Can a sales tax exemption hinge on intention? Wacky Tax Wednesday

A bill seeking to establish a sales tax exemption “for the needs of young children” has been introduced in Massachusetts. If enacted as written, Massachusetts will exempt sales of certain apparel “intended to be worn or carried on or about the human body by children five years of age and younger.” This includes children’s accessories, children’s clothing, children’s diapers, and children’s shoes.

Intended is an interesting word choice.

I intended to get up early and work out this morning but slept in instead. I intended to make a photo album of our last family vacation but the task remains undone. I intended to have a career in education but work in sales tax.

You see my point. Intention is nice and all, but it lacks conviction, certainty. Perhaps that’s why Scott Peterson, VP of Government Relations at Avalara, says, “it’s bad tax policy to use ‘intended’ as the basis for an exemption.”

What is the meaning of intend?

The Law Dictionary defines intend as: “To design, resolve, purpose. To apply a rule of law in the nature of presumption; to discern and follow the probabilities of like cases.”

Presumption means “a legal inference that must be made in light of certain facts.” According to the Cornell Law School Legal Information Institute, “most presumptions are rebuttable, meaning that they are rejected if proven to be false or at least thrown into sufficient doubt by the evidence.” However, “other presumptions are conclusive, meaning that they must be accepted to be true without any opportunity for rebuttal.”

The Massachusetts bill doesn’t provide a clear line in the sand (e.g., “clothing size 5Y or smaller is exempt from sales tax”), so how would the exemption play out? Would it be rebuttable or conclusive?

For retailers required to collect and remit Massachusetts sales tax, it would matter. And it’s unclear.

How do you prove intention?

Would a size 6Y shirt purchased for a big-and-burly child of four be exempt from sales tax? What about a size 5Y shirt purchased for a petite child of six?

Where would the line be drawn? Who decides?

Also, would the retailer be responsible for validating the exemption at checkout? If it had to, how would a store confirm a consumer is purchasing a size 6Y shirt for their 4-year-old nephew rather than their 6-year-old son? Would a retailer be expected to collect tax on a on a size 6Y shirt purchased for a big 5-year-old, or a size 5Y shirt purchased for a petite 6-year-old?

Products typically qualify for an exemption, or they don’t, based on how the manufacturer labels them — but labels don’t leave room for intention. So, what would a seller do if a 6-year-old’s parent brings a stack of stuff to the counter and expects it to be tax free because it’s a size 5Y? “That’s where ‘intended’ falls apart,” says Peterson.

The toy elephant in the room: Most children’s clothing is already tax free in Massachusetts

Aside from the issues with basing an exemption on intention, which are real, there’s another problem with the Massachusetts bill: Clothing that costs $175 or less is already exempt from Massachusetts sales tax. For items priced more than $175, sales tax is only due on the amount over $175.

Did the representative who introduced this bill not know this? Is he seeking a tax break for well-heeled parents? Whatever his motivation, the fact that the bill aims to carve out a difficult-to-enforce sales tax exemption that already exists in a less confusing way could be why the bill hasn’t yet been assigned a final bill number. It will likely be left to die.

Nevertheless, the issue of intention remains relevant because Massachusetts HD.4449 isn’t the only legislation using the word intended to describe a sales tax exemption. And some of those bills do make it into law.

Florida sales tax exemptions that rely on intention

In 2022, Florida created a sales tax holiday for books “primarily intended for children ages 12 or younger.” It also provided a temporary exemption for clothing and shoes “primarily intended for children age 5 or younger.”

The Sunshine State doubled down on this policy in 2023 with an exemption for baby and toddler clothing “primarily intended for and marketed for children age 5 or younger.” The 2023 law reads, in relevant part:

Baby and toddler clothing, apparel, and shoes, primarily intended for and marketed for children age 5 or younger. Baby and toddler clothing size 5T and smaller and baby and toddler shoes size 13T and smaller are presumed to be primarily intended for and marketed for children age 5 or younger. (emphasis added)

By referencing sizes, the 2023 law at least attempts to provide clearer guidelines for retailers than the 2022 law gave. But it retains that tricky word, intended, and it still doesn’t explain how a retailer should treat outlier situations (like size 4Y clothing intended for a 6-year-old, or size 6Y clothing intended for a 4-year-old.

Similar sales tax laws in Canada do specify what retailers need to do.

