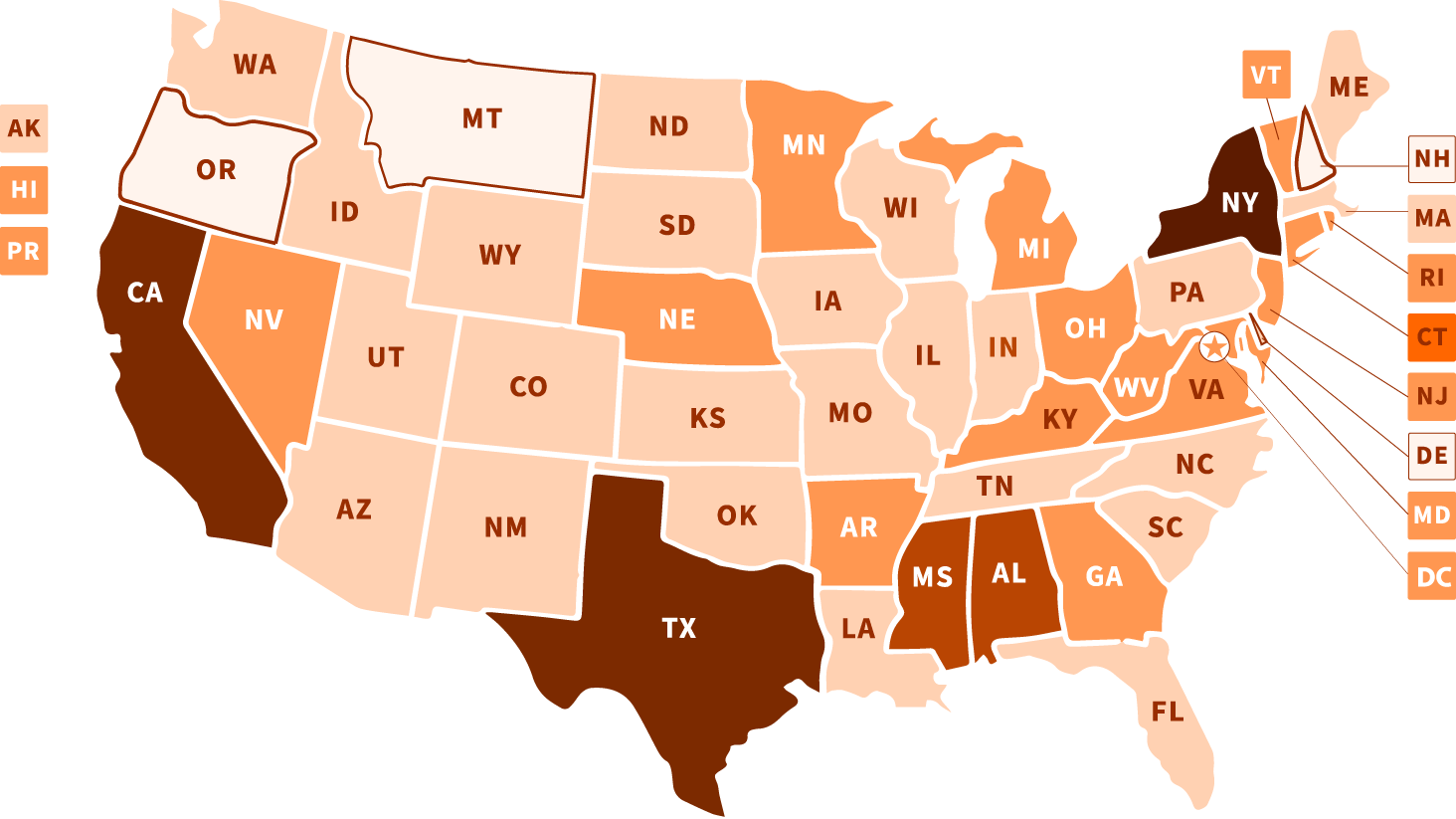

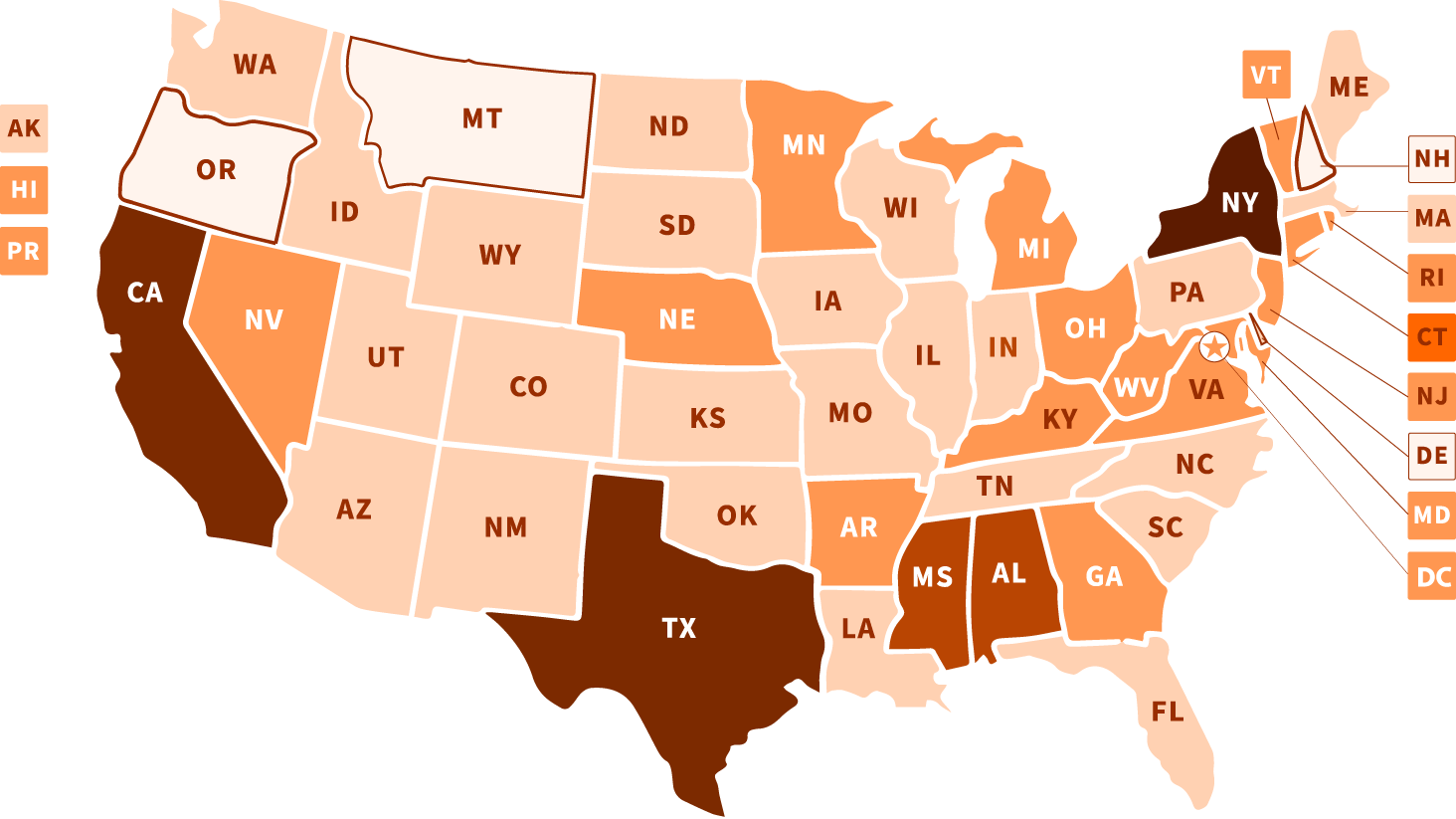

Economic nexus: Find out where you’re on the hook to collect and file sales tax

Out-of-state sales can trigger tax obligations known as economic nexus.

Avalara can help you track where you owe, register, and file.

Identify where and what triggers economic nexus for sales tax

Economic nexus for sales tax is triggered by reaching a certain amount of sales (e.g., $100,000) and/or a number of sales transactions (e.g., 200 transactions) in another state.

Exempt sales of goods and services may count toward your sales tax economic nexus threshold in some states.

You need to register to collect sales tax in states where you have economic nexus.

What is economic nexus?

Economic nexus is a connection between a state and a business that allows the state to require the business to register to collect and remit sales tax. It’s established when a business reaches a certain threshold of sales revenue and/or number of transactions in the state.

Who does economic nexus affect?

Economic nexus impacts businesses with no physical presence in a state (also known as remote sellers) that sell goods and services in the state and meet or exceed the state’s economic nexus threshold.

Economic nexus thresholds

Taxable transactions and exempt sales

Exempt sales can count toward your nexus threshold, so you may need to register and report these sales.

