Here are some resources to get you started.

Automate global indirect tax compliance for SAP Cloud ERP (Private) and SAP ECC

The Avalara Global Connector for SAP delivers a clean core-focused, cloud-native, and scalable indirect tax compliance solution built on SAP BTP.

BENEFITS

Offload the complexity of indirect tax compliance

Cloud native scalability

As businesses adopt SAP’s RISE model, Avalara scales effortlessly to increased transaction volumes, new geographies, and global requirements.

Optimized for SAP’s clean core strategy

Avalara’s tax engine operates outside SAP’s core systems, helping maintain a clean core, reducing complexity, and easing future system updates.

Comprehensive global compliance

Avalara’s cloud-based tax engine updates tax rules across 190+ countries, ensuring greater compliance without IT or tax teams managing manual updates.

Flexible data mapping

Implementation teams can easily map custom SAP fields to Avalara’s tax engine with the Flex Mapper tool, reducing the need for custom development.

Enhanced diagnostics

Detailed transaction logs for every tax calculation help IT teams trace, validate, and audit tax decisions with full transparency to support audit readiness.

Streamlined compliance data

Avalara connects data across legacy or custom ERP systems, enabling seamless tax compliance across global geographies and business units.

How it works

Plug the power of Avalara into your SAP workflows

-

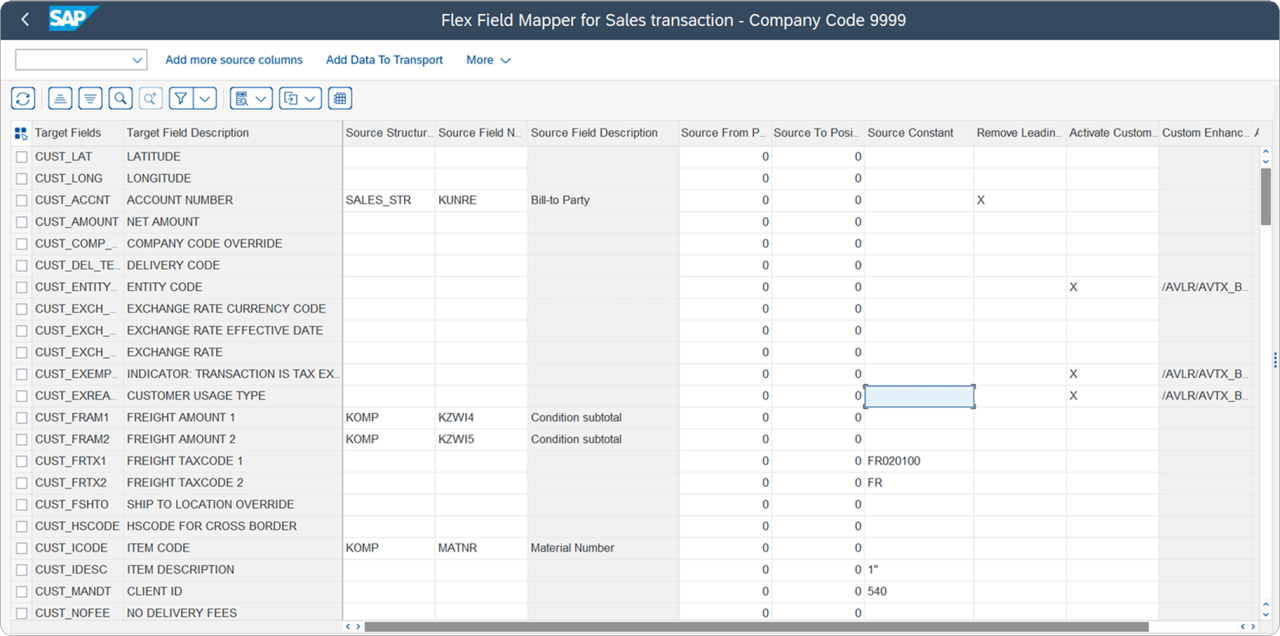

Flex Mapper tool

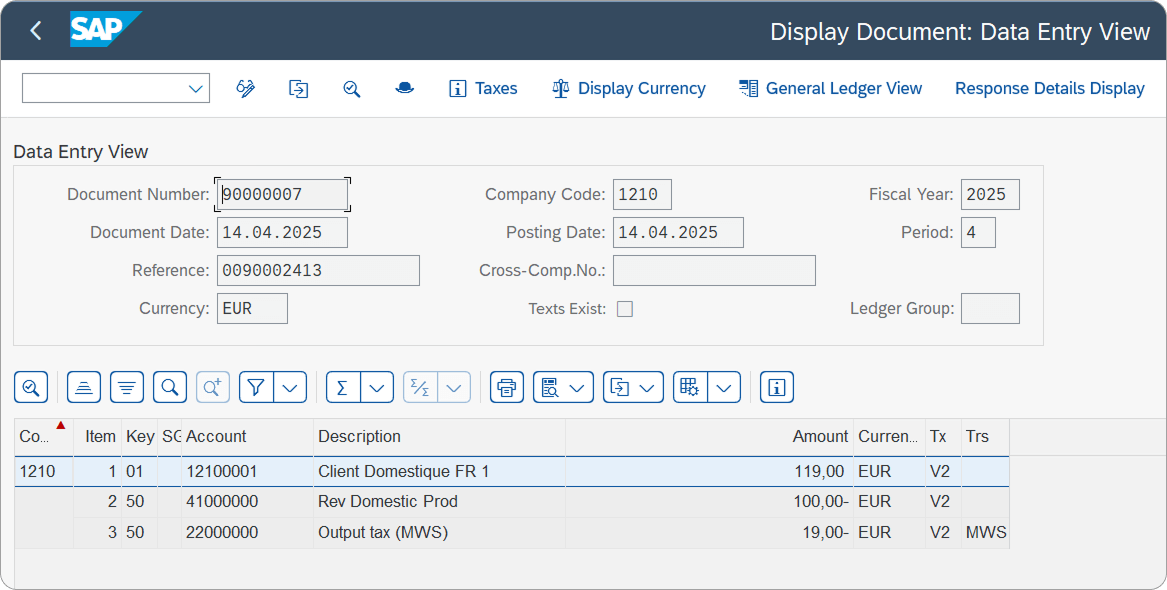

- Flexible data-mapping tools enable quick adaptation to custom fields, unique transaction flows by SD, MM, AP, AR, and FI documents, and tax configurations within SAP.

