New trends in B2B and B2C ecommerce impact tax compliance

Traditional business-to-business (B2B) and business-to-consumer (B2C) companies are discovering it pays to sell online. During the last year, extensive restrictions on in-person meetings and commerce forced many B2C and B2B companies, including manufacturers, to embrace ecommerce and grow direct-to-consumer sales. While the success of these efforts underscores the need for them, as the adage says, success comes at a price: An increase in B2B and B2C online sales can trigger new sales and use tax obligations.

The impact of the coronavirus pandemic on business and consumer habits was unexpected and immediate. Virtually overnight, businesses had to restrict or shut down in-person experiences and the internet became the only way to engage colleagues and customers. Ecommerce kept numerous businesses afloat during that difficult time, and many businesses and consumers will continue to rely on it even as eased restrictions and a hunger for face-to-face experiences encourage a return to “beforetime” habits.

To better understand how this shift in consumer habits has affected businesses, Salesforce surveyed close to 1,400 commerce leaders in August 2020 and analyzed the shopping behavior of more than 1 billion customers worldwide. The survey encompasses data from B2B and B2C organizations across 11 industries,* from advertising to travel.

The report classifies respondents by their digital commerce performance. About 35% of those surveyed are high performers, meaning they consider themselves to be “extremely successful” in digital commerce. Slightly more than half — 55% — believe their organization is “moderately successful” in digital commerce (moderate performers), while 10% are “underperformers” in the digital commerce space.

The results of the first State of Commerce report reveal how much companies relied on ecommerce last year. And lessons learned during the height of the pandemic won’t soon be forgotten: 66% of high-performing companies surveyed are augmenting or replacing in-store experiences with digital ones, and 56% of organizations expect the majority of their revenue over the next three years to come from digital channels.

For many industries, placing such an emphasis on the internet and ecommerce is new; only about 11% of all U.S. retail sales took place online in 2019. But brick-and-mortar sales dropped an estimated 14% in 2020, while ecommerce revenue increased 75% year over year during the second quarter of 2020 alone. Few companies, if any, can afford to disregard the opportunities afforded by the internet.

What is the state of B2C commerce?

When it comes to B2C commerce, companies that augmented in-person experiences with digital experiences during the pandemic performed best. In fact, just 24% of underperformers offered additional online experiences.

Augmenting in-person experiences with digital experiences

Among businesses that augmented in-store experiences with digital ones, 73% incorporated live chat or video services, and 58% tried virtual events such as Instagram Live. Other digital experiences include:

- Virtual shopping/stylist appointments (52%)

- Virtual reality (44%)

- Artificial reality (34%)

Many survey respondents showed a remarkable degree of adaptability and resilience, adding real-time web chats and implementing virtual shopping options in a matter of months.

Meeting customers where they are

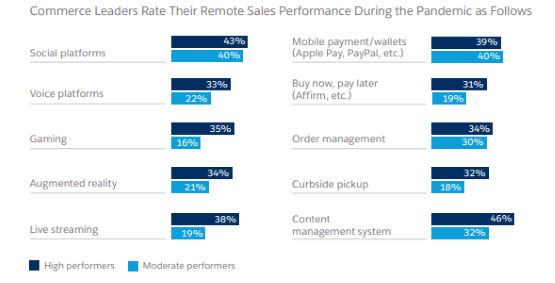

High-performing organizations don’t sit back and wait for consumers to land on their website — they go find them where they are. About 88% of these top-performing businesses increased investment in contextual or embedded commerce experiences in 2020. In addition to social media platforms, where sales increased by 104% from between Q2 2019 and Q2 2020, successful businesses explored augmented reality, gaming platforms, live streaming, and voice platforms. These proved prosperous for both moderate performers and high performers, but businesses that invested heavily in these new channels saw the greatest returns.

Expanding contactless options

Many B2C companies also embraced contactless and self-service options such as buy online, pickup in store (BOPIS) or click and collect, contactless payment or delivery, and curbside pickup. As above, the more businesses invested in these options, the more the investments paid off.

What is the state of B2B commerce?