Some states only count exempt sales of tangible personal property, others include exempt services.

Economic nexus details by state

Included transactions:

- Total retail sales of tangible personal property delivered into the state

- Sales made through a non-collecting marketplace

- Exempt sales

Excluded transactions:

- Sales made through a registered marketplace facilitator

- Exempt wholesale sales

- Exempt services

Effective date:

October 1, 2018

Evaluation period:

Previous calendar year

Included transactions:

- Statewide gross sales of goods, property, or products delivered into the state

- Services (taxable and exempt) rendered in the state

- Sales made through a registered marketplace facilitator

- Exempt sales

Excluded transactions:

- None

Effective date:

Varies by district

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- $100,000 or 200 transactions prior to January 1, 2025

Included transactions:

- Gross proceeds of sales of tangible personal property or services

- Gross income derived from business in the state

- Services (taxable and exempt) rendered in the state

- Exempt sales

Excluded transactions:

- Sales made through a registered marketplace facilitator

- Rentals of personal property

Effective date:

October 1, 2019

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- $200,000 in sales only as of January 1, 2019

- $150,000 in sales only as of January 1, 2020

- $100,000 in sales only as of January 1, 2021

Included transactions:

- Aggregated sales of taxable tangible personal property or services

- Taxable services

- Digital codes

- Specified digital products subject to Arkansas sales or use tax delivered into a state

Excluded transactions:

- Exempt sales

- Exempt services

- Sales made through a registered marketplace facilitator

Effective date:

July 1, 2019

Evaluation period:

Current or previous calendar year

Included transactions:

- Total combined sales of tangible personal property delivered into the state by the retailer and all persons related to the retailer

- Nontaxable sales (e.g., sales for resale)

- Sales made through a registered marketplace facilitator

Excluded transactions:

Services (taxable and exempt)

Effective date:

April 1, 2019

Evaluation period:

Current or previous calendar year

Included transactions:

- Retail sales of tangible personal property delivered into the state

- Commodities delivered into the state

- Services (taxable and exempt) rendered in the state

- Exempt sales

Excluded transactions:

- Exempt wholesale sales

Sales made through a registered marketplace facilitator

Effective date:

December 1, 2018

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- $100,000 or 200 transactions prior to April 14, 2019

Included transactions:

- Gross receipts from tangible personal property (including digital products and SaaS) sold into the state

- Exempt sales

- Taxable services

- Sales made through a registered marketplace facilitator

Excluded transactions:

- Sales for resale

- Exempt services

Effective date:

July 1, 2019

Evaluation period:

Threshold applies to all transactions within the 12-month period ending on September 30 immediately preceding the monthly or quarterly period when liability is established

Previous threshold rules:

- $250,000 and 200 transactions prior to June 30, 2019

Included transactions:

- Gross receipts from tangible personal property sold into the state

- Exempt sales in sales threshold only

Excluded transactions:

- Sales for resale in transactions threshold only

- Exempt services

- Taxable services

- Digital products and SaaS

Included transactions:

- Taxable sales of tangible personal property delivered physically into the state

Excluded transactions:

- Exempt sales

- Services (taxable and exempt)

- Sales made through a registered marketplace facilitator

Effective date:

July 1, 2021

Evaluation period:

Previous calendar year

Included transactions:

- Gross revenue from retail sales of tangible personal property delivered electronically or physically to a location in the state for consumption, use, or storage in the state

- Exempt sales

Excluded transactions:

- Services (taxable and exempt)

- Exempt resales

- Sales made through a registered marketplace facilitator

Effective date:

January 1, 2019

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- $250,000 or 200 transactions prior to January 1, 2020

Included transactions:

- Gross income or gross proceeds of tangible personal property delivered in the state

- Intangible property delivered in the state

- Services (taxable and exempt) delivered or consumed in the state

- Exempt sales

Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Effective date:

July 1, 2018

Evaluation period:

Current or previous calendar year; applies to tax years beginning January 1, 2018

Included transactions:

- Cumulative gross receipts from sales including taxable products and taxable services delivered into the state

- Exempt sales

- Exempt services

Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Effective date:

June 1, 2019

Evaluation period:

Current or previous calendar year

Included transactions:

- Cumulative gross receipts from sales

- Exempt sales

Excluded transactions:

- Occasional sales

- Sales for resale

- Services

- Sales made through a registered marketplace facilitator

Effective date:

October 1, 2018 (for state use tax)

