Craft fairs and sales tax: A state-by-state guide

Updated for 2020

Selling crafts? Check your state sales tax rules

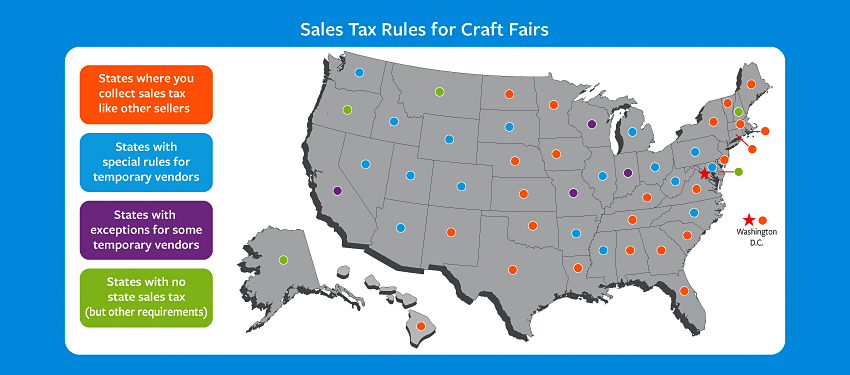

If you sell at craft fairs, flea markets, and similar events, you should probably be collecting sales tax. Most states require sellers — even temporary or transient vendors from another state — to register with the state and collect and remit tax on sales of taxable goods and services.

But sales tax laws and policies vary from state to state: some treat temporary vendors like any other seller, while some have a distinct registration process for them. There are states with exceptions for some vendors/sales, and, of course, states with no general sales tax (but other rules for temporary vendors). No wonder it’s often challenging to find pertinent information. Even the terms used to describe craft fair vendors and sales can differ in different states: one state department of revenue website may use the term “temporary vendor,” while another uses “occasional sales.”

Read on for a state-by-state sales tax guide for craft fair vendors. Click on the links to access additional information about sales tax requirements for temporary vendors in a given state.

States where you must collect sales tax like other sellers

The following table of states highlights those where craft fair sellers must adhere to sales tax laws like any other seller of taxable goods. In some of these states, craft sellers are addressed explicitly while in others they are encapsulated in statements pertaining to "all sellers".

| State | Sales tax rules for craft fair sellers | Source |

| Alabama | All sales at retail, except those defined by law, are subject to sales tax. Vendors must therefore register for a sales tax license and collect and remit tax. | Alabama Legislature |

| Connecticut | The Department of Revenue Services is clear: “You must obtain a Sales and Use Tax Permit … if you will be selling at a flea market, craft show, trade show, antique show, fair, etc. in Connecticut even if you will only be making sales for one day.” | Connecticut Department of Revenue Services |

| Florida | Anyone making taxable sales is required to obtain a Certificate of Registration. Dealers with temporary locations must have the certificate in their possession at the location at all times, visible to customers. | Florida Department of Revenue |

| Georgia | Any business selling tangible personal property or taxable services must register for a sales and use tax certificate. | Georgia Department of Revenue |

| Hawaii | Hawaii does not have a sales tax; instead, they have the general excise tax (GET), which is assessed on all business activities. Residents and vendors doing business in Hawaii must obtain a GET license and collect and remit GET and any other applicable taxes. | Hawaii Department of Taxation |

| Iowa | As of July 1, 2016, the Iowa Department of Revenue no longer issues temporary sales tax permits. Anyone making retail sales of taxable goods and services is required to obtain a permanent Iowa tax permit. | Iowa Department of Revenue |

| Kansas | Vendors at special events, craft shows, trade shows, etc. are required to register with the state and collect and remit state and local sales tax. | Kansas Department of Revenue |

| Kentucky | Temporary vendors are required to file sales and use tax returns, even if the event organizer collects and remits all sales tax revenue to the Department of Revenue. | Kentucky Department of Revenue |

| Louisiana | Vendors at special events, craft shows, trade shows, etc. are required to collect and remit state and applicable local taxes. Promoters of these events are required to notify the Department of Revenue of the event and provide a list of participating vendors. | Louisiana Department of Revenue |

| Maine | Temporary vendors must register for sales and use tax and collect and remit sales tax on taxable transactions. | Maine Revenue Services |

| Massachusetts | Temporary vendors and promoters of craft and trade shows and flea markets must register, collect and remit sales tax. | Massachusetts Department of Revenue |

| Minnesota | All vendors selling taxable goods at craft fairs, flea markets, and other temporary events must have a valid sales tax registration. | Minnesota Department of Revenue |

| Nebraska | Anyone selling taxable merchandise in Nebraska is required to collect and remit sales tax, even if the activity is considered a hobby rather than a business. | Nebraska Department of Revenue |

| New Jersey | All sellers in New Jersey are required to register with the state for tax purposes and comply with tax laws. Whether selling at "shops, at flea markets, at craft shows, by mail, or from home," all sellers are required to comply with state sales tax laws. | New Jersey Department of the Treasury |