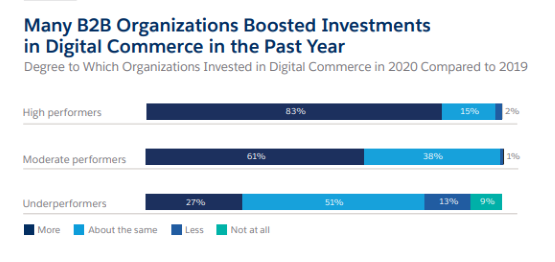

Like B2C businesses, most B2B companies were already selling online prior to the pandemic, and many increased investments in digital commerce during 2020: 83% of high performers and 61% of moderate performers spent more on digital commerce in 2020 than in 2019. By contrast, only 27% of underperformers increased investments in that area. Companies that invested the most saw the best results; a whopping 70% of high performers said their remote sales performed “extremely well” in 2020, while only 11% of underperformers could say the same.

Investing more in digital channels

Reliance on digital channels will only grow: 30% of survey respondents said digital channels provided more than 50% of B2B revenue in 2020, and 55% expect digital channels to provide more than 50% of B2B revenue within three years. However, it’s worth noting that the average order value of online sales was about half the average order value of in-person sales. Thus, it will be important for B2B companies to provide a variety of purchase options moving forward, and to understand which appeal most to which clients.

High performers, moderate performers, and underperformers all plan to invest in B2B ecommerce, customer self-service online options, in-person sales teams, inside sales teams, and distributors during the next two years, though to varying degrees. Despite this, most don’t plan to reduce their investments in sales teams. Indeed, 31% of organizations increased sales teams even after upping investments in ecommerce.

Keeping an ear to the ground

Top-performing companies tend to pay close attention to national and international news and economic trends. They read newspapers and trade journals and listen to industry podcasts to deepen their understanding of customer needs. What they learn often impacts customer communications as well as staffing needs.

Finding the perfect ecommerce platform

When picking an ecommerce platform, B2B companies have different priorities. Underperformers tend to place the greatest emphasis on revenue, which high performers often deprioritize. Top performers are most drawn to digital innovation, and all businesses want a solution that will help them grow and leave customers satisfied.

How going digital can impact tax compliance

Developing digital sales channels can help both B2B and B2C companies increase sales across the country and even around the globe. It can also create new sales tax obligations.

There are 45 states with a general sales tax in the U.S., plus Washington D.C., and parts of Alaska (where local sales taxes are allowed). As of June 2021, all but one of these states have economic nexus laws requiring out-of-state sellers to register then collect and remit sales and use tax. Missouri will enforce economic nexus starting January 1, 2023.

All economic nexus laws provide safe harbor for small sellers, those selling below the state’s economic nexus threshold. Yet each state’s economic nexus threshold is unique, of course. For example:

- Alabama’s threshold is $250,000 in total retail sales of tangible personal property during the previous calendar year

- California’s threshold is $500,000 in total combined sales of tangible personal property during the preceding or current calendar year

- Florida’s threshold is $100,000 in taxable sales of tangible personal property during the previous calendar year

- Illinois’ threshold is 200 transactions or $100,000 of cumulative gross receipts from sales of tangible personal property during the preceding 12 months (determined quarterly)

- New York’s threshold is 100 transactions and $500,000 of cumulative total gross receipts from sales of tangible personal property during the previous four sales tax quarters

It takes time and effort to determine where a sales tax obligation exists, and that’s the easy part. Once nexus has been established, businesses must register for sales tax and comply with all applicable sales and use tax laws. In addition to B2C companies, these laws can impact B2B companies that sell directly to consumers and even those dealing primarily in exempt transactions. To succeed today, B2B and B2C companies must understand industry trends and consider compliance.

Update: Learn what trends are affecting your industry in 2023. Read the 2023 Avalara Tax Changes report or attend a webinar.

*Advertising/marketing (7%), CPG, excluding food and beverage (7%), Food and beverage (7%), Healthcare provider (7%), Manufacturing (13%), Media and communications (7%), Medical devices (7%), Pharmacy (7%), Retail (13%), Telecommunications (8%), and Travel, transportation, and hospitality (7%).

The Avalara Tax Changes midyear update is here

Trusted by professionals, this valuable resource simplifies complex topics with clarity and insight.

Stay up to date

Sign up for our free newsletter and stay up to date with the latest tax news.