-

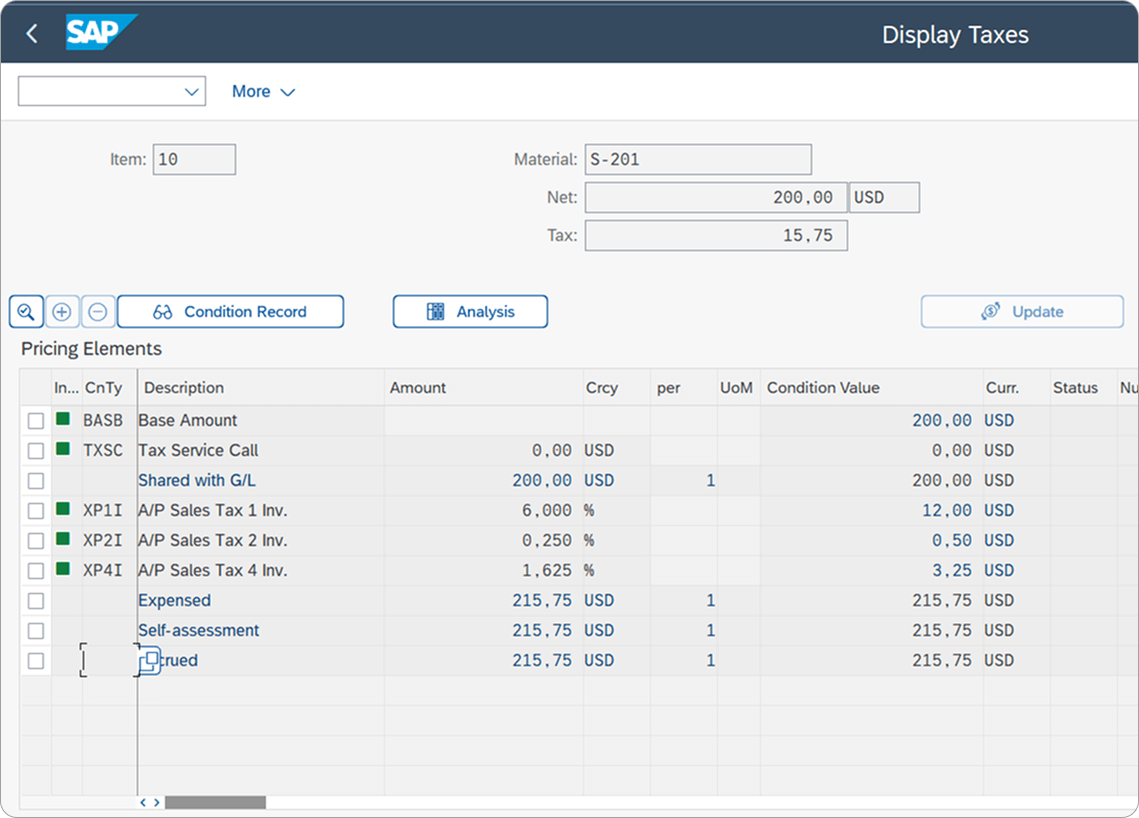

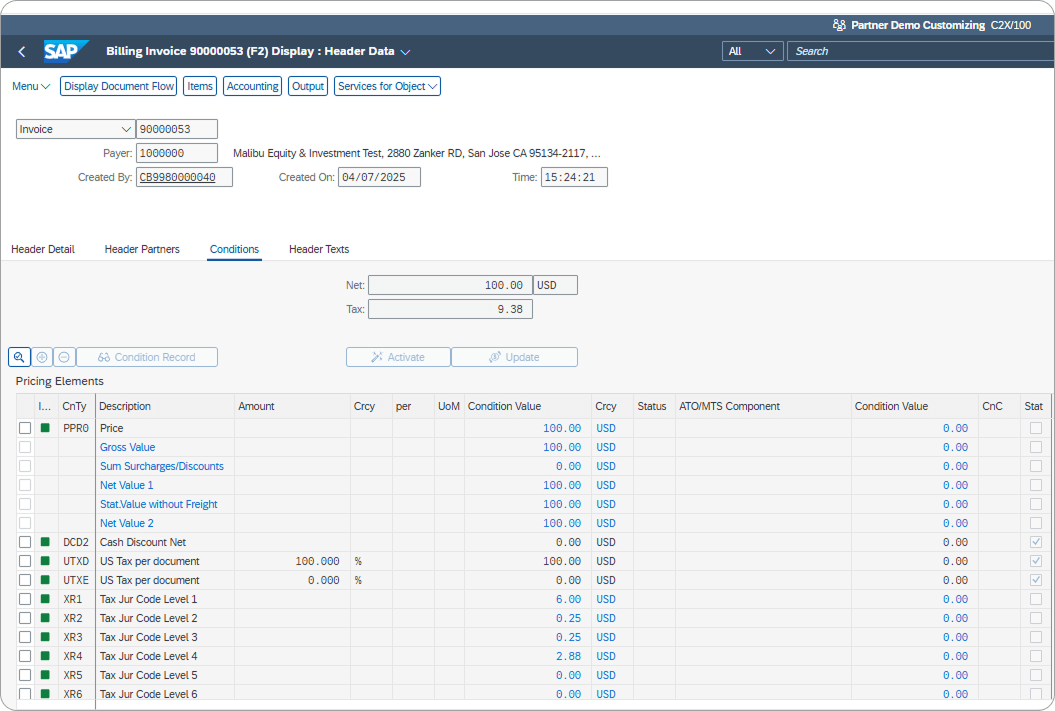

Sales and use tax calculation

- Avalara applies regularly updated tax rates and rules based on geolocation, product taxability, and transactional data to calculate sales and use tax across 13,000+ U.S. jurisdictions, and apply content for 190+ countries, to help increase accuracy of tax determination in real time.

- Automatically calculate tax for each line item on a sales order and invoice, providing a detailed breakdown of the applied tax.

- Identify undercollected and overcollected use tax to reduce liability and overpayments.