| New Mexico | Temporary vendors are required to register with the state and collect and remit gross receipts tax on taxable See also FYI-105 - Gross Receipts & Compensating Taxes. | New Mexico Taxation and Revenue Department |

| New York | Persons and businesses making taxable sales in New York must register with the Tax Department, obtain a Certificate of Authority, and collect and remit New York sales tax, even if only selling at one craft fair per year. | New York Department of Taxation and Finance |

| North Dakota | Vendors of taxable goods and services at special events such as craft fairs must collect North Dakota sales tax. The event organizer/promoter may be required to provide a vendor list to the Tax Commissioner’s office prior to the event. | North Dakota Office of State Tax Commissioner |

| Oklahoma | Vendors at craft fairs and similar events in Oklahoma must collect and remit Oklahoma sales tax. | Oklahoma Tax Commission |

| Rhode Island | Vendors at craft fairs and similar temporary events must register with the Department of Taxation and Finance and collect and remit Rhode Island sales tax. | Rhode Island Division of Taxation |

| South Carolina | Artists and crafters selling taxable goods at arts and crafts show and festivals must obtain a retail license from the South Carolina Department of Revenue and collect and remit all applicable sales and use taxes. | South Carolina Department of Revenue |

| Texas | Sellers at arts and craft shows, antique markets, flea markets and similar events are required to have a Texas sales and use tax permit if they sell or take orders for taxable goods or services, use the show to promote sales, or promote the events. Event promoters are liable for tax on sales made by vendors without a permit. | Texas Comptroller of Public Accounts |

| Tennessee | Vendors, even transient vendors, of taxable goods and services must register with the state and collect and remit tax. | Tennessee Department of Revenue |

| Vermont | Vendors, including those making occasional sales in Vermont (e.g., an out-of-state vendor selling at a craft fair), must collect sales tax at the time and place of sale. | Vermont Department of Taxes |

| Virginia | Sales tax applies to all taxable retail sales in Virginia. Online registration may be available for specialty dealers selling at flea markets, craft shows, etc. | Virginia Department of Taxation |

| Washington D.C. | Sellers at special events in the District of Columbia are liable for sales tax on taxable sales. | DC.gov |

States with special rules for temporary vendors

The following table of states highlights those where craft fair sellers are governed by specific taxation rules. In most cases, action still must be taken by the seller to obtain a seller's permit, but the specific circumstances (such as the length of the fair) will impact the required permit.

| State | Sales tax rules for craft fair sellers | Source |

| Arizona | Anyone selling taxable goods at special events such as arts and craft shows and fairs may require a transaction privilege and use tax license. Event promoters may obtain the license so all individual sellers don’t have to, in which case all sales must go through the promoter’s center cash register and the promoter will be responsible for filing and paying the TPT. | Arizona Department of Revenue |

| Arkansas | Vendors at special events, which include bazaars, craft fairs, and flea markets, are required to collect sales tax, file daily reports with the promoter or organizer of the event, and remit the daily sales tax along with the completed forms. A special event is defined as “an entertainment, amusement, recreation, or marketing event which occurs at a single location on an irregular basis and where tangible personal property is sold.” | Arkansas Department of Revenue |

| Colorado | Temporary vendors must obtain a special event license and collect and remit state sales tax. Additional taxes/licensing requirements may also be required at the local level (contact local governments directly for more information). As in most states, vendors selling exclusively exempt items (such as vegetables for home consumption) don’t need a sales tax license. | Colorado Department of Revenue |

| Idaho | A temporary seller’s permit is available for anyone making infrequent retail sales — “one-time events such as concerts, fund-raisers, and bazaars.” The state allows individuals to have two home yard sales without registering as a retailer and getting a seller’s permit to collect tax. | Idaho State Tax Commission |

| Illinois | The state considers anyone selling taxable merchandise at fairs, festivals, flea markets or craft shows in Illinois, whether as a full-time business or a hobby, to be a retailer. You must register with the state and collect and remit “any tax” you’re required to pay. If you sell in multiple locations, you must register as a “changing location” filer. The department sometimes sends agents to collect taxes daily, or at the end of an event, to ensure tax is collected from out-of-state or transient merchants. | Illinois Department of Revenue |

| Maryland | Temporary vendors are required to obtain a temporary license and collect a 6% or 9% sales and use tax for sales at events like craft shows and fairs. | Comptroller of Maryland |

| Michigan | Vendors making retail sales at more than two events in Michigan per year are required to register for sales and/or withholding taxes. Those making two or fewer retail sales should remit a Concessionaire’s Sales Tax Return and Payment (Form 5089). | Michigan Department of Treasury |

| Mississippi | Any person or company making retail sales to the public must collect and remit Mississippi sales tax. The operator or promoter of a craft fair or similar type of event is considered the seller and is responsible for remitting the tax collected by persons selling at the event. | Mississippi Department of Revenue |

| Nevada | Sales tax applies to all sales of tangible personal property, even when sold at a one-time event. Promoters should provide individual sellers with a “one-time sales tax return.” Anyone selling at more than two events in Nevada during a 12-month period must register with the Department of Revenue and obtain a Sales and Use Tax Permit. | Nevada Department of Taxation |