January 1, 2021 (for local use tax)

Evaluation period:

Quarterly review based on preceding 12-month period

Previous threshold rules:

- Sales made through a marketplace facilitator excluded as of January 1, 2020

- $100,000 in sales or 200 transactions prior to January 1, 2026

Included transactions:

- Gross revenue from sales of tangible personal property

- Electronically delivered products into the state

- Electronically delivered services into the state

- Exempt sales

- Services (taxable and exempt)

- Sales for resale

Excluded transactions:

- Sales made through a registered marketplace facilitator

Effective date:

October 1, 2018

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- $100,000 in sales or 200 transactions prior to January 1, 2024

Included transactions:

- Gross revenue from sales of tangible personal property

- Specified electronically delivered products

- Electronically delivered services into the state

- Exempt sales

- Services (taxable and exempt)

- Sales for resale

Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Effective date:

January 1, 2019

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- $100,000 or 200 transactions prior to July 1, 2019

Included transactions:

- Cumulative gross receipt from sales by the retailer to customers in Kansas

- Exempt sales

- Services (taxable and exempt)

- Digital products and SaaS

- Sales made through a registered marketplace facilitator

For marketplace facilitators, threshold is based on taxable sales

Excluded transactions:

- None

Effective date:

July 1, 2021

Evaluation period:

Current or previous calendar year

Included transactions:

- Gross receipts from sales of tangible personal property delivered or transferred electronically into the commonwealth

- Digital property delivered or transferred electronically into the commonwealth

- Exempt sales

- Services (taxable and exempt)

Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Effective date:

October 1, 2018

Evaluation period:

Current or previous calendar year

Previous threshold rules:

Taxable services excluded prior to January 1, 2023

Included transactions:

- Gross revenue from sales of products delivered into the state

- Electronically transferred products

- Services (taxable and exempt) rendered in the state

- Exempt sales

- For marketplace facilitators, threshold is based on remote retail sales

Excluded transactions:

- Sales made through a registered marketplace facilitator

Effective date:

July 1, 2020

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- $100,000 in sales or 200 transactions, prior to August 1, 2023

Included transactions:

- Gross sales of tangible personal property delivered into the state

- Taxable services delivered into the state

- Exempt sales

Excluded transactions:

- Exempt services

- Sales made through a registered marketplace facilitator

Effective date:

July 1, 2018

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- $100,000 in sales or 200 transactions, prior to January 1, 2022

Included transactions:

- Gross revenue from sales of tangible personal property delivered into the state

- Sales of software delivered into the state

- Digital goods delivered into the state

- Exempt sales of tangible personal property

- Exempt sales of software

- Exempt sales of digital goods

- Taxable services

Sales made through a registered marketplace facilitator

Excluded transactions:

- Exempt services

Effective date:

October 1, 2018

Evaluation period:

Current or previous calendar year

Included transactions:

- Sales of tangible personal property delivered into the commonwealth

- Services (taxable and exempt) rendered in the commonwealth

- Exempt sales

Excluded transactions:

- Sales made through a registered marketplace facilitator

Effective date:

October 1, 2019

Evaluation period:

Current or previous calendar year

Included transactions:

- Sales of tangible personal property delivered into the state

- Services (taxable and exempt) rendered in the state

- Exempt sales

- Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Effective date:

September 30, 2018

Evaluation period:

Previous calendar year

Included transactions:

- Retail sales made into the state from outside the state

- Taxable services

- Exempt sales

- Sales to tax-exempt entities

Sales made through a registered marketplace facilitator

Excluded transactions:

- Sales for resale

- Exempt services

- Taxable resales

Effective date:

October 1, 2019

Evaluation period:

Threshold applies to the prior 12-month period

Previous threshold rules:

- 10 or more sales totaling $100,000 or 100 transactions, prior to October 1, 2019

Included transactions:

- Total sales made into the state by remote sellers that purposefully or systematically exploit the market in the state

- Services (taxable and exempt)

- Exempt sales

Excluded transactions:

- Sales made through a registered marketplace facilitator

Effective date:

September 1, 2018

Evaluation period:

Threshold applies to all transactions for the prior 12 months

Included transactions:

- Gross receipts from taxable sales of tangible personal property delivered into the state

Sales of tangible personal property made through a registered marketplace facilitator

Excluded transactions:

- Exempt sales

- Services (taxable and exempt)

- Sales for resale

- Returned sales

Effective date:

January 1, 2023

Evaluation period:

Preceding 12-month period, determined each calendar quarter

Included transactions:

- Total retail sales made to customers in the state

- Exempt sales

- Services (taxable and exempt)

Sales made through a registered marketplace facilitator

Excluded transactions:

- Sales for resale, sublease, or subrent

Effective date:

April 1, 2019

Evaluation period:

Current or previous calendar year

Included transactions:

- Gross revenue from retail sales of tangible personal property into the state

- Exempt sales

- Sales made through a registered marketplace facilitator

Excluded transactions:

- Sales for resale

- Services (taxable and exempt)

Effective date:

October 1, 2018

Evaluation period:

Current or previous calendar year

Included transactions:

- Gross revenue from retail sales of tangible personal property into the state

- Specified digital products

- Taxable services (listed in N.J.S.A. 54:32B-3(b)) delivered into the state, even if exempt

- Nontaxable retail sales of tangible personal property

- Sales made through a registered marketplace facilitator

Excluded transactions:

- Exempt services

Effective date:

November 1, 2018

Evaluation period:

Current or previous calendar year

Included transactions:

- Total taxable gross receipts from sales, leases, and licenses of tangible personal property

- Sales from licenses and services for use of real property

- Digital products and SaaS

- Sales made through a registered marketplace facilitator

Excluded transactions:

- Exempt sales

- Exempt services

Effective date:

July 1, 2019

Evaluation period:

Previous calendar year

Included transactions:

- Cumulative total gross receipts from sales of tangible personal property delivered into the state

- Software as a service (SaaS) counts as tangible personal property

- Nontaxable retail sales of tangible personal property

Sales made through a registered marketplace facilitator

Excluded transactions:

- Services (taxable and exempt)

Effective date:

June 21, 2018

Evaluation period:

Immediately preceding four sales tax quarters

Included transactions:

- Gross sales sourced to the state

- Sum total sales price of tangible personal property

- Sum total sales price of digital property

- Sum total sales price of services

- Exempt sales

- Exempt services

Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Effective date:

November 1, 2018

Evaluation period:

Current or previous calendar year

Previous threshold rules:

Sales or transaction volume prior to July 1, 2024

Included transactions:

- Gross taxable sales of tangible personal property and other items into the state

- Gross taxable sales of services into the state

Excluded transactions:

- Exempt sales

- Exempt services

- Sales made through a registered marketplace facilitator

Effective date:

October 1, 2018

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- Sales or transactions included prior to July 1, 2019

- $100,000 in sales or 200 transactions prior to January 1, 2019

Included transactions:

- Gross receipts from sales of tangible personal property for storage, use, or consumption in the state

- Enumerated services, the benefit of which is realized in the state

- Exempt sales

- Sales made through a registered marketplace facilitator

Excluded transactions:

- Sales for resale

- Exempt services

Effective date:

August 1, 2019

Evaluation period:

Current or previous calendar year

Included transactions:

- Aggregate sales of taxable tangible personal property

- Taxable services

Excluded transactions:

- Exempt sales

- Exempt services

- Sales made through a registered marketplace facilitator

Effective date:

August 1, 2019

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- $10,000 in aggregate sales of taxable TPP over the preceding 12 calendar months from July 1, 2018, through October 31, 2019

- Taxable and exempt services excluded from threshold prior to November 1, 2023

Included transactions:

- Gross sales of products and services in the commonwealth

- Sales by agents, representatives, or subsidiaries in the commonwealth

- Exempt sales

- Exempt services

- Sales made through a marketplace facilitator that does not collect sales tax on behalf of a remote seller

Excluded transactions:

- Sales made through a registered marketplace facilitator that collects sales tax on behalf of a remote seller

Effective date:

July 1, 2019

Evaluation period:

Current or previous calendar year

Included transactions:

- Total gross sales delivered into the territory

- Exempt sales

- Services (taxable and exempt)

Excluded transactions:

- Sales made through a registered marketplace facilitator

Effective date:

January 1, 2021

Evaluation period:

Seller’s accounting year

Included transactions:

- Gross revenue from sales of tangible personal property

- Prewritten computer software delivered electronically

- Load and leave, vendor-hosted prewritten computer software

- Specified digital products

- Taxable services delivered into the state

- Exempt sales

Sales made through a registered marketplace facilitator

Excluded transactions:

- Exempt services

Effective date:

July 1, 2019

Evaluation period:

Previous calendar year

Included transactions:

- Gross revenue from sales of tangible personal property

- Electronically transferred products

- Services (taxable and exempt) rendered in the state

- Exempt sales

Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Effective date:

November 1, 2018

Evaluation period:

Previous or current calendar year

Included transactions:

- Gross revenue from sales of tangible personal property

- Electronically transferred products

- Services (taxable and exempt) rendered in the state

- Exempt sales

Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Effective date:

November 1, 2018

Evaluation period:

Previous or current calendar year

Previous threshold rules:

- $100,000 in sales or 200 transactions prior to July 1, 2023

Included transactions:

- Sales to customers in the state

- Exempt sales

- Services (taxable and exempt)

Excluded transactions:

- Sales made through a registered marketplace facilitator

- Sales for resale

Effective date:

July 1, 2019

Evaluation period:

Previous 12-month period

Previous threshold rules:

- $500,000 in sales only prior to October 1, 2020

Marketplace sales included prior to October 1, 2020

Included transactions:

- Gross revenue from sales of tangible personal property and services into the state

- Exempt sales

- Exempt services

Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Effective date:

July 1, 2019

Evaluation period:

Previous 12-month period

Included transactions:

- Gross revenue from sales of tangible personal property and services into the state

- Any product transferred electronically into the state

- Services (taxable and exempt) rendered in the state

- Exempt sales

Excluded transactions:

- Sales made through a registered marketplace facilitator

Effective date:

January 1, 2019

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- $100,000 in sales or 200 transactions prior to July 1, 2025

Included transactions:

- Sales of tangible personal property and services into the state

- Products transferred electronically

- Services (taxable and exempt) in the state

- Exempt sales

Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Note: Businesses that only sell tax-exempt items into Vermont are not required to register for sales tax

Effective date:

July 1, 2018

Evaluation period:

Previous 12-month period

Included transactions:

- Sales of tangible personal property

- Products transferred electronically

- Taxable services

- Exempt sales

Excluded transactions:

- Sales for resale

- Exempt services

- Sales made through a registered marketplace facilitator

Effective date:

July 1, 2019

Evaluation period:

Current or previous calendar year

Included transactions:

- Cumulative gross annual income

- Exempt sales

- Services (taxable and exempt)

- Sales for resale

- Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Effective date:

October 1, 2018

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- Cumulative gross receipts from retail sales and taxable services into the state prior to December 31, 2019

- Cumulative gross annual income as of January 1, 2020

- Resales included as of January 1, 2020

Included transactions:

- Gross receipts from retail sales delivered into the district

- Exempt sales

- Taxable services

- Sales made through a registered marketplace facilitator

Excluded transactions:

- Exempt services

- Sales for resale

Effective date:

January 1, 2019

Evaluation period:

Current or previous calendar year

Included transactions:

- Gross sales of tangible personal property and services into the state

- Exempt sales

- Exempt services

Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Effective date:

January 1, 2019

Evaluation period:

Current or previous calendar year

Included transactions:

- Annual gross sales of tangible personal property into the state

- Annual gross sales of services (taxable and exempt) into the state

- Exempt sales

Sales made through a registered marketplace facilitator

Excluded transactions:

- None

Note: Businesses that make only nontaxable sales into Wisconsin are not required to register for sales tax

Effective date:

October 1, 2018

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- $100,000 in sales or 200 transactions prior to February 20, 2021

Included transactions:

- Annual gross sales of tangible personal property into the state

- Annual gross sales of services (taxable and exempt) into the state

- Annual gross sales of admission into the state

- Taxable, exempt, and wholesale sales

- Exempt sales

Excluded transactions:

- Sales made through a registered marketplace facilitator

Effective date:

February 1, 2019

Evaluation period:

Current or previous calendar year

Previous threshold rules:

- $100,000 in sales or 200 transactions prior to July 1, 2024

Wait, do you owe back taxes?

Let us sort things out for you in each state prior to registering.

Discover key tax changes and trends shaping compliance in our 10th annual report.

Discover key tax changes and trends shaping compliance in our 10th annual report.

Your next stages for automating compliance

Register in the states where you meet thresholds

Ready to collect and remit sales tax in new states? Avalara Sales Tax Registration can get you registered for $349 per location.

Automate your sales tax rate calculations

Avalara AvaTax calculates sales and use tax using more accurate tax rates, helps track nexus, and integrates with your existing business systems.

Simplify your sales tax returns process

Avalara Managed Returns syncs your sales data so you can track where you owe and file sales tax returns in a few steps. Learn how you can save time and money, improve accuracy, and reduce audit risk.