-

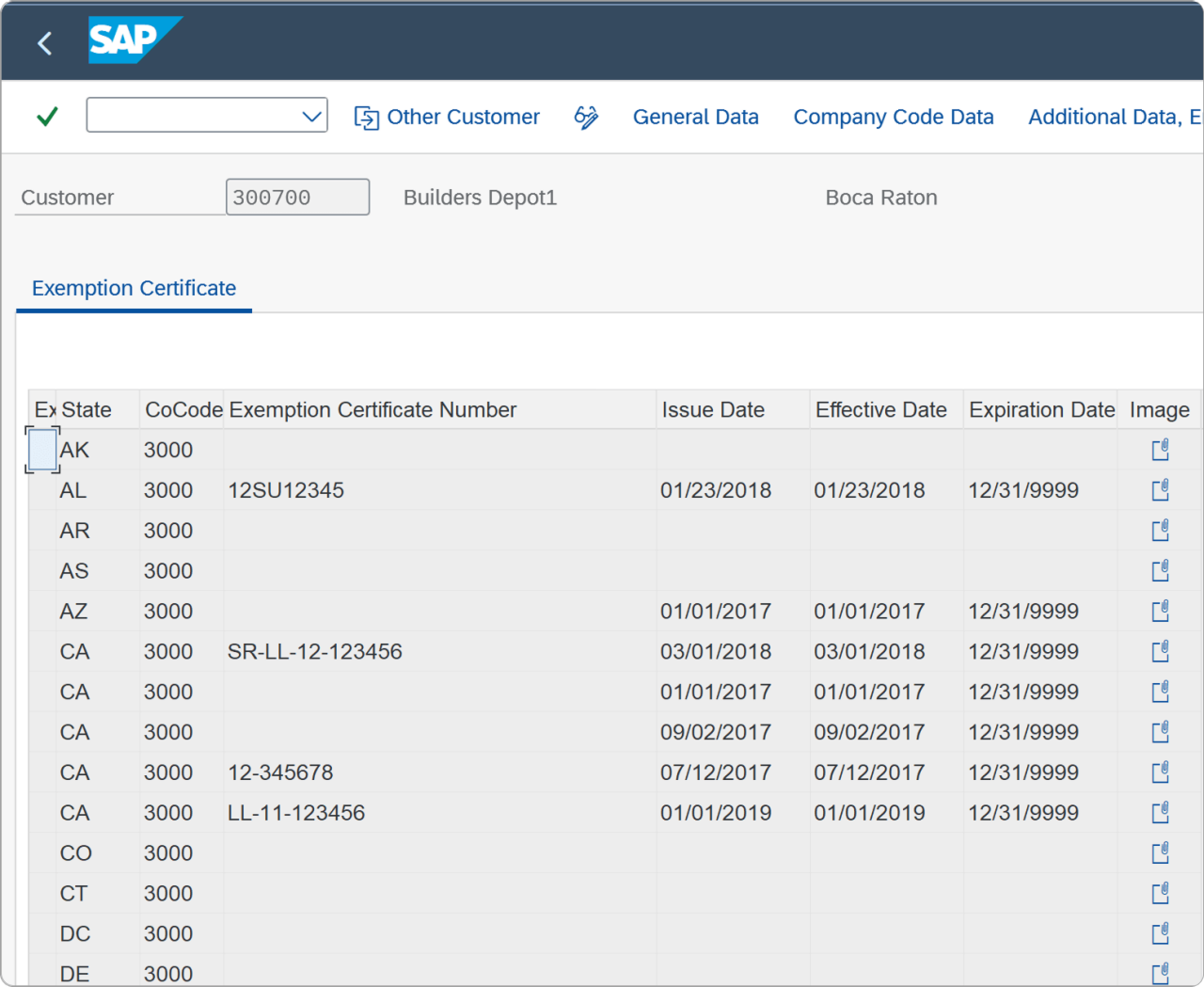

Exemption management

Request, collect, validate, and archive customer exemption certificates directly within SAP to help ensure compliance documents are up to date, formatted correctly, and ready for audits.

The Exemption Certificate Management integration is available outside the Global Connector, working seamlessly with our suite of compliance solutions to automate exemption management.

-

Logging and monitoring

- Robust logging features provide visibility into tax determinations, making it easy for IT teams to track, troubleshoot, and validate transactions.