| North Carolina | All sales of taxable goods and services are subject to North Carolina sales tax, but vendors engaged in business for “six or fewer consecutive months” should register as a seasonal filer. | North Carolina Department of Revenue |

| Ohio | All vendors in Ohio must obtain one or more vendor’s license (number varies depending on the nature of their business). A transient vendor license must be obtained by anyone who transports goods to temporary places of business in order to make sales. The license is issued by the Department of Taxation and valid statewide. | Ohio Department of Taxation |

| Pennsylvania | Temporary vendors selling taxable goods and services are required to obtain a transient vendor license and collect and remit tax. | Pennsylvania Department of Revenue |

| South Dakota | Sales at craft shows are subject to South Dakota sales tax; June through September, they’re also subject to the tourism tax. | South Dakota Department of Revenue |

| Utah | All vendors participating in special events, like art shows and craft fairs, are required to obtain a Temporary Sales Tax License and Special Return from the Utah State Tax Commission. Each license is only good for the event for which it’s issued. | Utah State Tax Commission |

| Washington | Sellers of taxable goods and services at craft fairs and similar events in Washington must register with the state and collect sales tax. Vendors selling at no more than two events per year may obtain a temporary registration certificate. | Washington Department of Revenue |

| West Virginia | All sales of goods and services are presumed subject to West Virginia sales and use tax unless a specific exemption applies. Special requirements apply to transient vendors. | West Virginia State Tax Department |

| Wyoming | Any person engaged in the business of selling taxable tangible personal property in Wyoming is considered a vendor and must register with the state and collect and remit tax. An Occasional Vendor sales tax return may be appropriate. | Wyoming Department of Revenue |

States with exceptions for some temporary vendors

The following table of states highlights those where craft fair sellers are governed by specific exceptions to taxation rules.

| State | Sales tax rules for craft fair sellers | Source |

| California | If you make three or more sales of taxable items in a 12-month period, you’re required to register with the state and collect sales tax. Merchants selling taxable goods on a temporary, short-term basis (less than 90 days) should register for a temporary California seller’s permit and report sales tax. | California Department of Tax and Fee Administration |

| Indiana | Certain “casual” sales are not subject to Indiana sales and use tax. However, most craft fair vendors will not qualify for the casual sales exemption and must register with the state and collect and remit sales tax. | Indiana Department of Revenue |

| Missouri | Anyone making retail sales of taxable goods to the public/final consumer is required to obtain a sales tax license and collect and remit Missouri sales tax. However, “You may be exempt from collecting sales tax if you or your spouse is at least 65 years of age and the income from the sales of handicraft items does not constitute more than 50% of your annual income.” | Missouri Department of Revenue |

| Wisconsin | Generally, sellers making $1,000 or more in taxable sales in Wisconsin during a calendar year are required to have a seller’s permit and collect and remit tax. This is true even for sellers engaged in a “one-time” event. Sellers are liable for Wisconsin sales or use tax on all Wisconsin sales through the end of the seller’s tax year. When in doubt about how much money will be made, it’s best to err on the side of caution and obtain a seller’s permit. | Wisconsin Department of Revenue |

States with no state sales tax (but other requirements)

The following table of states highlights those where craft fair sellers are not required to collect a sales tax. There may, however, be other requirements such as obtaining a temporary business license.

| State | Sales tax rules for craft fair sellers | Source |

| Alaska | Although there’s no state sales tax in Alaska, many municipalities have a local sales tax and policies vary by locality. In the Kenai Peninsula Borough, for example, “all sellers are REQUIRED to register for sales tax collection” [emphasis theirs], including sellers at temporary events. | Kenai Peninsula Borough Finance Department |

| Delaware | Transient retailers must obtain a Delaware business license and register with the Division of Revenue. A transient retailer license is available for vendors who do not intend to become a permanent retailer and who conduct business for ten days or less during a calendar year. There’s no general sales tax in Delaware, but there is a gross receipts tax. | Delaware Division of Revenue |

| Montana | There’s no state sales tax in Montana, but certain communities do levy a local resort tax, and vendors may be required to collect and remit it (as in Whitefish). Contact the local government directly to learn more. | Montana Department of Revenue |

| New Hampshire | There is no general sales tax in New Hampshire but there is Meals and Rooms (Rentals) Tax on lodging and meals costing more than 35 cents. Temporary vendors of food should contact the New Hampshire Department of Revenue Adminsitration for additional information. | New Hampshire Department of Revenue Administration |

| Oregon | Although there is no general sales tax in Oregon, temporary businesses must obtain a temporary business license certificate. | City of Portland Revenue Division |

Filing sales tax returns

Smaller craft sellers can likely manage sales tax filing on their own. As your business expands to platforms like Etsy and sales grow, however, manual filing can become a hassle. With Avalara Returns for Small Business, businesses can automate their returns filing to save time and avoid costly errors.

Related reading

Connect with Avalara

Find out how we can help your business improve tax compliance and reduce risk.

Connect with Avalara

Find out how we can help your business improve tax compliance and reduce risk.