Canada requires written certification from some consumers

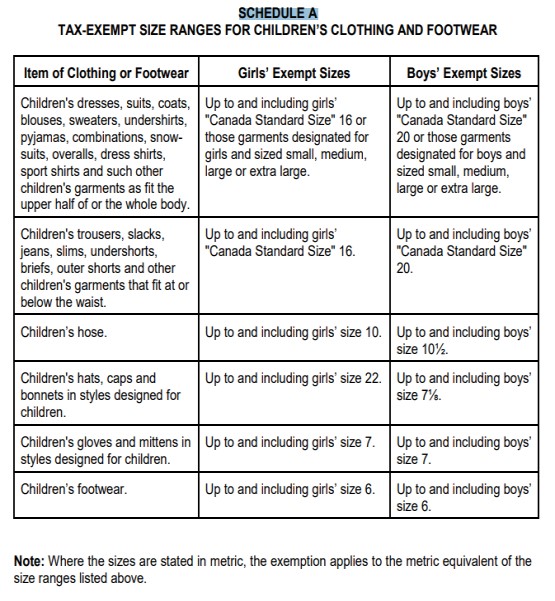

Manitoba provides a sales tax exemption for children’s clothing, footwear, and accessories with a selling price of $150 or less (children’s clothing priced more than that is taxable). Eligible items qualify for the exemption, no questions asked, if within the size ranges detailed below in Schedule A.

Recognizing that not all children fall into typical size categories, Manitoba also provides the exemption for clothing, footwear, and accessories priced $150 or less that are larger than the sizes displayed in Schedule A, if purchased for a child 14 years of age or under. However, in this event, questions must be asked.

Information Bulletin No. 001 explains: “To allow this exemption, the seller is required to obtain a written certification from the customer, attesting that the purchase is for a child 14 years of age or under. The certification must include the following information:

- Date

- Description of items purchased

- Invoice number

- Price

- Purchaser’s name, address, and phone number

- Purchaser’s signature and certification”

The certification must state: “I certify the clothing, footwear or accessory exempted on this sale is being purchased for a child 14 years of age or under, and the information provided is true and correct.”

If a fully completed and signed certification is not obtained, the sale is taxable. “The seller is responsible for the RST (retail sales tax) owing, if tax is not collected and the completed certification is not retained.”

Manitoba’s requirement solves one issue — it provides clear guidance on which transactions are exempt, which are taxable, and who’s liable for the tax if the proper procedures aren’t followed. Yet it creates other issues: Consumers need to ask for the exemption and certify that they’re buying clothing for children presumably too large to fit into clothing sized to fit children their age. That could be embarrassing, especially if the child in question is present, fresh out of the fitting room.

Moreover, the retailer then needs to treat the certification as confidential personal information that must be “protected and stored accordingly.” It can’t simply be tossed because the certification must be retained for tax audit purposes.

This requirement also complicates tax compliance for internet, mail-order, and phone vendors. They, too, need to obtain the required certification from consumers “to support the RST exemption on items purchased for children 14 years of age or under that do not fall within the exempt size ranges.”

It may be clear tax policy, but it’s awkward. And there’s a similar exemption and certification requirement in British Columbia.

Do sales tax exemptions need to be this complicated?

Sales tax exemptions tend to be complicated by nature and a bugbear for businesses. Qualifying exemptions based on the age, intention, or size of the consumer make them more so.

There’s often fine print where sales tax exemptions are concerned: A transaction may be exempt under certain circumstances but not others. Thus, public schools in New Jersey aren’t required to collect sales tax during occasional fundraising events, but only if all of the proceeds benefit the school. Diapers are exempt from Indiana sales tax, but only if marketed to be worn by children, not adults. Some digital products purchased by school districts in Washington state are tax exempt; others are taxable.

Unless a product or service is statutorily exempt from sales tax, businesses need to validate their exempt sales by collecting a valid exemption certificate or resale certificate from the buyer. If they don’t, the taxing authority could hold them liable for the uncollected tax. Similarly, tax authorities in British Columbia and Manitoba could go after a clothing retailer for failing to obtain the necessary certification from consumers.

The bottom line is that states can pursue retailers for any tax not collected and remitted as required by law, and collecting sales tax as required is difficult when the law isn’t crystal clear. Unfortunately, it’s hard to have clear sales tax policy that hinges on intention.

Find yourself flummoxed by sales tax exemptions? Watch our on-demand webinar, Managing tax-exempt sales 101.

Avalara Tax Changes 2026 is here

The 10th edition of our annual report engagingly breaks down key policies related to sales tax, tariffs, and VAT.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.