2018 (amended as of November 1, 2019)

Summary:

A remote seller, marketplace facilitator, or referrer with aggregate sales of at least $10,000 in Oklahoma must file an election with the Tax Commission to either collect and remit sales and use tax on behalf of remote sellers or comply with non-collecting seller use tax notice and reporting requirements. Marketplace facilitators, referrers, or remote sellers with a place of business in Oklahoma must collect tax on their own sales.

Learn more about Oklahoma’s economic nexus law and Oklahoma registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, Oklahoma reports non-collecting seller use tax

Additional information:

Pennsylvania

Enforcement date:

April 1, 2018

Summary:

A marketplace facilitator that maintains a place of business in the commonwealth is required to collect and remit sales tax on the taxable sales made through its forum by any marketplace seller using the forum. A marketplace facilitator that doesn’t maintain a place of business in the commonwealth and makes or facilitates $10,000 or more in taxable sales to Pennsylvania customers in the previous calendar year must register to collect and remit Pennsylvania sales tax or comply with notice and reporting requirements.

Effective July 1, 2019, a remote marketplace facilitator with more than $100,000 in Pennsylvania sales in the previous 12 months is required to collect and remit sales tax on all sales into the commonwealth (i.e., cannot opt out by complying with non-collecting seller use tax reporting requirements).

Learn more about Pennsylvania’s economic nexus law and Pennsylvania registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, Pennsylvania reports non-collecting seller use tax

Additional information:

Puerto Rico

Enforcement date:

January 1, 2020

Summary:

Marketplace facilitators are required to collect and remit sales tax on “mail-order sales” of tangible personal property, specified digital products, and taxable services after December 31, 2019. In addition, they’re responsible for collecting Puerto Rico sales and use tax on behalf of third-party sellers.

The collection requirement for marketplace facilitators was signed into law on April 16, 2020, with an effective date retroactive to January 1, 2020. The Puerto Rico Department of Treasury has yet to issue guidance regarding marketplace facilitator obligations for sales prior to April 16, 2020.

Learn more about Puerto Rico’s economic nexus law and Puerto Rico registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, Puerto Rico reports non-collecting seller use tax

Additional information:

Rhode Island

Enforcement date:

July 1, 2019

Summary:

Marketplace facilitators that meet the economic nexus threshold of more than $100,000 in gross revenue or 200 or more transactions are required to collect and remit sales tax on behalf of all sellers making sales in Rhode Island through the marketplace (third-party or marketplace sellers), even those whose sales into the state are below the economic nexus threshold.

Learn more about Rhode Island’s economic nexus law and Rhode Island registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, Rhode Island reports non-collecting seller use tax

Additional information:

South Carolina

Enforcement date:

November 1, 2018; reinforced April 26, 2019

Summary:

South Carolina defines an online marketplace as the retailer of all tangible personal property sold on its website. As the retailer, the online marketplace must obtain a retail license and remit the South Carolina sales and use tax on all taxable products sold into the state on its website, whether the product is owned by the online marketplace or another party. Any online marketplace with a physical presence in South Carolina is required to register and collect for all taxable sales into the state.

Online marketplace facilitators without a physical presence but with more than $100,000 in gross revenue from sales of tangible personal property, products transferred electronically, and services delivered into the state are required to register and collect sales and use tax on all sales made through the marketplace.

Learn more about South Carolina’s economic nexus law and South Carolina registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

South Dakota

Enforcement date:

March 1, 2019

Summary:

A marketplace provider must collect and remit sales tax on all sales it facilitates into South Dakota if, in the current or preceding calendar year:

- The marketplace provider is a remote seller with $100,000 or more in gross sales in South Dakota;

- The marketplace provider facilitates sales for at least one marketplace seller that exceeds that $100,000 sales; or

- The marketplace provider facilitates the sales of two or more marketplace sellers that, when their sales are combined, exceed the $100,000 sales threshold

Learn more about South Dakota’s economic nexus law and South Dakota registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, South Dakota reports non-collecting seller use tax

Additional information:

Tennessee

Enforcement date:

October 1, 2020

Summary:

A marketplace facilitator that made or facilitated more than $100,000 in total sales to customers in Tennessee during the previous 12-month period is required to collect and remit Tennessee sales tax on behalf of its third-party sellers.

Learn more about Tennessee’s economic nexus law and Tennessee registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information

Texas

Enforcement date:

October 1, 2019

Summary:

A marketplace provider that has an obligation to collect Texas sales or use tax and sells or facilitates sales of taxable items into Texas must collect and remit sales or use tax on all sales made through the marketplace for delivery into Texas.