-

Global compliance

Automate calculation and reporting of VAT, GST, and customs duties and import taxes within SAP to maintain compliance on international sales.

Integrated global solutions

AvaTax is the global tax engine at the heart of our AI-powered compliance platform. It delivers highly accurate, real-time tax calculations for multiple tax types (U.S. sales and use tax, VAT, and industry-specific taxes) across city, county, state, federal, and international jurisdictions.

Avalara AvaTax for Accounts Payable automates consumer use tax compliance at scale. It uses real-time data and AI to determine product taxability, detect vendor sales tax errors, self-assess use tax, and allocate tax across jurisdictions — all from one centralized platform that integrates with most purchasing systems.

Gain access to a one-stop shop for end-to-end international trade compliance. Avalara Cross-Border offers a suite of purpose-built products designed to calculate and estimate customs duties and import taxes in real time; automate the assignment and management of HS, HTS, and schedule B codes; and help businesses navigate global trade restrictions. Avalara Item Classification offers HS code support for over 180 countries.

Avalara AvaTax for VAT delivers automated VAT calculation for global sales and purchasing transactions. The solution uses AI to assign country-specific rates in real time, helping businesses apply the correct VAT treatment, reduce errors, and prepare for cross-border expansion. AvaTax for VAT integrates with most business systems, supports 190+ countries, and enables compliance with complex VAT rules at scale.

Streamline exemption certificate management to increase efficiency, save time, and reduce risk. ECM automates the process of collecting, storing, and validating exemption certificates for businesses of any size. ECM managed over 51 million documents and certificates in 2024.

Simplify the process of complying with vastly complex e-invoicing requirements. Avalara E-Invoicing and Live Reporting provides global compliance and coverage through a single application.

Improve the way you manage Forms 1099, W-9, W-2, 1095, and others to simplify IRS e-filing, reduce the risk of IRS penalties, and streamline vendor information collection.

Offload the hassle of returns preparation, filing, remittance, and notice management (for U.S. sales and use tax or VAT). Our solution saves time, reduces costs, and ensures greater accuracy for businesses of any size in any industry. Avalara Returns processed and filed more than 6 million returns in 2024.

Avalara VAT Returns automates preparation, filing, and remittance of VAT in 49 countries. The solution validates and files data based on local rules; supports real-time reporting, OSS/IOSS, and SAF-T; and uses AI to improve accuracy and reduce compliance risk across global operations.

Dive deeper

EXPLORE

IMPLEMENT

USE

Frequently asked questions

How is Avalara AvaTax different from other tax calculation systems?

AvaTax is an advanced solution that uses geolocation and address verification to calculate sales tax down to a specific address, accounting for multiple tax jurisdictions in a single ZIP code, complex tax tiers, and more. If you need to calculate tax on international transactions, AvaTax offers an option for that too. Avalara also has solutions to prepare and file your returns as well as easily manage exemption certificates in the cloud, all of which are tightly integrated with AvaTax.

Do you offer an annual or monthly agreement? Does it renew automatically?

Avalara provides a 12-month agreement that you can pay annually or in monthly installments. Agreements automatically renew at the end of each term, but you can cancel before your new term begins, according to our terms.

Is usage measured annually or monthly? Will any unused portion of my plan roll over to the next year?

Annually. If your plan allows for calculations on 500 transactions a year, for example, you can use those transactions anytime during your annual subscription term. Transactions don’t roll over and must be used within the subscription term in which they are purchased.

Does Avalara provide support?

Yes, you’ll have unlimited access to the Avalara Help Center 24 hours a day, seven days a week. More advanced support packages are also available to purchase.

Can Avalara AvaTax still calculate tax if I don’t have addresses for every customer?

Yes, but for the most reliable rates, Avalara needs an accurate and complete address, or the latitude and longitude (U.S. only), to calculate tax.

Does Avalara AvaTax calculate sales tax on return transactions?

Yes, AvaTax calculates sales tax on credit memos.

I have multiple companies. Will Avalara AvaTax work for me?

Yes, AvaTax will manage your tax compliance across multiple companies, even across complex corporate structures (such as parent/child companies).

Connect with Avalara

Learn how our solutions work with SAP.