Learn more about the Texas economic nexus law and Texas registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information

Utah

Enforcement date:

October 1, 2019

Summary:

A marketplace facilitator must collect and remit sales or use tax on all sales into Utah if, in the previous or current calendar year, it has more than $100,000 in gross revenue in Utah or makes at least 200 separate transactions in the state. When calculating the threshold, a marketplace should include all sales made through the platform, its own and third-party sales.

Learn more about Utah’s economic nexus law and Utah registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Vermont

Enforcement date:

June 1, 2019

Summary:

A marketplace facilitator must collect and remit the sales tax on retail sales in Vermont by marketplace sellers through the marketplace if, during any 12-month period, it facilitated sales by marketplace sellers to destinations in Vermont of at least $100,000, or totaling at least 200 individual sales transactions.

Learn more about Vermont’s economic nexus law and Vermont registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, Vermont reports non-collecting seller use tax in some cases

Additional information:

Virginia

Enforcement date:

July 1, 2019

Summary:

Marketplace facilitators who contract with a marketplace seller to facilitate the sale of their products in Virginia through a physical or electronic marketplace and have more than $100,000 in gross revenue or 200 or more transactions in the commonwealth must collect and remit sales and use tax on all marketplace transactions. The threshold refers to all Virginia sales made through the marketplace — its own and third-party sales.

Marketplace facilitators may obtain a waiver from the collection requirement for a marketplace seller that already has nexus with Virginia, or that establishes economic nexus after July 1, 2019.

Learn more about Virginia’s economic nexus law and Virginia registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Washington

Enforcement date:

January 1, 2018 (amended as of March 14, 2019)

Summary:

Marketplace facilitators with no physical presence in the state and more than $100,000 in gross retail sales in the state in the current or preceding calendar year must collect Washington retail sales tax on taxable retail sales. As of January 1, 2020, the $100,000 threshold is based on cumulative gross income in Washington, not retail sales. The threshold refers to all Washington sales made through the marketplace — its own and third-party sales.

Marketplaces may also have a B&O tax obligation.

Learn more about Washington’s economic nexus law and Washington registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

Yes, Washington reports non-collecting seller use tax in some cases

Additional information:

Washington, D.C.

Enforcement date:

April 1, 2019

Summary:

Marketplace facilitators must collect and remit sales tax on all sales into the district, both their own and those by third-party sellers.

Learn more about Washington, D.C.’s economic nexus law and Washington, D.C. registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

West Virginia

Enforcement date:

July 1, 2019

Summary:

A remote marketplace facilitator with more than $100,000 in gross revenue from West Virginia sales or 200 or more transactions in the state in the current or preceding calendar year must collect and remit sales tax on all sales made or facilitated in the state.

Learn more about West Virginia’s economic nexus law and West Virginia registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

- HB 2813

- West Virginia Tax Division

Wisconsin

Enforcement date:

January 1, 2020

Summary:

A remote marketplace facilitator with more than $100,000 in gross revenue from Wisconsin sales in the state in the current or preceding calendar year must collect and remit sales tax on all sales made or facilitated in the state. A transaction threshold was eliminated effective February 20, 2021.

Learn more about Wisconsin’s economic nexus law and Wisconsin registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Wyoming

Enforcement date:

July 1, 2019; updated effective July 1, 2024

Summary:

An in-state marketplace facilitator must collect and remit sales tax on all sales facilitated and sold into Wyoming, regardless of whether the marketplace seller has a sales tax permit or is otherwise required to collect sales tax. A remote marketplace facilitator must collect and remit Wyoming tax on all marketplace sales if it has $100,000 in gross sales in Wyoming for delivery in Wyoming during the current or preceding calendar year.

Learn more about Wyoming’s economic nexus law and Wyoming registration requirements for marketplace sellers.

Non-collecting seller use tax reporting:

No

Additional information:

Stay current on sales tax requirements for marketplace sales

Because each marketplace is unique, we recommend sellers work directly with marketplace facilitators to determine the best practice for managing sales tax collection and remittance in a particular state.

There are many ways to trigger a sales tax collection obligation in a state. If you have questions about what business activities can establish nexus, visit our sales tax laws by state resource. If you’ve determined you have a new sales tax collection obligation, the typical next step is to register your business with the jurisdiction. Avalara Sales Tax Registration can help with that.